In a shocking turn of events in the financial world, GloriFi, a startup launched by oil and gas investor Toby Neugebauer, raised $55 million from Republican billionaires and bigwigs before shutting down just 12 months later. Neugebauer is now suing his former partner Nick Ayers, his billionaire backers, and former GloriFi employees, alleging that they conspired to destroy his company. The lawsuit, filed in May 2023, seeks damages in excess of $100 million, claiming that the investors took control of GloriFi, launched competing companies, and destroyed Neugebauer’s reputation.

Neugebauer’s complaint alleges that one of the investors, Strive Asset Management, took GloriFi’s ideas and used them to create a competing energy fund. Other backers are accused of taking GloriFi’s credit card design and launching a banking firm that was meant to serve as GloriFi’s banking arm. Despite denials from the defendants, Neugebauer has support from two individuals knowledgeable about GloriFi and six former employees who defend his version of events, saying that the alleged conspiracy is plausible. The lawsuit faces hurdles as Neugebauer seeks to bring the complaint as a conspiracy under the RICO Act.

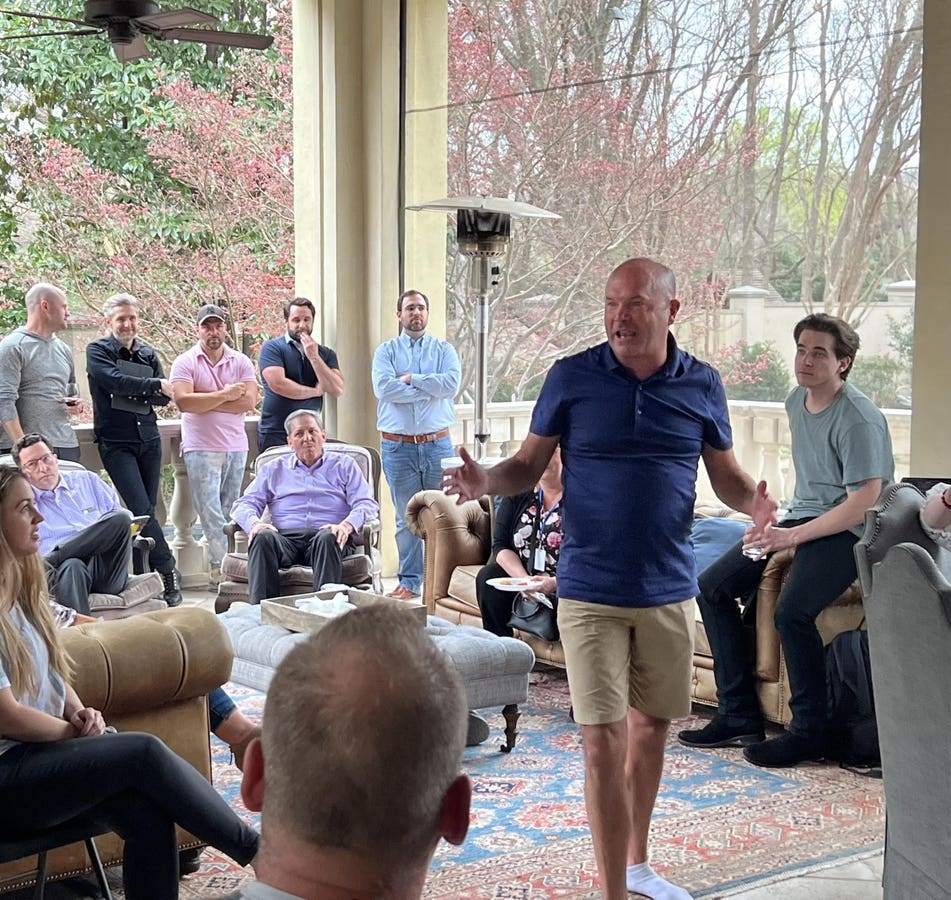

The lawsuit highlights the relationship between Neugebauer and his billionaire investors, who allegedly undermined GloriFi’s business by delaying funding rounds and creating liquidity crises. GloriFi’s spending habits were also cited as a factor in its demise, with the startup burning through over $60 million in just 16 months. Neugebauer attempted to outflank his investors by putting up his own cash to complete a fundraise, but the transaction fell apart due to complaints about his behavior from employees and board members, leading to outside investigations that hampered funding efforts.

Before its collapse, Neugebauer and his investors believed in a significant opportunity for GloriFi in providing anti-woke financial services to a large segment of Americans. However, the success of GloriFi’s would-be competitor, Strive Asset Management, which was touted by Biotech investor Vivek Ramaswamy on the 2024 campaign trail, suggests that the opportunity was overly optimistic. Strive, with $1.5 billion in assets, is seeking to raise more equity capital and appears to be using a similar pitch to GloriFi, echoing Neugebauer’s vision for the company.

As the legal battle continues, Neugebauer remains determined to seek justice for what he believes was a conspiracy to destroy his company. With his substantial wealth and political connections, including ties to former U.S. Congressman Randy Neugebauer and former Vice President Mike Pence, Neugebauer has the resources to pursue his legal campaign against his investors. The trial date for the lawsuit has been set for July 24, where the judge will decide whether Neugebauer’s claims can move forward, shedding more light on the complex and controversial circumstances surrounding the collapse of GloriFi.