As the tax deadline approaches, the IRS and TurboTax are providing much-needed help for the over 40 million Spanish-speaking residents in the US. For many, like accountant Maria Purser in San Diego, translating tax forms for elderly parents who prefer Spanish over English can be a daunting task. With the introduction of a new Spanish language version of the tax software, the process is expected to be smoother and more efficient.

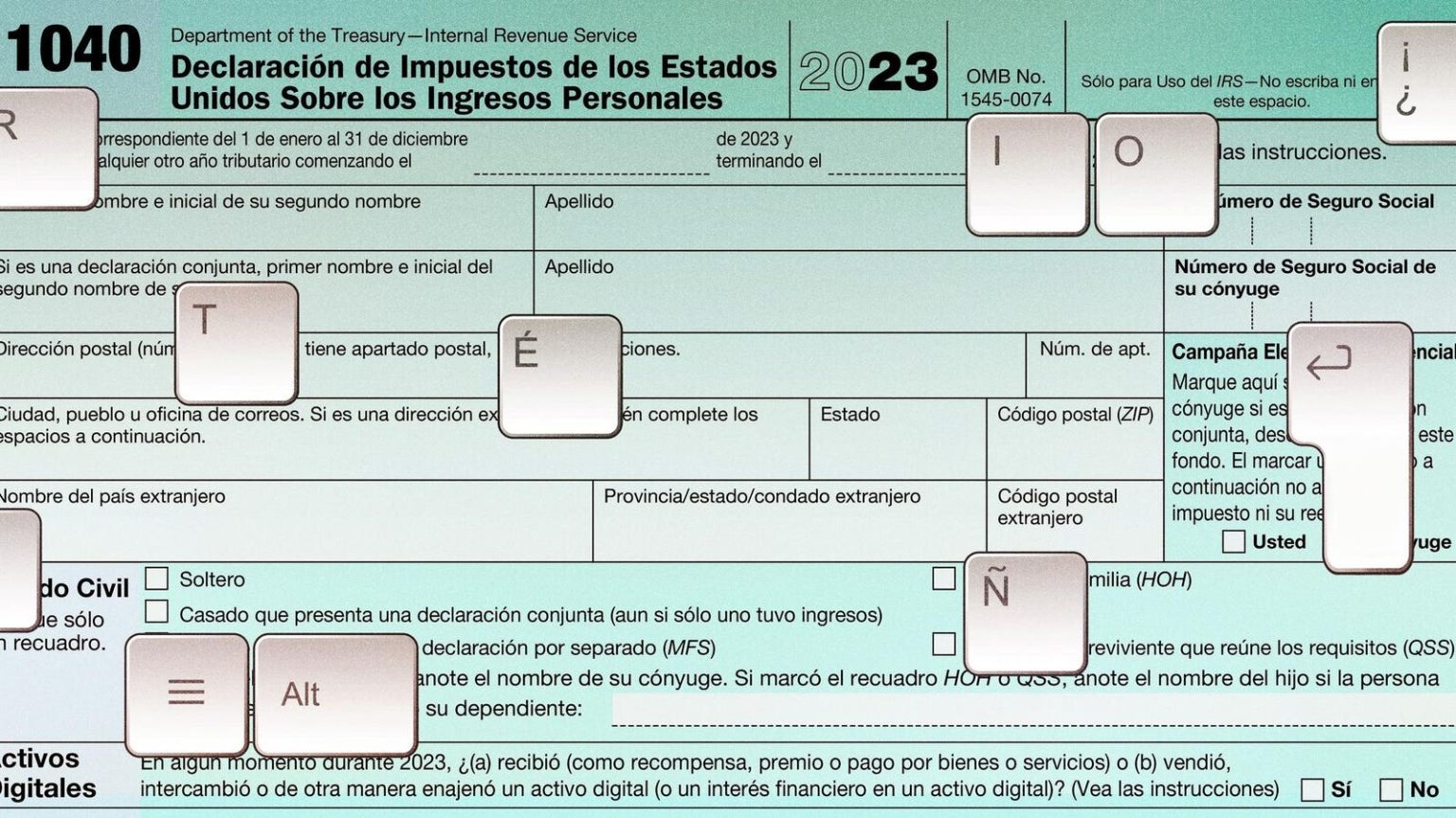

The increase in the Spanish-speaking population in the US, with 42 million speaking Spanish at home in 2019, has highlighted the need for tax assistance in Spanish. The IRS has been slow in meeting this demand, with Spanish language resources only becoming fully available in 2020. However, recent efforts by the IRS, such as providing forms, instructions, and publications in Spanish, have shown progress in serving traditionally underserved taxpayers, including bilingual individuals.

TurboTax, a popular tax software provider, has taken steps to cater to Spanish-speaking taxpayers by introducing a full suite of products for the filing of 2023 returns in Spanish. This includes software-only versions, live-assist options, and full professional tax preparation services, all available in Spanish. This initiative was a longtime goal of Mark Notarainni, the general manager of Intuit’s Consumer Group, who has made it a priority to offer accessible services for Spanish-speaking taxpayers.

Aside from tax software, the IRS has also improved its services for Spanish-speaking taxpayers, including a Spanish-language version of the IRS.gov website and the IRS2go mobile app. Taxpayers can now get translation services at all 338 physical Taxpayer Assistance Centers, and there is an option to request post-filing tax notices in formats such as Braille and large print. While there have been advancements, there is still a need for more Spanish-language options, especially for common information returns like Forms W-2 and 1099s.

Another development in tax assistance is the use of AI-powered chatbots by tax software providers like TurboTax and H&R Block. These chatbots offer guidance on tax-related questions, although they may struggle with more complex or individual-specific inquiries. The use of AI in tax preparation, as seen in services like Latino Tax Pro’s Ask A Tax Pro product, is becoming more common, making the process more efficient for tax preparers and bilingual individuals.

Overall, the efforts by the IRS and tax software providers to cater to Spanish-speaking taxpayers are a step in the right direction. The availability of Spanish-language resources, translation services, and AI-powered assistance are making tax preparation more accessible and user-friendly for bilingual individuals and those who prefer Spanish. As technology continues to advance, it is expected that these services will become even more efficient and effective in the years to come.