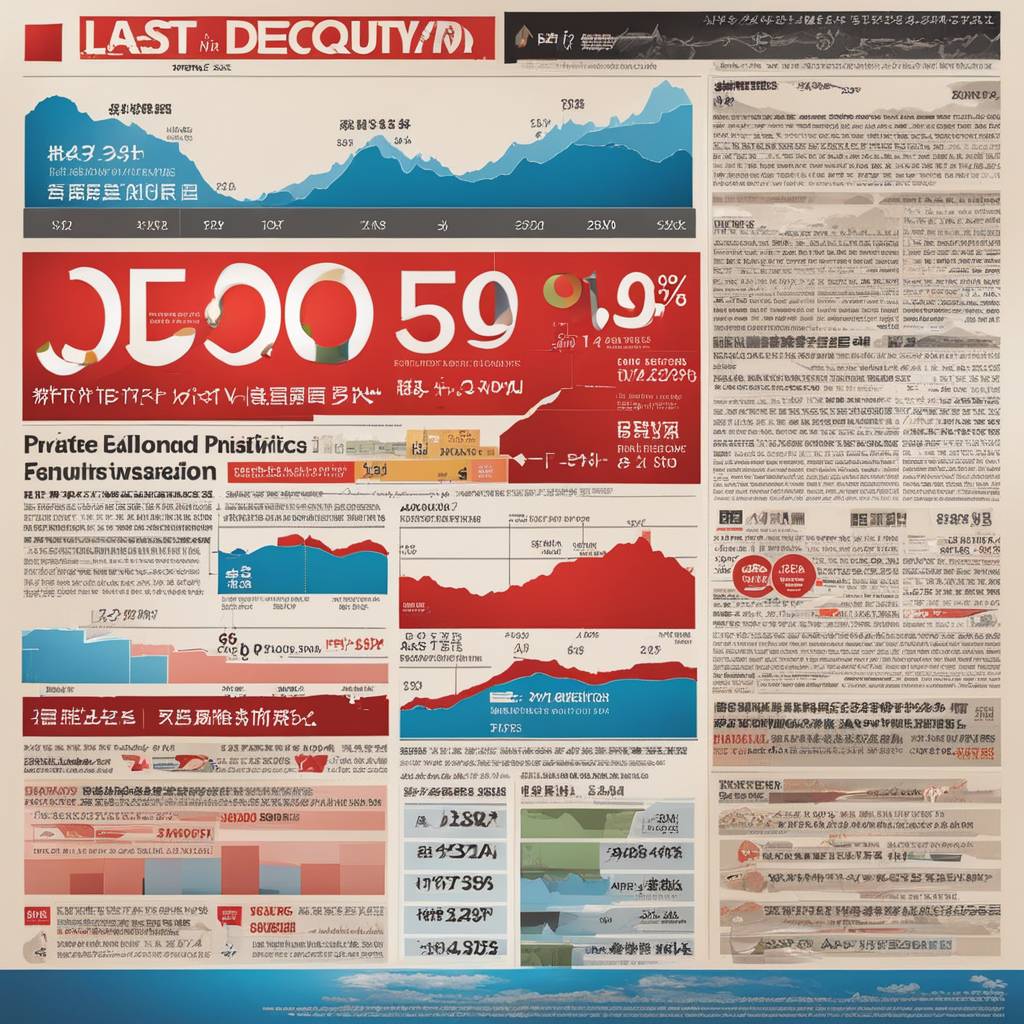

The total value of private equity deals in Asia Pacific last year fell to its lowest since 2014 due to factors such as slowing growth, high interest rates, and volatile public markets. However, Japan experienced a significant increase in deal value, making it the largest private equity market in Asia Pacific for the first time. Japan’s attractiveness as an investment destination is attributed to its deep pool of target companies with potential for performance improvements and pressure on Japan Inc to dispose of non-core assets. Despite this outlier, overall deal value in the region declined more than 23% to $147 billion from the previous year, with exits plunging 26% to $101 billion in 2023.

Exits in the Asia-Pacific region saw a decrease, with 40% of exits occurring via initial public offerings, primarily in Greater China where 89% of the IPO exit value was accounted for. The uncertain outlook for exits in 2024 has led successful funds to proactively pave the way for sales that meet their target returns by highlighting potential deal value to buyers. Leading private equity funds have also turned to exploring alternative asset classes such as infrastructure operations, renewable energy storage, data centers, and airports to diversify their portfolio and secure medium to high returns.

Buyouts constituted 48% of total deal value in Asia Pacific last year, surpassing the value of growth deals for the first time since 2017. Despite a declining pool of investors, private equity returns are still more attractive compared to public markets over a five-, 10-, and 20-year horizon. While signs of improvement were observed towards the end of last year, the timing of a recovery remains unclear. As the recovery takes effect, disruptive technologies like generative artificial intelligence are expected to offer new opportunities for private equity investment.

Japan, India, and Southeast Asia are among the Asia-Pacific markets viewed favorably for private equity investment opportunities in the next 12 months, according to Preqin’s 2023 investor survey. Private equity funds operating in the region are strategically positioning themselves to achieve successful exits and return cash to limited partners through 2024 despite the challenging exit market conditions. The report highlights the trend of private equity funds exploring various asset classes beyond traditional investments to optimize returns and diversify their investment portfolios in response to the changing market environment and uncertain economic conditions.