Maryland lawmakers are nearing a final vote on a $63 billion budget legislation that includes tax and fee increases to fund transportation and education initiatives. Governor Wes Moore proposed a balanced budget without tax increases, but the General Assembly, controlled by Democrats, has made some changes to the plan. Transportation-related fees have been added to raise about $252 million, including a statewide fee of 75 cents per trip for ride-hailing services, increased vehicle registration fees, and surcharges for zero-emission and plug-in electric vehicles.

The budget also includes tobacco tax increases to generate about $91 million for K-12 education, though revenue from these sources is expected to drop due to a projected decline in tobacco use. The focus of the revenues raised is on funding transportation projects and the Blueprint for Maryland’s Future education plan, which aims to expand early childhood education, boost teacher salaries, and support struggling schools. Democratic Sen. Guy Guzzone, the Senate’s budget chairman, believes that the revenue increases were done in an efficient and responsible way to cover the costs of these initiatives.

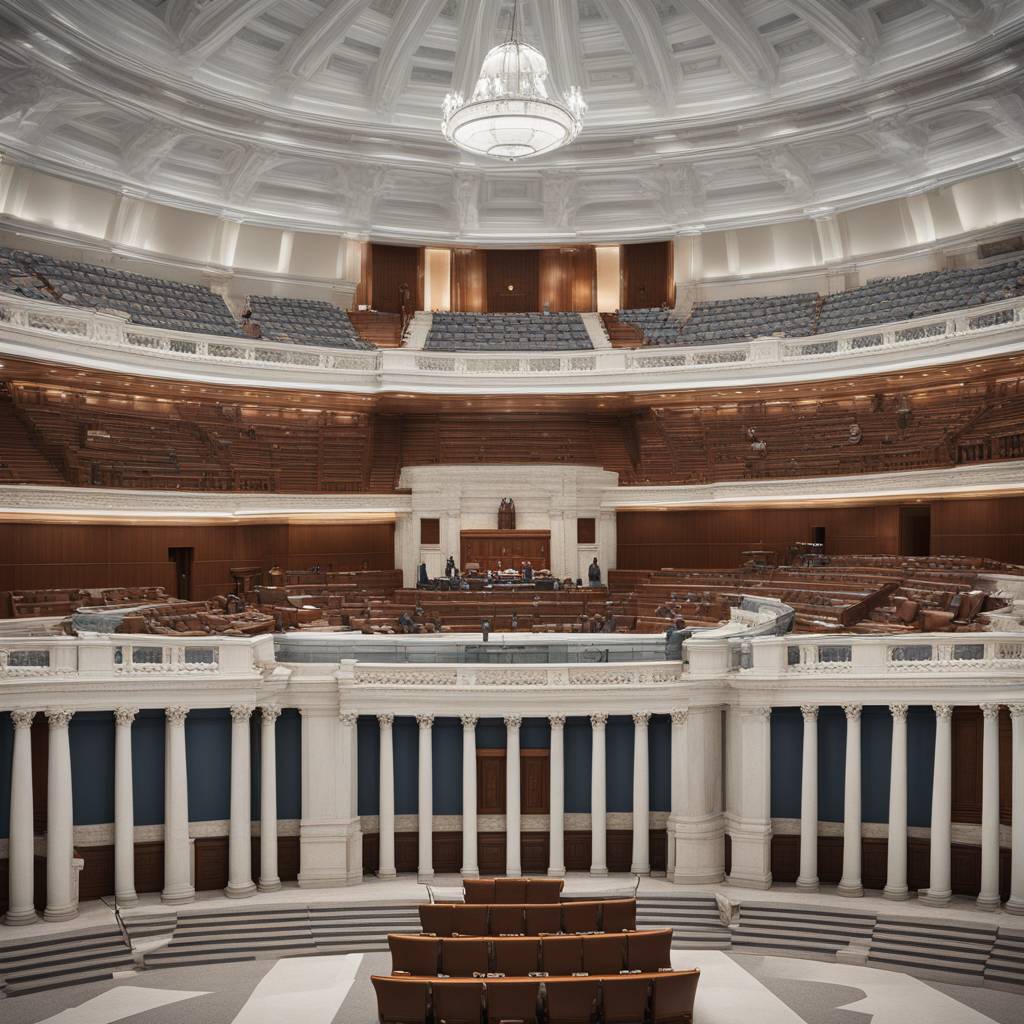

House and Senate negotiations surrounding the budget were held up until late in the legislative session, set to adjourn on Monday. The House proposed a $1.3 billion plan that included further taxes, fees, and tolls to address expected education costs and transportation funding shortfalls, as well as corporate tax reform and the legalization of internet gambling. The Senate rejected some of these proposals but added some new revenues during negotiations. Del. Ben Barnes, a Democrat who chairs the House Appropriations Committee, expressed satisfaction with the final compromise, stating that they were able to “thread the needle.”

The revenue debate comes during an election year in Maryland, with an open U.S. Senate seat and congressional races, featuring former Republican Governor Larry Hogan as a surprise candidate for the Senate. Hogan, who campaigned against tax increases to win his first term in 2014 and was reelected in 2018, has been a vocal opponent of tax hikes. However, the budget plan faced pressure from lawmakers to generate more revenue for education and transportation, leading to compromises and adjustments to the original proposal. The final vote on the budget is imminent, as lawmakers work to solidify the state’s financial plan for the coming year.