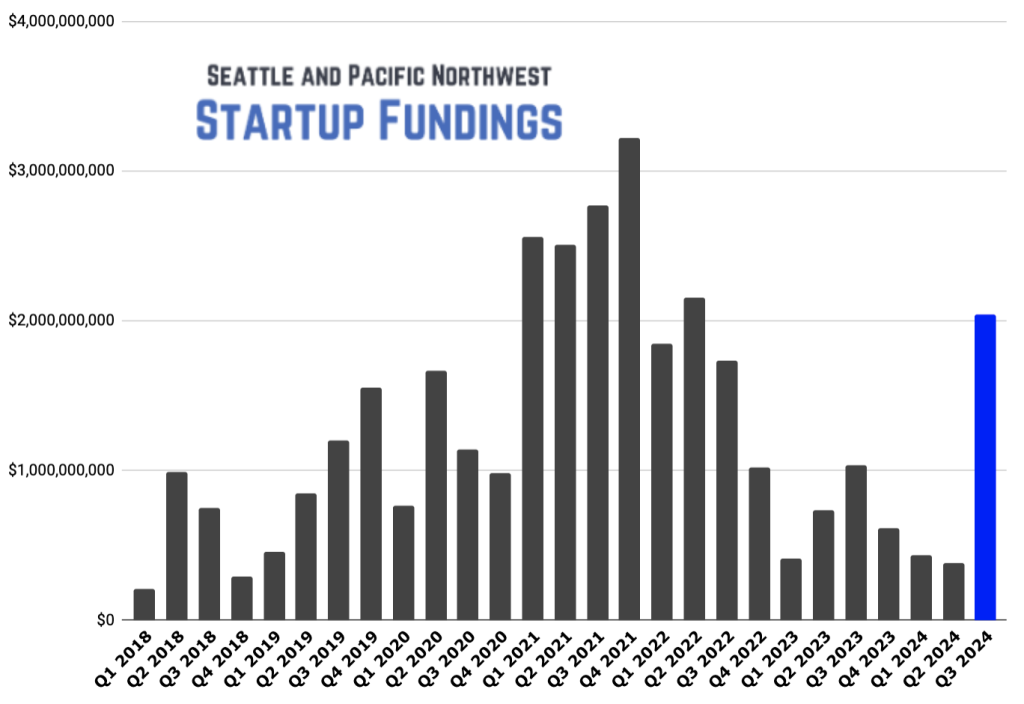

In the third quarter of the year, venture capital funding for Pacific Northwest startups showed positive momentum. Privately held tech companies in the region were able to raise over $2 billion across 44 deals during this time period. This was a significant increase from the previous quarter, which saw $382 million raised across 35 deals, as well as an increase from the same quarter in the previous year when $1.02 billion was raised. A large part of this funding came from a $900 million round for Vancouver, B.C.-based legal tech giant Clio in July, which made up nearly half of the total Q3 funding for the entire region.

Biotech and healthcare startups also saw success during this time, with companies such as Kestra Medical Technologies, Borealis Biosciences, and Outpace Bio raising rounds of over $100 million. Additionally, cybersecurity firm Chainguard received a notable investment of $140 million, making it a new unicorn in the Seattle region. Carly Kiser, managing director at J.P. Morgan, stated that there is increased optimism about fundraising in the region, particularly from early-stage companies in critical sectors like AI, cybersecurity, infrastructure, and clean tech.

Despite the positive momentum in the Pacific Northwest, the overall venture capital market is still relatively tepid compared to the record highs set in 2021. While total deal value for this year is expected to surpass 2020 levels, higher interest rates and fewer exits are keeping investors cautious. The latest PitchBook-NVCA Venture Monitor report notes that as liquidity remains elusive, venture investors are becoming increasingly cautious and are prioritizing quality over quantity in their investments.

Looking at the top funding rounds for companies based in Seattle and the broader Pacific Northwest during Q3, it is clear that there is a diverse range of industries receiving funding. This includes sectors such as AI, cybersecurity, healthcare, and legal tech. The report also anticipates a slowdown in the back half of Q4 due to the typical end-of-year pause and the upcoming U.S. election, but expects that fundraising activity will pick up again in early 2025. Overall, there is optimism about the future of venture capital funding in the region, with continued interest in supporting innovative startups across various sectors.