As the first quarter of 2024 was great for markets, April brought a different story with stocks and gold experiencing pullbacks. Investors are now left wondering if this is just a temporary pause or a signal of more trouble to come. Top MoneyShow contributors shared their insights on the current situation, with Lucas Downey from Mapsignals.com highlighting a major ultra-bullish signal approaching for growth stocks despite the recent halt in institutional demand.

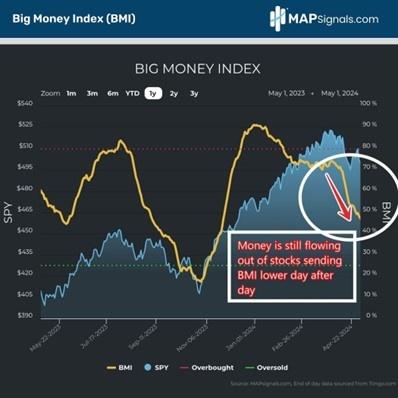

The Fed’s presser from Wednesday did little to instill confidence in investors, leading to a focus on Money Flows at MAPsignals. The Big Money Index (BMI) has been in a freefall, dropping even further after Wednesday’s events, but a monster bullish setup is forming in the data. Despite the overall weakness and rotational action in the market, there are signs of potential crowd-stunning rally later in the year, emphasizing the need for cheerfulness over fear.

While the all-clear signal is still not present, the continued drop in the BMI suggests seasonal volatility causing weakness and rotational action in the market. Inflows are seen in cyclical sectors, with money flowing out of Big Tech, which anchors major large-cap indices due to the sector’s significant market weight. The BMI data has been trending lower, hinting at a major ultra-bullish signal approaching, despite the prolonged period of weakness since December 29.

In the gold market, Brien Lundin from Gold Newsletter discusses the recent sell-off, which was anticipated due to gold’s overbought status after seven weeks of gains. The drop in gold and silver prices was fueled by geopolitical events, and after a significant decline, both metals rebounded, reaffirming the belief that the market is driven by conventional factors rather than a runaway train. The selling may have provided a necessary pause in the rally and an opportunity for new investors to enter the market.

Matthew Carr from Tipping Point Profits debunks the “Sell in May and Go Away” myth, pointing out that while May is historically a challenging month for stocks, it is not the worst. The theory originated in England and carried over to the US as investors pared their market exposure during the summer months. However, recent data shows that since 2014, there has been an 80% success rate for gains from May through October, suggesting that staying invested during these months could be beneficial.

Danielle Shay from Fivestartrader.com provides insights on the loss of momentum in sectors like technology and financials, as well as options trading tactics and stock market trends. She discusses the impact of Q1 earnings on sectors like tech and energy, highlighting profit opportunities in commodity stocks. With a focus on pattern recognition and options trading techniques, Shay emphasizes the importance of sentiment extremes and options spread trading. Attendees can expect to learn more about these strategies at the upcoming MoneyShow Masters Symposium in Las Vegas.