Nvidia, a leading AI chipmaker, experienced a significant decline in stock value, resulting in a loss of $279 billion in market value, the largest single-day loss in stock market history. This decline is attributed to concerns over the high valuations of AI stocks, potential economic weakness impacting investment decisions, and disappointing outlook despite strong earnings. CEO Jensen Huang also suffered a personal loss of $10 billion as a result of the sharp tumble in Nvidia’s stock price.

The decline in Nvidia’s stock price started in June when it reached a peak value of $3.3 trillion, eventually falling over 20% since then. Other tech giants like Microsoft and TSMC, as well as former chipmaking leader Intel, have also experienced stock price declines due to various challenges. Nvidia faces additional issues as reports suggest that the US Justice Department has issued a subpoena as part of an antitrust investigation. Despite this, Nvidia disputes any wrongdoing and emphasizes its value to customers and performance in benchmark tests.

The broader tech sector, including Nvidia, continued to face declines in premarket trading, with the Nasdaq Composite down 0.7%. However, some investors remain bullish on Nvidia due to its strong market position, growing demand for AI chips, and the company’s ability to deliver returns on investment. Huang highlighted the efficiency of Nvidia’s GPU chips in processing data and saving clients money, leading some analysts to see the current stock decline as a buying opportunity.

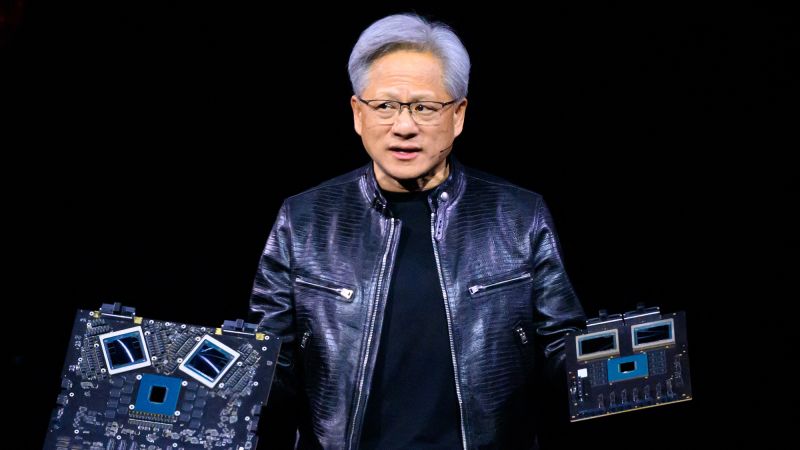

Nvidia’s stock has still performed well overall, with a 118% increase year to date and a $2.7 trillion market valuation, placing it among the top tech companies. Despite challenges in the market and regulatory scrutiny, Nvidia continues to innovate and expand its product offerings. The company’s latest AI chips, like the “Blackwell” chip, are seeing high demand, indicating strong growth potential. Analysts like Dan Ives view Nvidia’s stock decline as an opportunity for investors to capitalize on the company’s continued success and dominance in the tech industry.

Overall, Nvidia’s recent stock decline, driven by concerns over high valuations, economic uncertainty, and regulatory issues, has put the tech giant in a challenging position. Despite this, the company remains a strong player in the AI chipmaking industry, with promising growth opportunities ahead. While the market fluctuates, some investors see Nvidia’s current situation as a chance to purchase stock at a lower price and benefit from the company’s long-term success. As Nvidia navigates these challenges, it will be critical for the company to maintain its innovative edge and customer value to sustain its position in the competitive tech landscape.