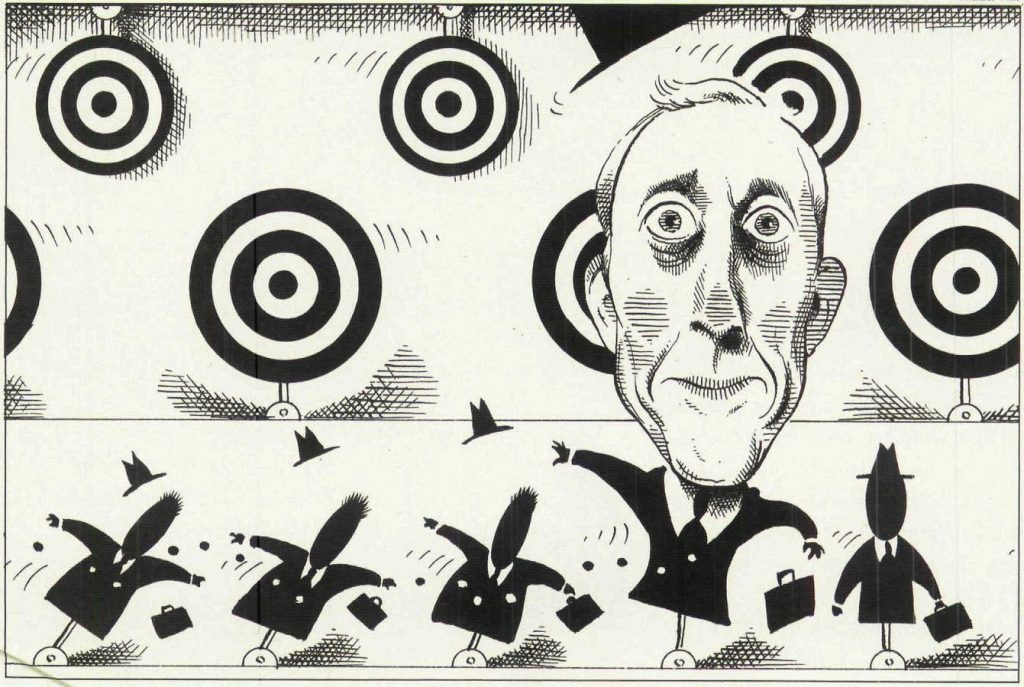

Infamous trader Ivan Boesky, known for breaking laws and serving time in prison, passed away at the age of 87 at his home in California. In the late 1980s, Boesky pled guilty to insider trading and agreed to pay a $100 million fine. Despite once appearing on The Forbes 400 list of richest Americans, his legacy became synonymous with greed on Wall Street due to his fraudulent activities.

An article in Forbes magazine from December 1986 shed light on Boesky’s questionable investment practices. While he was hailed as the Emperor of Arbitrage, his actual performance failed to meet expectations, prompting him to cheat to maintain the illusion of success for his investors. Boesky’s plummeting investment record forced him to resort to illegal activities to boost his numbers after other risk arbitrage traders outperformed him.

The article highlighted how Boesky’s recent profits were largely attributed to insider information obtained from Dennis Levine, a fact confirmed by the Securities & Exchange Commission. Boesky’s new $900 million fund, formed after receiving illicit tips from Levine, ultimately suffered losses despite initial gains. Boesky’s risky leverage strategies and exorbitant fees meant investors bore the brunt of losses while he pocketed significant profits, endangering their financial security.

Boesky’s financial track record showed significant fluctuations in returns, with wild swings from losses to substantial gains over the years. While his first fund was successful in the 1970s, subsequent funds yielded diminishing returns, failing to outperform market benchmarks. The third fund, backed by Drexel Burnham Lambert, struggled to generate enough profits to cover its mounting debt, leaving equity investors vulnerable to potential lawsuits in the aftermath of Boesky’s fraudulent activities.

In conclusion, Ivan Boesky’s once high-flying reputation as an arbitrager crumbled under the weight of illegal activities and poor investment performance. Boesky’s unethical practices and relentless pursuit of profit at any cost overshadowed his early success, tarnishing his legacy in the financial world. The article exposed the reality behind Boesky’s façade of success, revealing a flawed investment strategy that ultimately led to his downfall and imprisonment. Boesky’s story serves as a cautionary tale of the dangers of greed and the consequences of dishonesty in the pursuit of wealth on Wall Street.

Reflecting on Ivan Boesky: The Wizard of Arb and his underwhelming performance

Keep Reading

Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.

© 2025 Globe Timeline. All Rights Reserved.