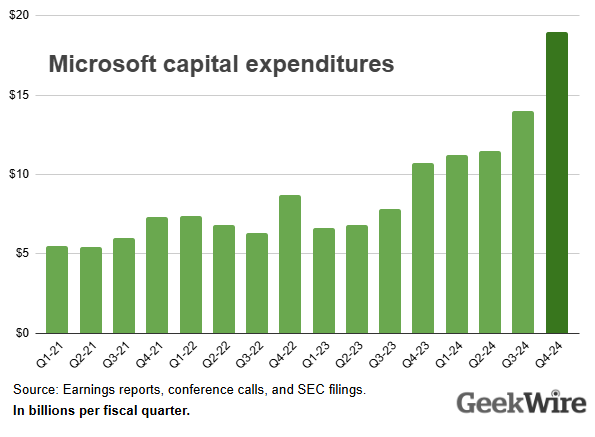

Microsoft reported a record $19 billion in capital expenditures for the quarter, a 35% increase from the previous quarter, in order to expand and update its data center infrastructure to meet the growing demand for AI. This surge in spending reflects a broader trend among tech giants who are investing heavily in boosting their capacity for training and running AI models. Despite this significant investment, Wall Street has reacted with some skepticism to Microsoft’s results, indicating that investors may be reserving judgment on the implications of this aggressive spending strategy.

While Microsoft exceeded analysts’ expectations for quarterly revenue and profits in its fiscal fourth quarter, the growth rate of its cloud business fell short of investor expectations. This led to a decline in the company’s shares in after-hours trading, despite reporting earnings of $64.7 billion (a 15% increase from the same quarter the previous year) and profits of $22 billion, with earnings of $2.95 per share. The Azure cloud business, a key area of focus for Microsoft, experienced a growth rate of 29% for the quarter, including a significant contribution of 8 percentage points from AI services, marking a new high for this metric.

However, the growth rate of Azure, when adjusted for currency variations, was only 30%, falling at the lower end of the company’s prior guidance of 30% to 31% growth. This lower-than-expected growth in Azure may have contributed to the decline in Microsoft’s shares following the earnings report, as some analysts and investors had hoped for stronger growth in this key area of the business. Microsoft’s stock fell more than 5% in after-hours trading, indicating that there are concerns among investors about the company’s ability to maintain robust growth in its cloud business moving forward, despite its significant investments in infrastructure and AI services.

It is clear from Microsoft’s latest earnings report that the company is prioritizing the expansion of its data center infrastructure and AI capabilities in order to meet the growing demand for these services, which has led to a substantial increase in capital expenditures. While the company has seen strong growth in its overall revenue and profits, the slightly lower-than-expected growth rate in its Azure cloud business has raised concerns among investors and analysts about its future prospects. Microsoft will need to address these concerns and demonstrate its ability to continue driving growth in its cloud business in order to reassure investors and maintain its position as a leader in the tech industry.

In response to the reaction from Wall Street, Microsoft remains confident in its long-term strategy and outlook, emphasizing the importance of its investments in infrastructure and AI to support future growth opportunities. The company’s focus on expanding its data center capacity and enhancing its AI services reflects its commitment to staying ahead of the curve in a rapidly evolving tech landscape. Despite the temporary setback in its stock price following the earnings report, Microsoft’s financial performance and strategic direction indicate that it is well-positioned to capitalize on the growing demand for cloud services and AI technologies in the years to come.

Overall, Microsoft’s strong financial performance in the fiscal fourth quarter, coupled with its ongoing investment in data center infrastructure and AI services, underscores its position as a key player in the tech industry. While concerns about the growth rate of its Azure cloud business have affected its stock price in the short term, Microsoft’s long-term focus on innovation and expansion bodes well for its future success. As the demand for AI and cloud services continues to increase, Microsoft’s aggressive investment strategy positions it to capitalize on these growth opportunities and maintain its competitive edge in the global tech market.