The CNBC Investing Club with Jim Cramer offers an actionable afternoon update called the Homestretch, which is released every weekday just in time for the final hour of trading on Wall Street. The S&P 500 reached a new record high on Wednesday, with markets seeing a continuation of a theme where U.S. stocks have been rallying due to sliding oil prices and China’s market giving back recent gains. Despite some disagreement among central bankers, the Federal Reserve opted for a 50-basis-point reduction in interest rates last month to start its cutting cycle. Financials were leading the market higher, with stocks like Morgan Stanley hitting multiyear highs and Honeywell gaining momentum after announcing plans to spin off its advanced materials business.

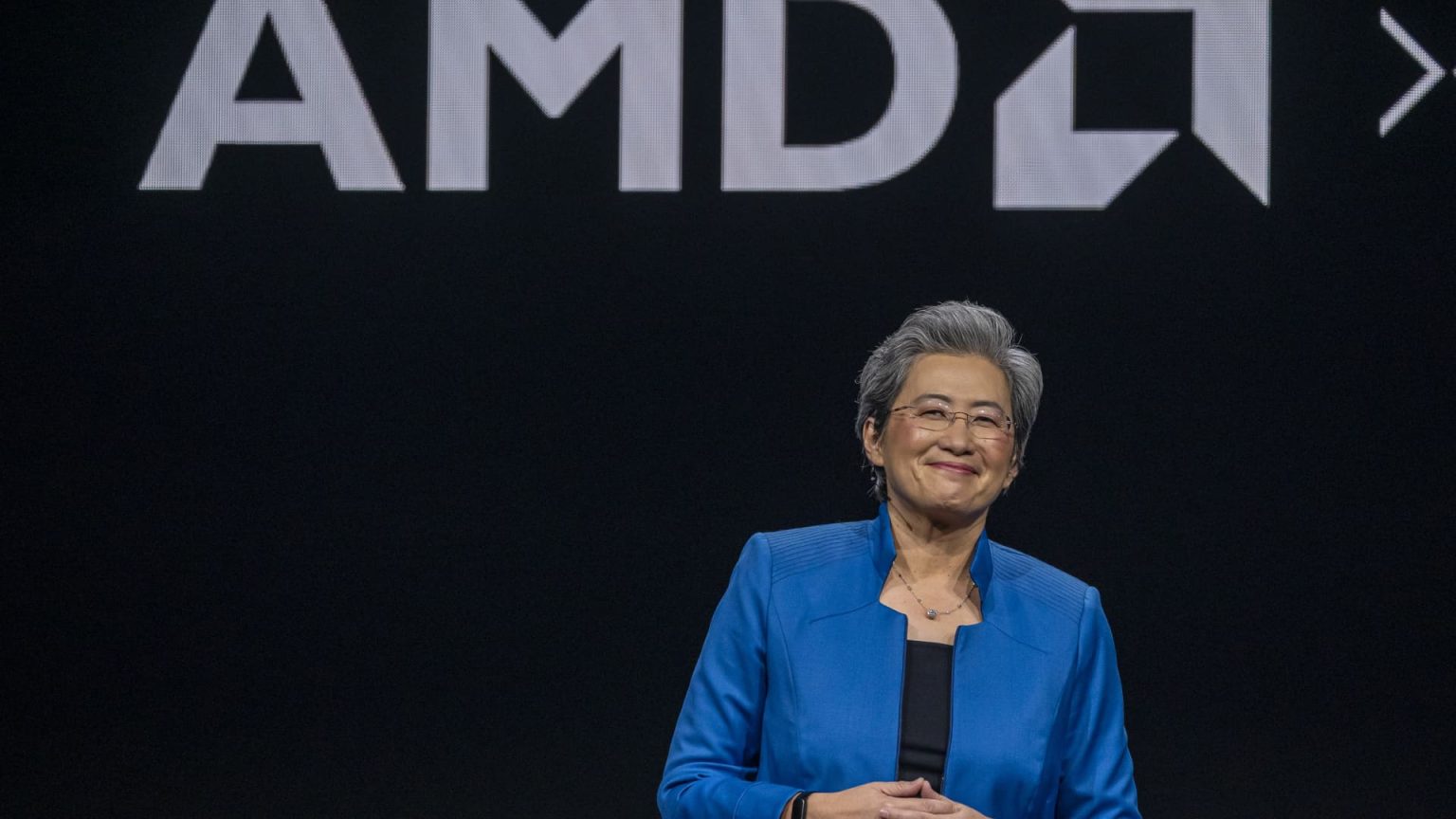

In terms of movers, financials were leading the market higher, with stocks like Morgan Stanley hitting multiyear highs and Honeywell gaining momentum after announcing plans to spin off its advanced materials business. Semiconductors were mixed, with Nvidia and Advanced Micro Devices slightly down but Broadcom hitting a new all-time high. AMD was set to hold its Advancing AI event, which analysts at Bank of America believed could be a catalyst for the stock. The company was expected to introduce new products like the MI325 accelerator and Turin CPU, with expectations of raising its full-year AI sales forecast to over $5 billion. Additionally, questions remained about whether AMD would provide a 2025 AI sales target and announce another cornerstone customer of its AI chips.

Looking ahead, there were no major earnings after Wednesday’s closing bell or Thursday’s open, with the September Consumer Price Index expected to show a continued deceleration in inflation. As a subscriber to the CNBC Investing Club with Jim Cramer, individuals receive trade alerts before Jim makes a trade. He waits 45 minutes after sending a trade alert to buy or sell a stock in his charitable trust’s portfolio and 72 hours after discussing a stock on CNBC TV. It is crucial to note that the information provided in connection with the Investing Club is subject to terms and conditions, privacy policy, and disclaimer, with no guaranteed specific outcome or profit.

Overall, the market saw a continuation of the theme driving U.S. stocks higher, with financials leading the market and semiconductors experiencing mixed results. AMD was expected to hold an Advancing AI event that could be a catalyst for the stock, while questions around forward guidance and the possibility of a 2025 AI sales target remained. Looking ahead, the focus was on the September CPI data and upcoming PPI release, with subscribers to the CNBC Investing Club receiving trade alerts and adhering to specific guidelines before making trades. It is essential to consider the terms and conditions, privacy policy, and disclaimer associated with the Investing Club, with no guaranteed outcome or profit.