Summarize this content to 2000 words in 6 paragraphs

Data from GeekWire’s fundings list.

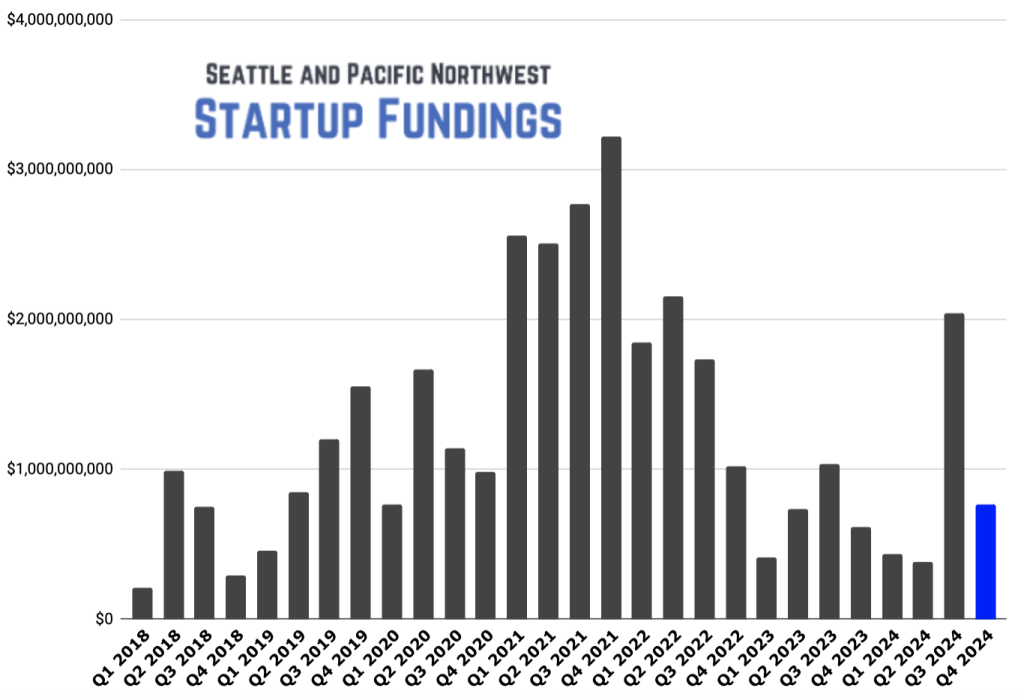

Venture capital funding to startups based across the Pacific Northwest rose more than 20% year-over-year during the fourth quarter of 2024.

Total funding in Q4 topped $762 million across 48 deals, according to GeekWire’s funding tracker.

That’s nowhere near the $3.2 billion raised in the fourth quarter of 2021, amid the venture capital boom and ZIRP era. But there is some positive momentum for the early stage startup scene in Seattle and the broader region.

Fusion company Zap Energy and supply chain software startup Auger raised more than $100 million each, helping boost funding levels in Q4. Weed-zapping manufacturer Carbon Robotics and productivity software maker Read AI also reeled in sizable rounds.

The overall U.S. venture capital market remains tepid, relative to the record highs set in 2021, given the lack of exits and more cautious investors. That could change this year with recent interest rate cuts and the potential for more M&A.

“As a team, our outlook on U.S. VC is moderately positive for 2025,” PitchBook wrote in its venture capital outlook last month. “That does not mean that challenges are gone. Flat and down rounds will likely continue at higher paces than the market is accustomed to. More companies will likely shut down or fall out of the venture funding cycle.”

Total deal value in the U.S. rose to $209 billion in 2024, up from $162.2 billion in 2023, according to PitchBook. Total deals fell from 14,712 in 2023 to 13,776 last year.

AI is dominating venture, representing nearly half of U.S. deal value in 2024, according to PitchBook. Generative AI startups raised $56 billion in 2024, up nearly 200% year-over-year, according to PitchBook data cited by TechCrunch.

Here’s a look at the top funding rounds for companies based in Seattle and the Pacific Northwest during Q4. Several are focusing on AI-fueled enterprise software, but other industries including logistics, biotech, apparel, space, healthcare, and clean energy are represented. See all the latest deals at our funding tracker.

Previously: Investor predictions 2025: Seattle VCs sound off on AI, remote work, and city’s tech ecosystem