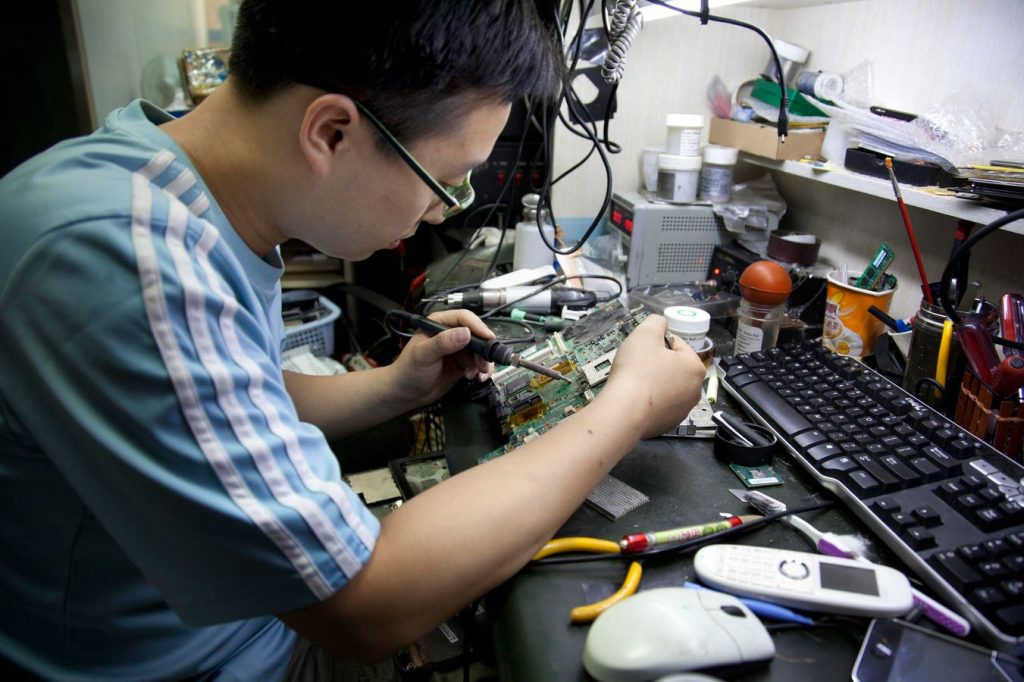

Investors are increasingly turning to tin as another hot metal for investment alongside copper, with tin prices rising by 38% over the last 12 months. Despite being considered a commodity of the past, tin is essential for various technologies such as electronics, solar panels, and batteries, making it a critical metal in today’s industrial landscape. Tin is also known as the “spice element” due to its small production volume compared to other base metals like copper.

Global annual production of tin stands at around 380,000 tons, a fraction of copper’s production at 22 million tons. The scarcity of tin, along with only a few major producers such as China, Myanmar, and Indonesia, can lead to sudden price spikes in the market. With most tin destined for China, similar to other critical metals in the electronics industry, China’s control over the tin market is evident. The recent demand surge has attracted investor interest in reviving old tin mines, such as the South Crofty mine in Cornwall, which closed in 1998.

Geopolitical factors, along with supply and demand dynamics, play a crucial role in the tin market. The collapse of the International Tin Council in 1985 tarnished the reputation of the London Metal Exchange and banks involved in tin trading. However, the current surge in tin prices is attributed to genuine supply and demand imbalances, with traditional uses of tin meeting increasing electrical demand amid tight supply and Chinese dominance in the market. Supply shocks, including disruptions in Indonesian tin supply earlier this year, are compounding the upward pressure on prices.

The electronics industry is expected to become the primary consumer of tin, which has been used for more than 5000 years in various applications. The London-listed Cornish Metals aims to revive the tin mines in Cornwall, embracing the renewed interest in tin investment. Mineral intelligence consultancy BMI anticipates tin prices to continue rising, potentially reaching $37,000 per ton by 2033. Given tin’s history of sharp price surges during supply disruptions and rising demand, this projection might be conservative, highlighting the volatility and potential for significant gains in the tin market.

The smaller production base and critical importance of tin in modern technologies underscore the metal’s significance as an investment opportunity. The recent price spike and renewed interest in tin mining projects, such as the redevelopment of old mines in Cornwall, signify the growing importance of tin in the investment landscape. As supply disruptions and strong demand from the electronics industry continue to impact tin prices, investors are closely monitoring the market for potential investment opportunities. Overall, tin’s revival as a hot metal for investors highlights its essential role in the industrial sector and the potential for significant price gains driven by supply and demand imbalances.