Summarize this content to 2000 words in 6 paragraphs

A Florida woman took over a co-op building in trendy Williamsburg, illegally pocketed rent and even tried to sell the building for $1.4 million, a new lawsuit claims.

But phony landlord Jessica Vargas claims did nothing wrong because a city official told her ownership of the squatter-infested building was “good to go” before she allegedly collected nearly $450,000 from the low-income co-op.

“A thief?” Vargas told The Post. “That’s not who I am — I’ve always been honest.”

Vargas was named in a lawsuit this week filed by state Attorney General Letitia James, seeking to take the building’s title back, and pushing Vargas to pay the co-op back.

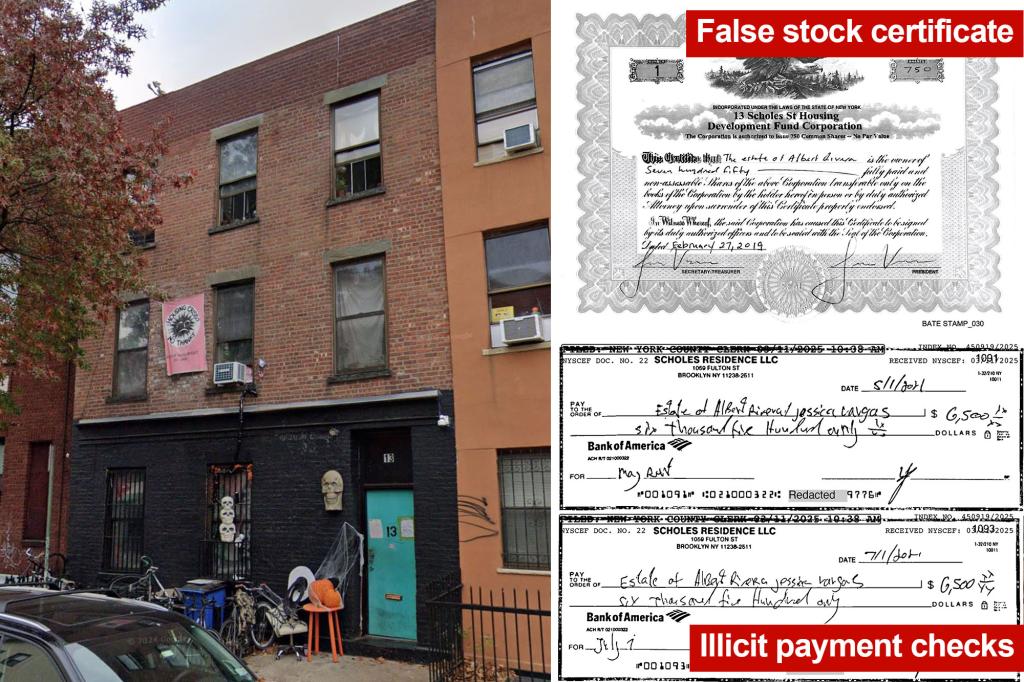

Vargas, the suit contends, created multiple false documents to claim ownership of 13 Scholes St., a three-family limited-equity co-op building known as an HDFC, turning the supposedly affordable building into “a Floridian’s personal piggy bank,” James said in a statement this week.

“Jessica Vargas declared herself president of a building she had no claim to, exploiting New Yorkers for her personal gain while living over a thousand miles away,” James said.

But Vargas said that she only inherited a situation her late father created — and that after he died in 2018 a since-retired city official told her everything was kosher.

Her lawyer, Alexander Levkovich, said Vargas is innocent, and called the suit “a significant overreach.”

The suit states that Vargas, 41, who grew up in the building with her family and now lives in a Tampa suburb where she works as a data specialist, “has engaged in repeated fraudulent acts” and must return $442,000 in rent that should have gone to the co-op. The building owes over $40,000 in city property taxes.

Vargas said the money she netted — $6,500 in monthly rent paid by a developer-owned LLC her father signed an agreement with before he died — was used to support her siblings and legal fees for the building, not to make her rich.

“I’ve been living in the same house for over 20 years,” Vargas said. “I have no fancy cars. I have nothing — nothing. They say: ‘Wow, yeah, she came into a lot of money.’ No, I’m just doing what I have always been doing since I was 5-years old: taking care of my siblings.”

Her father, Albert Rivera, first claimed ownership of the co-op’s shares in a document containing only his and his wife’s signatures, which the lawsuit said is fraudulent since it lacked signatures from the other shareholders.

Vargas said that when the other shareholders died, their shares transferred back into the HDFC and her father, an idea that James’ office said flies in the face of basic estate law.

Court documents include an affirmation from a shareholder’s estate claiming their shares were never transferred to Rivera.

Rivera signed a 2017 lease agreement with an LLC held by developers, giving them reign over the building and an option to buy for $1.4 million, as long as they paid a rent of $6,500 a month.

But James’ office said that lease agreement was void, since any tenant would have to meet strict income criteria with shareholder approval. Even if the lease were legitimate, that money was meant for the co-op, not Rivera’s or Vargas’ pockets, the office contends.

When Rivera died, Vargas, as administrator of her father’s estate, continued to collect the money and presented herself as the building’s sole owner through several alleged false documents filed with city agencies — including a fraudulent stock certificate claiming sole ownership, according to James’ filings.

Vargas told The Post that following her father’s death, she met with an HPD official, whom her father allegedly met with years ago and had approved the lease.

She showed him “everything that I had” related to the building, and that the official “said I was good to go…He told me to put down that I’m the owner,” Vargas said.

An email from her father in December 2016 states that he met with the official and noted that “HPD cannot give anything in writing” in regards to his ownership claim.

The Post was unable to reach the official — whose name is being withheld — to verify any of Vargas’ claims.

HPD confirmed that the official no longer works at the department and that they have no records of any meetings with Vargas or Rivera.

The spokesperson added that the LLC lease would not be permissible due to HDFC restrictions, and that the HDFC was never dissolved.

Vargas’ dealings have left the co-op in debt — including $41,479 in unpaid property taxes and a $3,000 water bill — as she collected at least $442,000 in unreported income from the building, the suit alleges.

When the AG’s office first opened its investigation over a year ago — spurred by questions of ownership raised during a suit to remove alleged squatters who took over the long-vacant building in 2023 — they asked Vargas to produce documents showing her ownership and the dissolution of the HDFC.

Vargas told The Post she had cooperated fully, but officials said Vargas failed to produce any evidence that her claim was legitimate.

Then the AG’s office offered a deal: if Vargas dropped her claims to the title, prosecutors wouldn’t go after the allegedly stolen funds.

Vargas rejected the offer.

“The benefit of Jessica entering into this agreement would have been strictly for the AG to pretty much take over the property,” said Levkovich, Vargas’ attorney.

Vargas said she’s been “nothing but honest,” and that if HPD told her there was a deficiency in the title, she would have followed whatever they told her to do at the time.

An AG spokesperson said the lengths Vargas went to prop up her false tale of ownership, including an allegedly false stock certificate, contradict her claims of not knowing better.

Levkovich said they’ll have to start a gofundme to pay for the “significant resources to defend the suit.”

“I can’t sleep,” Vargas said. “Being accused of stealing something? That’s not me — I’ve always been honest.”