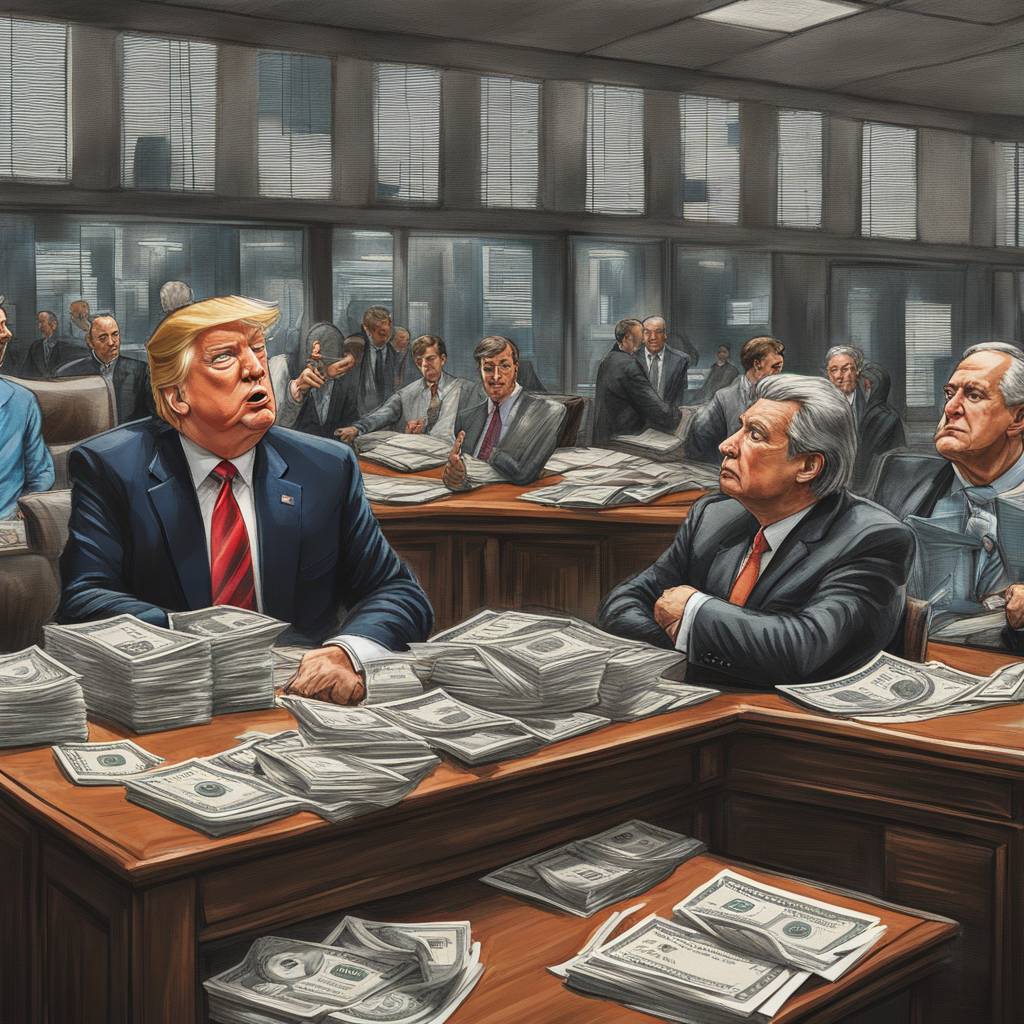

Florida venture capitalist Michael Shvartsman and his brother Gerald pleaded guilty to insider trading related to the Trump Media & Technology Group deal. The brothers admitted to securities fraud in New York, facing a maximum sentence of 20 years in prison. They were arrested in June, charged with trading on nonpublic knowledge of the merger between DWAC and Trump Media to make illegal profits. Along with a third individual, they allegedly made over $22 million through insider trading.

The indictment accused the brothers and another individual of using confidential information about the merger to engage in illegal trading. Digital World Acquisition Corporation’s stock surged after announcing its merger with Trump Media. US Attorney Damian Williams stated that insider trading is cheating and emphasized the consequences of corrupting the stock market. The convictions of the Shvartsman brothers serve as a reminder to potential offenders about the severe penalties for such misconduct.

The Trump Media merger recently closed after years of legal delays, resulting in a significant increase in the company’s share price. Former President Trump, the dominant shareholder, saw a financial windfall with his stake in Trump Media valued at $4.1 billion. Despite the positive developments, Trump Media’s stock fell by 4% following the guilty pleas of the Shvartsman brothers. The excitement surrounding the merger began in October 2021 when Trump announced the plans to merge his social media business with Digital World Acquisition Co.

Prosecutors alleged that the defendants shared inside information about the impending Trump Media deal with friends, colleagues, and neighbors, allowing them to buy securities before the deal became public. The information was reportedly exchanged during a trip to Las Vegas and at a furniture supply store. However, there was no implication of Trump’s involvement in the insider trading scheme. The story has been updated with additional developments and context provided by CNN’s Kara Scannell.

Overall, the guilty pleas of Michael and Gerald Shvartsman shed light on the consequences of insider trading and the importance of maintaining the integrity of the stock market. The significant financial gains resulting from the Trump Media merger highlight the potential for misconduct and illegal activities in high-profile business deals. The legal proceedings and convictions serve as a cautionary tale for those who may be tempted to engage in similar fraudulent practices. Additionally, the role of transparency and accountability in financial transactions is underscored by the prosecution of individuals involved in illegal trading activities.