Building wealth for retirement is essential, and the key is to have your money work for you through investing and compounding. One effective strategy to start building your retirement nest egg is by investing in the S&P 500, an index comprised of 500 prominent U.S. companies. This allows you to diversify your investments and benefit from the success of some of the best-performing companies in the U.S. market. While stock market investments can be volatile, the S&P 500 has always rebounded and shown growth over the long term, making it a relatively safe wealth-building tool.

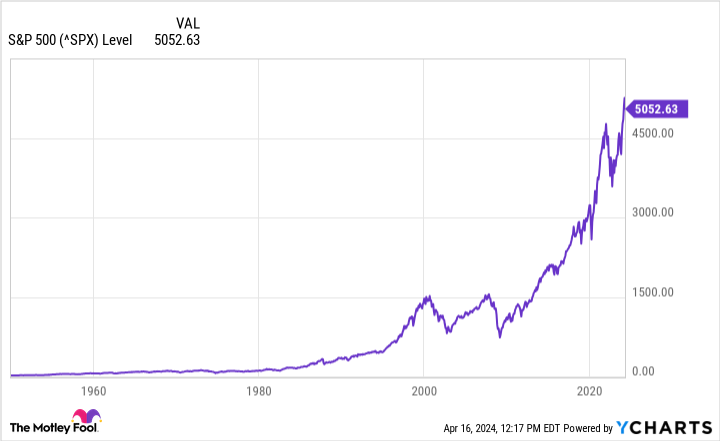

The fear of losses often deters investors from the stock market, but it is crucial to understand that volatility does not necessarily equal risk. The S&P 500, introduced in 1957, has consistently grown over time, demonstrating the resilience and upward trajectory of the U.S. stock market. By applying the Rule of 72, a simple formula to calculate how long it takes for an investment to double, investors can see the power of compounding in action. Investing early and letting your money grow over time through the S&P 500 can lead to significant wealth accumulation in the long run.

One of the advantages of investing in the S&P 500 is the ease of tracking and benefiting from the growth of the top companies in the index. By holding an index fund that mirrors the S&P 500, investors can capitalize on the overall performance of the U.S. stock market without the need for constant monitoring and management of individual stocks or portfolios. This passive approach to investing allows individuals to focus on their long-term financial goals and let the market work for them.

It is important to start investing as early as possible to take advantage of the power of compounding and maximize your retirement savings. By investing in an index fund that tracks the S&P 500 and letting your money grow over time, you can set yourself up for a financially secure future. While market crashes and fluctuations are inevitable, history has shown that the U.S. stock market has always bounced back and continued to grow in the long run. By staying committed to your investment strategy and focusing on long-term goals, you can build wealth for retirement and create a solid financial foundation for the future.