Summarize this content to 2000 words in 6 paragraphs The total U.S. student loan debt has continued to rise despite former President Joe Biden’s historic efforts to provide debt relief. Data shows that while millions of borrowers have benefited from loan forgiveness programs, new loans continue to outpace repayments, pushing the overall debt burden higher.Why It MattersStudent loan debt affects millions of Americans, influencing financial stability, homeownership and long-term savings. As of late 2024, outstanding federal student loan debt reached approximately $1.64 trillion, up from $1.59 trillion in early 2021. While the Biden administration forgave $188.8 billion in student loans for 5.3 million borrowers, new borrowing—totaling over $300 billion during Biden’s tenure—has surpassed debt cancellation.Rising tuition costs continue to drive borrowing, with data from the Education Data Initiative showing the total average cost of higher education reaching over $100,000. For borrowers, these trends mean potential long-term financial strain, as repayment obligations impact daily expenses and major life decisions such as buying a home or starting a business.

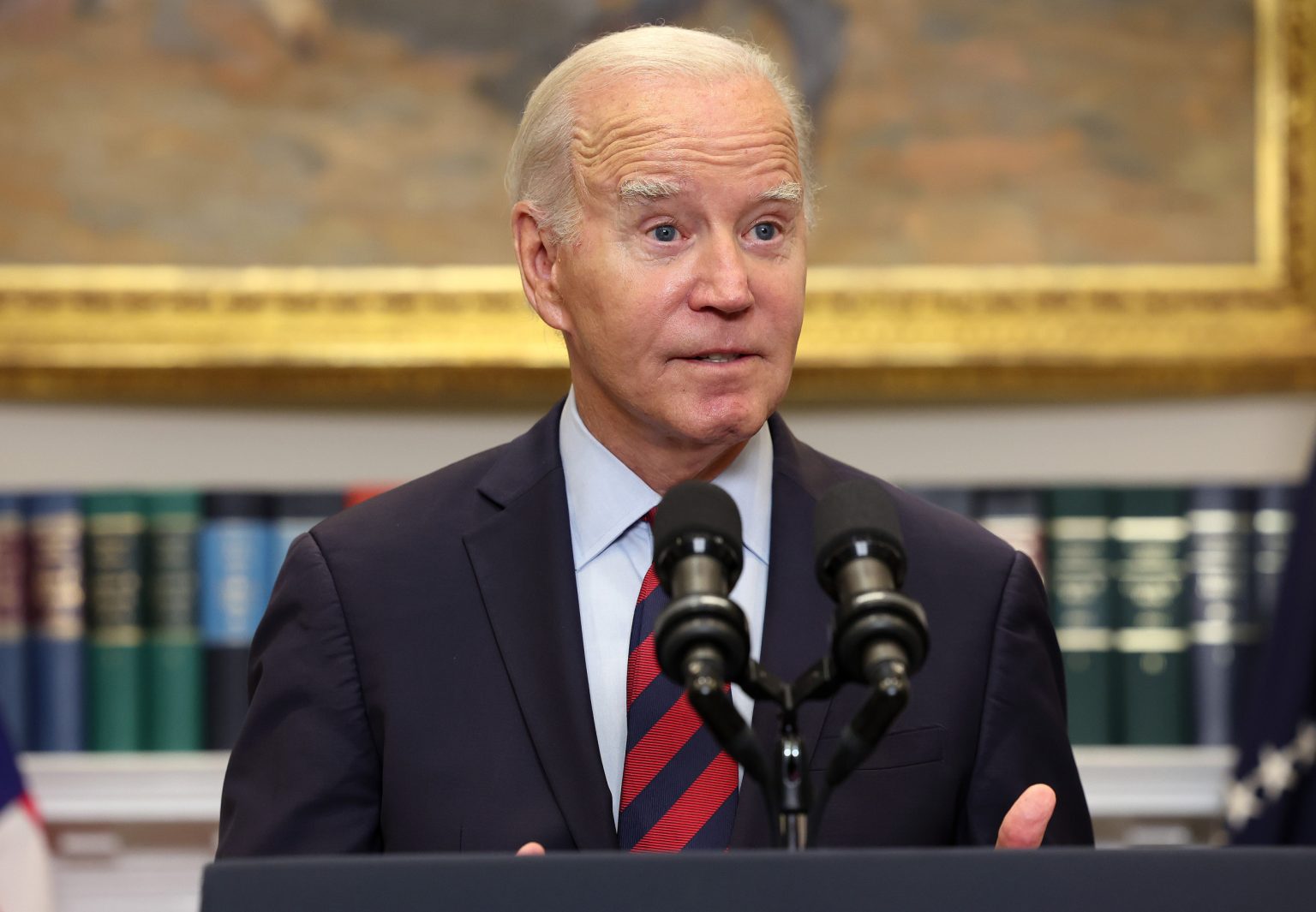

U.S. President Joe Biden delivers remarks on new Administration efforts to cancel student debt and support borrowers at the White House on October 04, 2023 in Washington, DC.

U.S. President Joe Biden delivers remarks on new Administration efforts to cancel student debt and support borrowers at the White House on October 04, 2023 in Washington, DC.

Kevin Dietsch/Getty Images

What to KnowAccording to the Education Data Initiative, total student loan debt in the U.S. reached $1.7 trillion as of early 2025, with federal loans accounting for 92.4 percent of that total. The average federal student loan debt per borrower is $38,375, and total average balances—including private loans—can reach as high as $41,520.Despite the Biden administration’s debt relief measures, more than $300 billion in new federal student loans were issued during his presidency, outpacing the debt being forgiven according to calculations from higher education expert, Mark Kantrowitz.The temporary COVID-era pause on federal student loan payments, which lasted from March 2020 to September 2023, also contributed to the mounting balances, as it allowed borrowers to defer payments without accruing interest.”There are a few key reasons for why total student loan debt outstanding increased during the Biden administration despite his forgiving about 12% of the total. The payment pause meant that borrowers weren’t making progress in paying down their loan balances,” Kantrowitz told Newsweek.”Later, the 12-month on-ramp increased the number of borrowers in forbearances. Also, every year there are new students in college who must borrow to pay for their education. The new borrowing exceeds the payments made on existing loans. That’s partly because student loans are usually repaid over decades, as opposed to years, and some borrowers are not in active repayment. Finally, the total forgiveness was only $188 billion, which is the amount of new debt that accumulates in about 2 years. So, it was a two steps forward, one step back situation,” Kantrowitz continued.The same data from the Education Data Initiative also shows that student loan debt saw a 2.53 percent year-over-year increase in Q4 2024, marking the first sustained growth since declines began in 2023. Federal student loan debt specifically increased by 2.27 percent over the same period.What People Are SayingMichael Lux, an attorney and founder of The Student Loan Sherpa, told Newsweek: “The root cause problem of the student loan crisis is that college, despite being essential for entry into many professions, is extremely expensive. Forgiveness helps the borrowers overwhelmed with debt, and it is arguably good for the economy, but it doesn’t help lower the cost of college.Ultimately, student loans are a symptom of a higher education affordability crisis. Democrats and Republicans can’t agree on how to treat the symptom, and very little progress has been made to address the main issue.”Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek: “Unfortunately, the takeaway from the student loan forgiveness initiatives by the Biden administration were splashy headlines over actual data. While there were student loans forgiven over the past few years, that forgiveness was heavily targeted to a select group of borrowers whose loans had accrued an alarming amount of interest due to the conditions of the loan that made it difficult to fully pay off.They didn’t cover the billions of dollars in new loans currently being acquired by students attending college. Many universities are seeing enrollment equal to or increasing over their pre-pandemic highs, and with the increases in cost of living, students are kicking more of that cost of attendance down the road in the form of loans. Even with more aggressive efforts to cancel student debt, it’s easy to see why the overall total went up.”Mark Kantrowitz, author and nationally-recognized higher education expert, told Newsweek: “The problem with the broad student loan forgiveness proposed by the Biden administration is it included many borrowers who are capable of repaying their student loans. Nobody loves their student loans, so most borrowers would willingly accept a handout if offered to them.”What’s NextWith the new administration in office, federal student loan policies are under review, and changes to repayment plans and forgiveness programs are expected. The future of initiatives like the SAVE plan and Public Service Loan Forgiveness remains uncertain as legal challenges and policy shifts take shape.Borrowers should continue to stay informed about policy changes and explore available repayment options to manage their debt effectively.