Investors who are looking to invest in Kinder Morgan should take note of the upcoming ex-dividend date of 7/31/24, where the company will be trading without the upcoming quarterly dividend of $0.2875. This dividend, payable on 8/15/24, works out to be approximately 1.35% of KMI’s recent stock price of $21.37. Therefore, it is expected that shares of Kinder Morgan will trade 1.35% lower on 7/31/24 when trading opens.

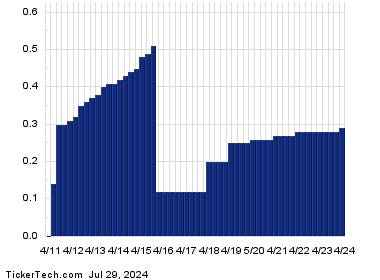

The dividend history chart for KMI shows the historical dividends prior to the most recent $0.2875 dividend. Dividends are not always predictable, but looking at past data can help investors judge whether the current estimated yield of 5.38% on an annualized basis is a reasonable expectation of annual yield going forward. The one year performance chart of KMI shares compared to its 200-day moving average can also provide insight into the stock’s performance.

KMI’s 52-week range shows its low point at $15.89 per share and its high point at $21.86 per share, with the last trade at $21.27. This information can help investors understand the potential volatility of the stock and make informed decisions about buying or selling shares. In Monday trading, Kinder Morgan shares were up about 1.4% on the day, indicating positive momentum in the stock.

Investors looking to capitalize on dividends from Kinder Morgan should pay attention to the ex-dividend date and consider the impact of the upcoming dividend on stock prices. By analyzing historical dividend data and stock performance, investors can make informed decisions about the potential yield and overall investment strategy for KMI. Keeping track of dividend dates and understanding stock movements can help investors maximize their returns and navigate market volatility effectively.