Kilroy Realty Corp has been recognized as a Top 10 Real Estate Investment Trust (REIT) by Dividend Channel in its most recent ”DividendRank” report. The report highlighted that KRC shares exhibit attractive valuation metrics and strong profitability metrics compared to other REITs. With a current share price of $32.68, KRC boasts a price-to-book ratio of 0.7 and an annual dividend yield of 6.61%, outperforming the average stock in Dividend Channel’s coverage universe in terms of yield and price-to-book ratio. Additionally, the report mentioned the company’s strong quarterly dividend history and favorable long-term growth rates in key fundamental data points.

According to the report, dividend investors who focus on value investing are interested in researching companies that are not only profitable but also trade at an attractive valuation. DividendRank’s proprietary formula ranks companies based on criteria for profitability and valuation to identify the most promising stocks for further research. REITs are particularly favored by dividend investors due to their requirement to distribute at least 90% of their taxable income as dividends, resulting in high dividend yields. However, this also leads to volatility and uncertainty in dividend payments based on the REIT’s profitability.

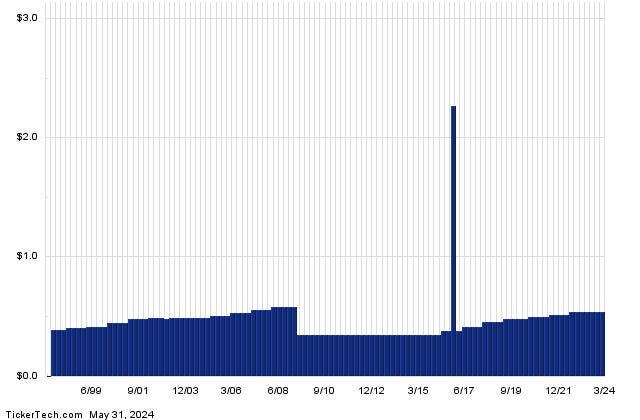

Kilroy Realty Corp currently pays an annualized dividend of $2.16 per share, distributed in quarterly installments, with an upcoming ex-dividend date of 06/28/2024. The report emphasized the importance of studying a company’s past dividend history to assess the likelihood of continued dividend payments. Analyzing the consistency and growth of dividend payouts over time can provide valuable insights into a company’s financial stability and potential for future dividend sustainability.

REITs like KRC are attractive investment options for dividend investors seeking a balance between profitability and valuation. With a focus on distributing a significant portion of their income to shareholders as dividends, REITs offer high dividend yields but also come with the risks of fluctuating dividend payments based on the company’s financial performance. Kilroy Realty Corp’s inclusion in the Top 10 REITs by Dividend Channel reflects its strong performance in terms of profitability metrics, valuation metrics, and long-term growth rates, making it a compelling choice for investors seeking dividend income and potential capital appreciation.

In conclusion, Kilroy Realty Corp’s recognition as a top-performing REIT by Dividend Channel underscores the company’s strong financial performance and commitment to shareholders through consistent dividend payouts. As an attractive investment option for dividend investors, KRC’s combination of high dividend yield, favorable valuation metrics, and long-term growth potential positions it as a promising opportunity for those seeking to generate income from their investments. By focusing on value investing principles and analyzing key fundamental data points, dividend investors can identify companies like KRC that offer a balance of profitability and valuation for long-term investment success.