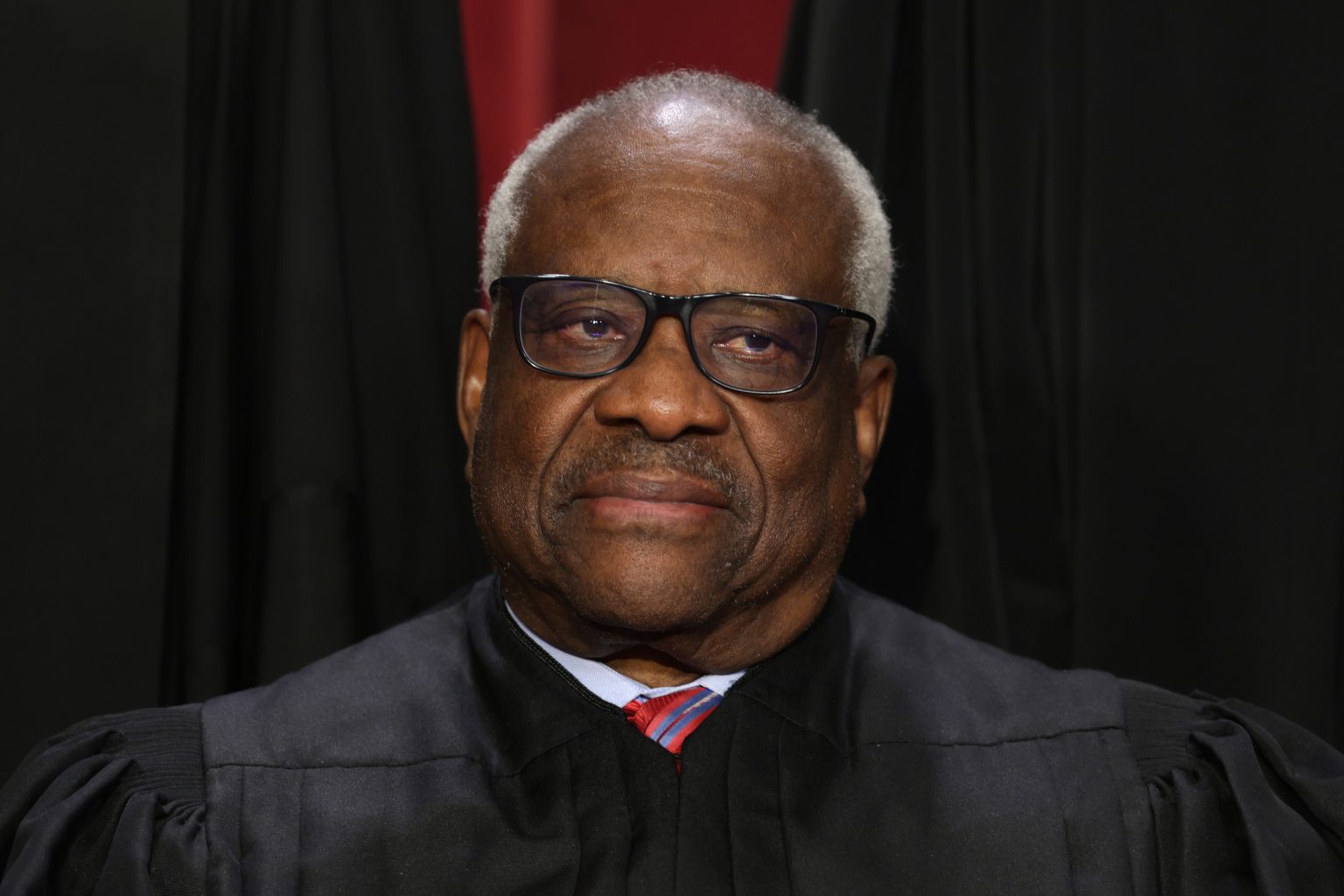

Supreme Court analysts were surprised by Justice Clarence Thomas’s ruling in a 7-2 decision involving the Consumer Financial Protection Bureau (CFPB). The court ruled that the CFPB’s funding mechanism is legal, overturning a previous decision by the Court of Appeals for the Fifth Circuit. The case originated in 2018 when trade groups representing payday lenders sued the CFPB.Thomas, a conservative judge, wrote the majority opinion in favor of the agency, stating that the funding mechanism meets the requirements of the Appropriations Clause.

Three conservative justices, including Chief Justice John Roberts and Justices Brett Kavanaugh and Amy Coney Barrett, as well as three liberal justices, sided with Thomas in the opinion, while Justices Alito and Gorsuch ruled against the CFPB. Analysts expressed surprise at Thomas’s ruling, with some commenting on social media about their unexpected agreement with the decision. The CFPB issued a statement praising the court’s decision, calling it a victory for essential consumer protection enforcement.

Justice Alito, in his dissenting opinion, criticized the court’s decision, arguing that it circumvents the Constitution and does not align with the original understanding of the appropriations clause. President Joe Biden, on the other hand, welcomed the ruling as a win for American consumers, characterizing it as a victory against attacks from Republicans and special interests looking to undermine consumer protection efforts. The CFPB reiterated its commitment to carrying out its vital work in protecting consumers.

Overall, the court’s decision in favor of the CFPB’s funding mechanism was seen as a surprising turn of events by analysts and commentators alike. Despite some dissenting opinions, the majority opinion upheld the constitutionality of the agency’s funding structure, ensuring its continuity in carrying out its mission to protect consumers. This ruling is expected to have significant implications for the financial regulatory system and the future of consumer protection efforts in the United States. The CFPB remains steadfast in its commitment to fulfilling its mandate, despite ongoing challenges from various stakeholders.