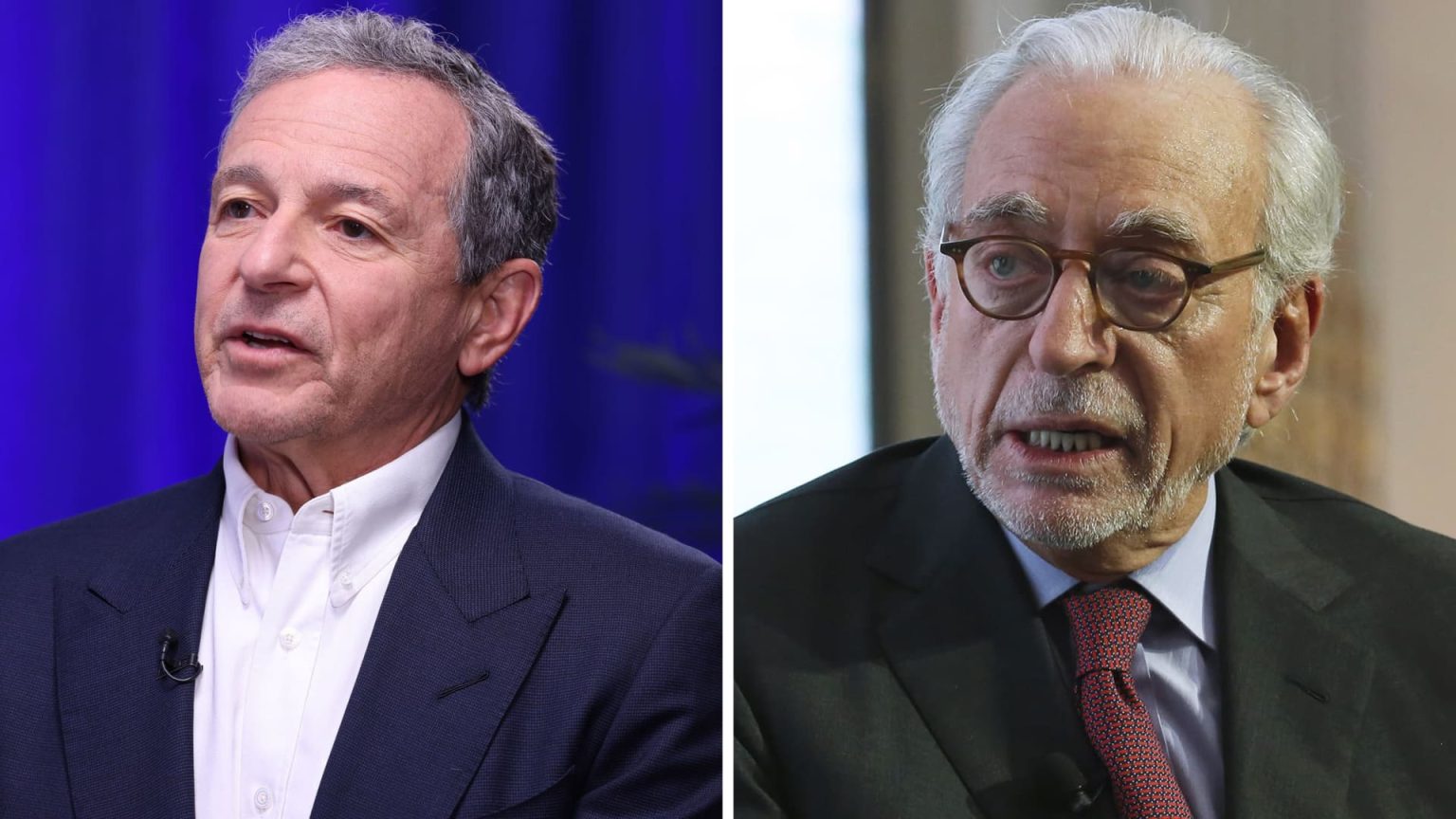

Activist investor Nelson Peltz has recently sold his entire stake in Disney at close to $120 dollars per share, netting approximately $1 billion on the position. This move comes after Peltz’s Trian Partners lost a proxy battle at Disney in April, where shareholders reelected the company’s full slate of board nominees, thwarting Peltz’s attempt to elect himself and former Disney CFO Jay Rasulo to the board. Peltz has been critical of Disney’s governance, particularly focusing on the company’s streaming strategy and a failed succession plan for CEO Bob Iger.

In October, Peltz increased his stake in Disney to around 30 million shares and renewed his proxy campaign, highlighting concerns about the company’s direction and leadership. Despite the setback of losing the proxy battle, Trian Partners expressed pride in their impact on refocusing Disney on value creation and good governance. Disney’s stock currently trades at around $100 per share, with shares up approximately 11% for the year, slightly outperforming the S&P 500. Disney has not yet commented on Peltz’s sale of his stake in the company.

Peltz’s decision to sell his Disney shares marks a significant shift in his investment strategy, as he exits a position that had been a key focus for Trian Partners. The move comes amid ongoing challenges and uncertainties in the entertainment industry, particularly regarding the impact of streaming services and changes in consumer behavior. Despite the sale of his stake in Disney, Peltz’s reputation as an influential activist investor remains intact, as he continues to engage with companies and advocate for change to drive shareholder value.

The sale of Peltz’s stake in Disney highlights the complex dynamics at play in shareholder activism, where investors seek to influence corporate decision-making and governance to enhance shareholder returns. Peltz’s involvement with Disney underscores the importance of strong leadership and strategic focus in navigating the rapidly changing landscape of the entertainment industry. As Disney continues to evolve its business and adapt to new market challenges, the departure of Peltz and Trian Partners raises questions about the company’s future direction and priorities in a competitive and rapidly evolving market.

Overall, Peltz’s exit from Disney reflects the broader trends and challenges facing investors and companies in an environment of ongoing disruption and transformation. As activist investors like Peltz continue to play a significant role in shaping corporate strategies and governance, the impact of their involvement on shareholder value and long-term performance remains a topic of debate and scrutiny. With Disney facing a range of strategic and operational challenges in a rapidly changing industry, the company’s response to these developments will be closely watched by investors and analysts alike as it seeks to maintain its position as a leading player in the global entertainment market.