Investors have recently been focused on the Federal Reserve, but are now turning their attention to Nvidia, a $3 trillion artificial intelligence gem. Nvidia’s stock has risen 154% this year due to the AI frenzy, and has seen a 3,000% surge over the past five years. With a market value over $3 trillion, Nvidia is one of only three US companies to reach this milestone, and its large weighting in the S&P 500 means that swings in its stock can impact the broader market.

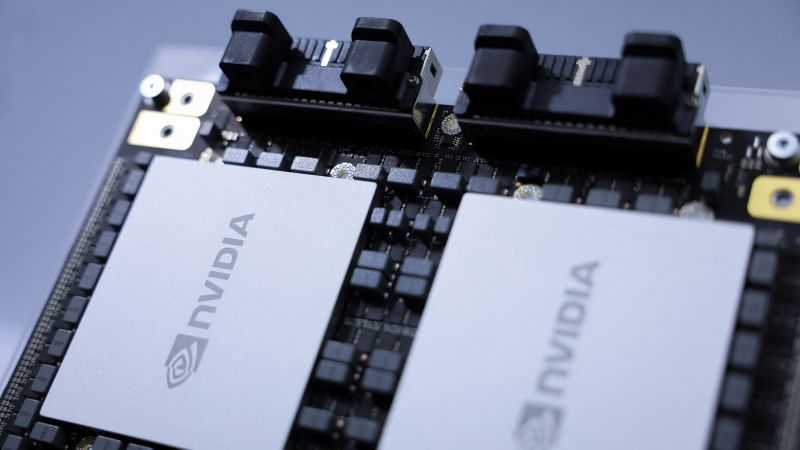

Nvidia’s earnings reports have become highly anticipated events, with the company consistently beating analyst expectations in recent quarters. Wall Street analysts are expecting Nvidia to post over 100% sales and profit growth year-over-year for the second quarter. The company is known for its processors, which are considered the best for powering artificial intelligence technology, and its stock has seen significant growth in recent years due to the AI craze on Wall Street.

Investors will be looking to Nvidia’s earnings report for insights into the demand for artificial intelligence products. Despite skepticism on Wall Street about the productivity gains from AI, companies are continuing to invest in AI tools and products. Tech companies, in particular, need to invest in AI to stay competitive and avoid becoming outdated. Nvidia is well-positioned to benefit from increased AI spending, as Silicon Valley giants like Google, Microsoft, and Meta Platforms have all signaled plans to increase their AI investments.

Even as the hype surrounding Nvidia’s stock may die down, the company’s fundamentals remain strong. Google’s CEO has highlighted the importance of investing in AI, stating that the risk of underinvesting is greater than the risk of overinvesting. With tech companies increasing their AI spending and continuing to invest in Nvidia’s chips, the company’s dominant position as an AI beneficiary is expected to remain strong for the foreseeable future. Overall, Nvidia’s earnings report and the broader trend of AI investment in the tech sector will be closely watched by investors.