The economic landscape has been tumultuous over the past few weeks, with fluctuating unemployment rates, rising inflation, and rollercoaster stock market movements. While the current situation may not align with the expectations of a smooth “soft landing” predicted in December, it has certainly exceeded the dire forecasts of a looming recession that were widespread at the beginning of last year. Despite some setbacks, such as stubborn inflation and high interest rates, the overall outlook remains cautiously optimistic.

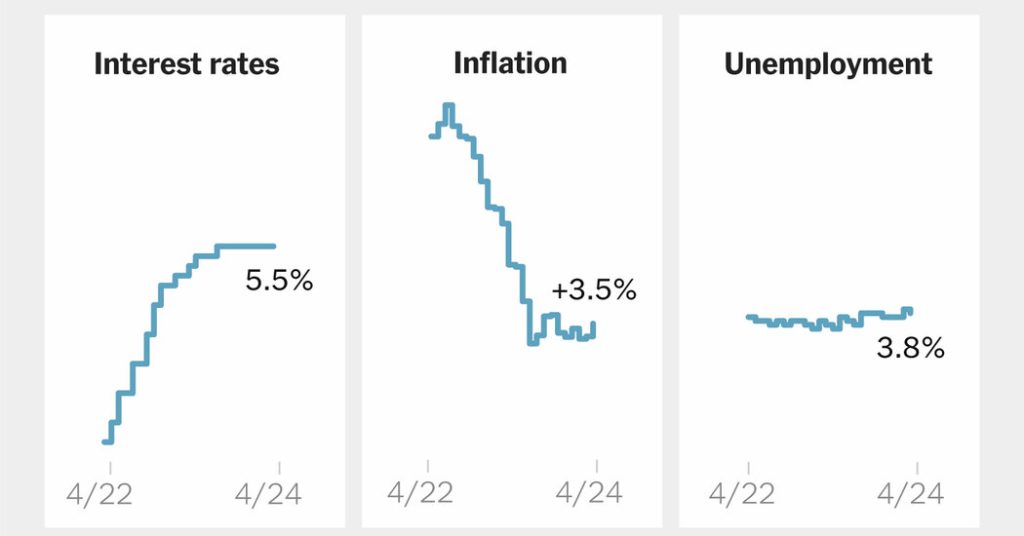

Inflation, as measured by the Consumer Price Index, peaked at over 9 percent in the summer of 2022 but has since slowed to around 3.5 percent in recent months. An alternate measure preferred by the Federal Reserve shows inflation at 2.5 percent in the latest data, indicating a general decline. While certain categories, such as car insurance and repairs, continue to see price increases, other areas like grocery prices and durable goods have remained stable or decreased. Inflation, while still too high, is less widespread than in previous years.

Despite concerns about inflation, other aspects of the economy are faring well. The labor market continues to exceed expectations, with robust job growth and unemployment rates remaining low. Wages are rising steadily, keeping ahead of inflation, allowing consumers to maintain spending levels. Various sectors of the economy are experiencing growth, with industries that struggled in the past showing signs of recovery. Overall, economic growth appears to be accelerating, driven by consumer spending and investments in sectors like manufacturing.

In light of the current economic conditions, interest rates are expected to remain high for the foreseeable future. The Federal Reserve has delayed anticipated rate cuts, signaling that rate hikes may be more likely in the near term. This shift in monetary policy has impacted stock prices, causing some volatility in the market. Borrowers, particularly low-income individuals reliant on loans, are feeling the pressure of high interest rates. Despite this, the economy has not seen a significant increase in bankruptcies, foreclosures, or business failures, suggesting a level of resilience.

While there are concerns about the impact of high interest rates on certain segments of the population, the overall economic performance has been relatively stable. The real worry lies in the juxtaposition of a slowing economy with persistent inflation. As long as strong consumer demand persists, monetary policy will need to remain tight to ensure that inflation is kept in check. The current economic environment presents a delicate balancing act for policymakers, who must navigate between controlling inflation and supporting economic growth. As the economy continues to evolve, policymakers must remain vigilant and flexible in their approach to ensure a stable and sustainable economic future.