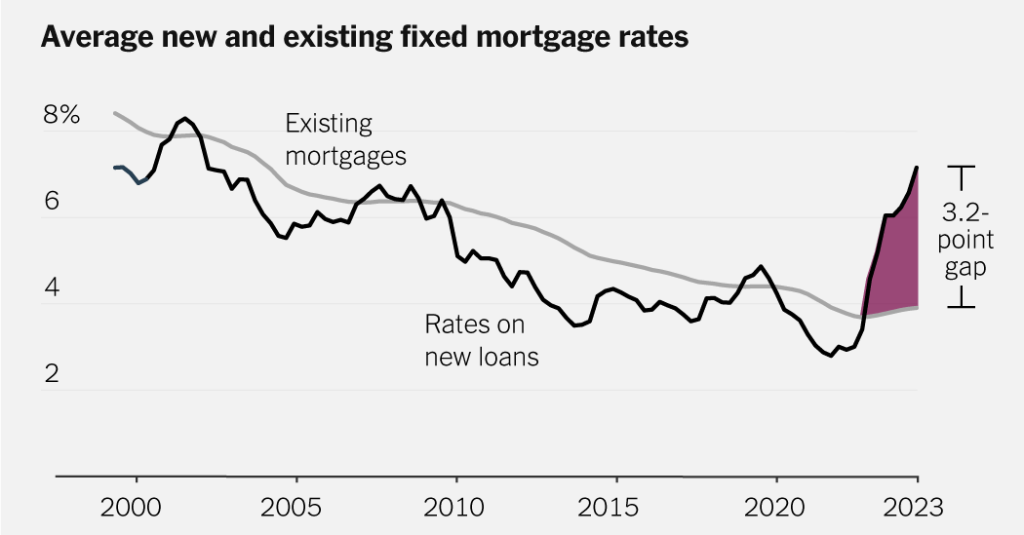

The American housing market has experienced a significant shift over the last two years as mortgage rates have risen to around 7 percent. This increase has caused a gap between these rates and the lower fixed rates that most American households with mortgages are currently sitting on. This has resulted in a nationwide lock-in effect, preventing many homeowners from moving, downsizing, or acquiring more space. As a result, economists estimate that about 1.3 million fewer home sales have occurred due to this lock-in effect, causing a disruption in the housing market as a whole.

Unlike previous years where homeowners had rates relatively close to market conditions, the majority of mortgage holders now have rates that are three percentage points lower than what the market would offer for a new loan. This scenario has led to a sense of stuckness in the housing market, negatively impacting the economy at large. The distribution of rates held by homeowners has shifted significantly over the years, with many households securing historically low rates during the pandemic, making it financially challenging to sell their homes now that rates have risen so high.

The increase in mortgage rates has created a situation where it may not be financially prudent for homeowners to sell their homes due to the difference in payment amounts at current rates. Professor Julia Fonseca estimates that locked-in rates are worth about $50,000 to the average mortgage holder, influencing decisions households make and causing shock waves in the housing market. The ripple effects of this situation are evident in the decline in mobility rates for homeowners with mortgages, impacting labor market dynamics and wage growth in certain areas.

President Biden has acknowledged the challenges faced by homeowners in this situation and has proposed temporary tax credits for new buyers and the owners who sell to them. These incentives aim to ease the burden of high rates for potential buyers, but do not fully address the financial implications for homeowners with locked-in rates. The uniqueness of the current housing market situation, with rates significantly lower than market conditions, has created a lasting challenge for many homeowners who find themselves unable to optimize their housing decisions.

In contrast to the aftermath of the 2008 housing crash, current challenges in the housing market may have a more long-lasting impact due to the 30-year term of mortgage rates. With rates unlikely to drop below 3 percent anytime soon, many homeowners are faced with the difficult decision of whether to move or stay put and potentially miss out on the value of their locked-in rates. The complex interplay between high rates, housing decisions, and broader economic implications has created a sense of uncertainty in the housing market that may persist for the foreseeable future.