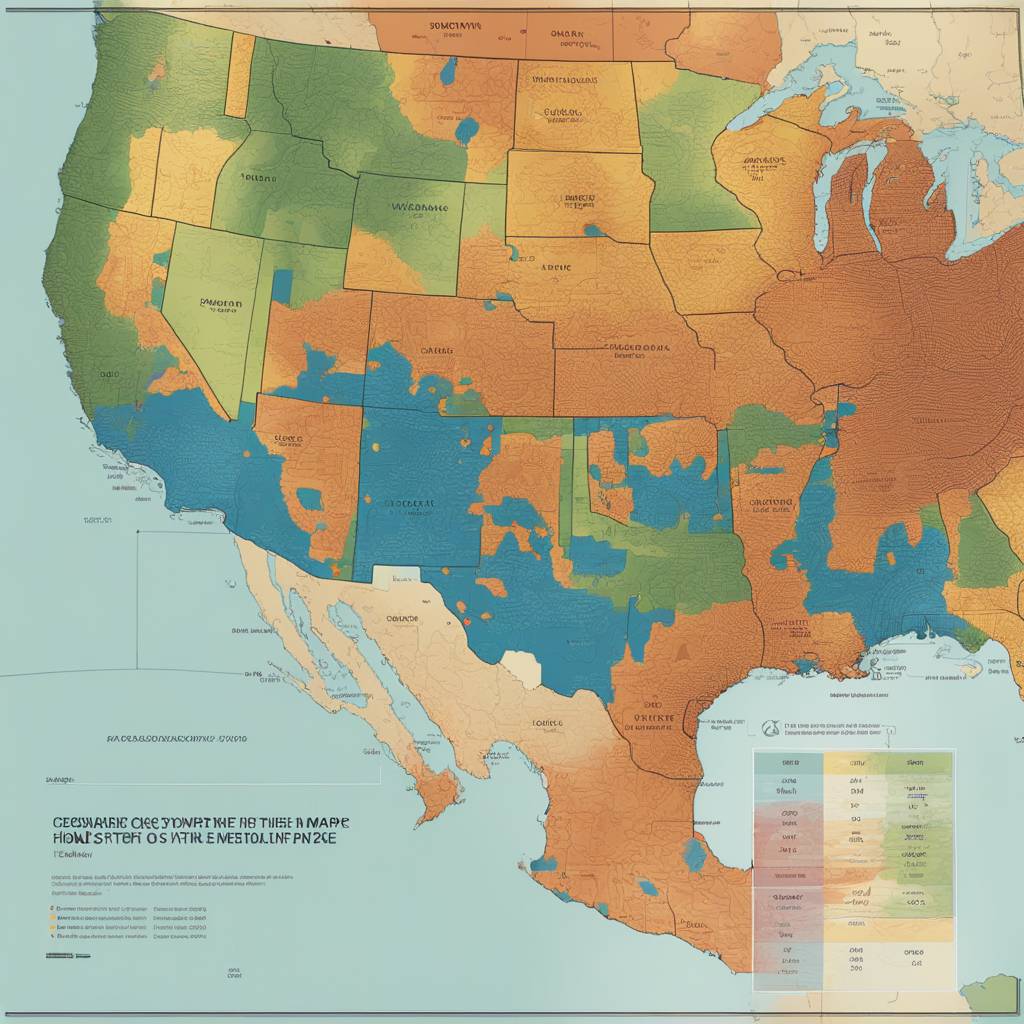

Buying a new home in the current real estate market can be challenging due to high mortgage rates, high home prices, and a shrunken housing supply. According to a new analysis from Bankrate.com, nearly half of US states require a six-figure household income to afford a median-priced home when getting a mortgage. This marks a significant increase from January 2020 when only six states and the District of Columbia required a six-figure income.

Assuming a 20% down payment and a 30-year fixed-rate mortgage at the average 52-week rate, Bankrate’s analysis shows how much household income is needed to afford the median-priced home in each state. The analysis focuses on the costs of securing a manageable mortgage payment, which includes principal, interest, property taxes, and property insurance. A manageable payment is defined as not exceeding 28% of the gross household income. However, closing costs and post-purchase homeowner expenses were not factored in the analysis.

It is important to consider that the median price of a home in a state may not accurately reflect the median price in the specific area where a buyer is looking to purchase. This discrepancy can impact the amount of household income needed to afford a home in a desired location. The analysis provides a general overview of affordability based on state median prices but does not account for variations within states or additional expenses associated with homeownership.

The housing market’s current conditions, including high prices and limited inventory, have made it increasingly difficult for buyers to afford a home. The requirement of a six-figure household income in many states highlights the financial challenges faced by potential homebuyers. Factors such as mortgage rates, down payment amount, and location all play a role in determining the affordability of a home purchase, making it essential for buyers to carefully assess their financial situation before entering the market.

As the real estate market continues to evolve, potential homebuyers should be prepared for the financial burden of purchasing a home. Understanding the income requirements, mortgage rates, and additional costs associated with homeownership can help buyers make informed decisions. Working with a financial advisor or real estate professional can provide guidance and support throughout the homebuying process, ensuring that buyers are well-equipped to navigate the challenges of the current housing market.

In conclusion, the current state of the real estate market presents significant challenges for potential homebuyers, with many states requiring a six-figure household income to afford a median-priced home with a mortgage. Buyers must carefully consider their financial situation, including income, expenses, and location, to determine if homeownership is feasible. Awareness of market conditions and financial obligations can help buyers make informed decisions and navigate the complexities of purchasing a home in today’s competitive housing market.