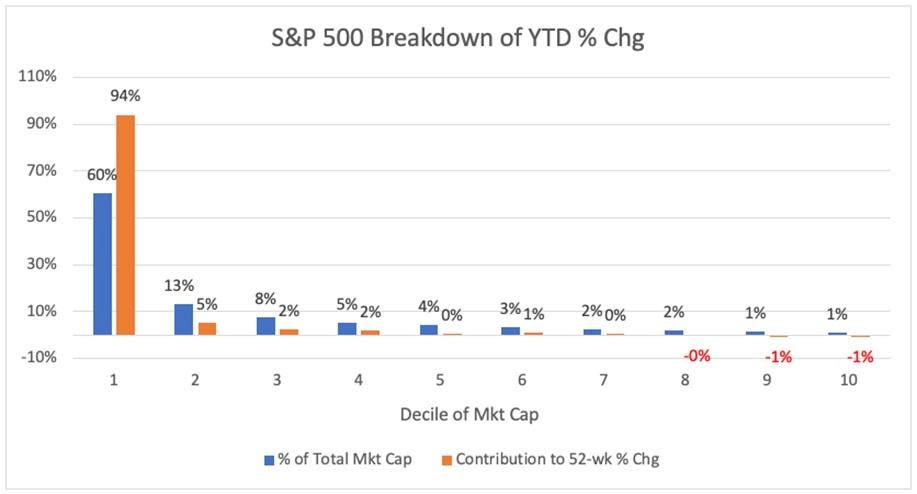

The S&P 500 has seen a significant increase of about 14% so far this year, with gains being highly concentrated in the top-50 stocks by market capitalization. Nvidia alone accounts for around 35% of the overall gains, and the top-10 stocks make up nearly 80% of the overall S&P 500 gains. Additionally, the top-10 stocks have increased their share of the total market cap from 32% to nearly 38%.

There are two main ways to gauge the concentration of the market: Relative Strength (RS) lines of cap-weighted versus equal-weighted indices, and oscillators of equal-weighted indices versus cap-weighted indices. Both of these methods demonstrate how the top stocks have been dominating performance in both the S&P 500 and the Nasdaq 100.

The concentration of major market indexes has come at the expense of small capitalization stocks, which have seen three years of downside performance with only minor periods of reversion. Historically, periods of concentration have eventually led to the end of bull markets, as seen in 2000 and 1973. However, the market could also see a shift where the rest of the market catches up in terms of performance, as was seen in late 2020 when the Russell 2000 outperformed the S&P 500.

There are signs that the market’s concentration may not continue for much longer, as an increase in the number of breakouts across the market could indicate a major move up. Thematic leadership outside of mega-cap Technology, such as in areas like housing and infrastructure, would also signal a change in market dynamics.

It is unclear whether the market’s current state of concentration will lead to a decline in the leaders or an increase in performance of lagging segments. However, investors are advised to monitor for any signals of change and adjust their strategies accordingly. O’Neil Global Advisors has contributed to the data compilation, analysis, and writing of this article, and they emphasize the importance of staying alert to market developments.