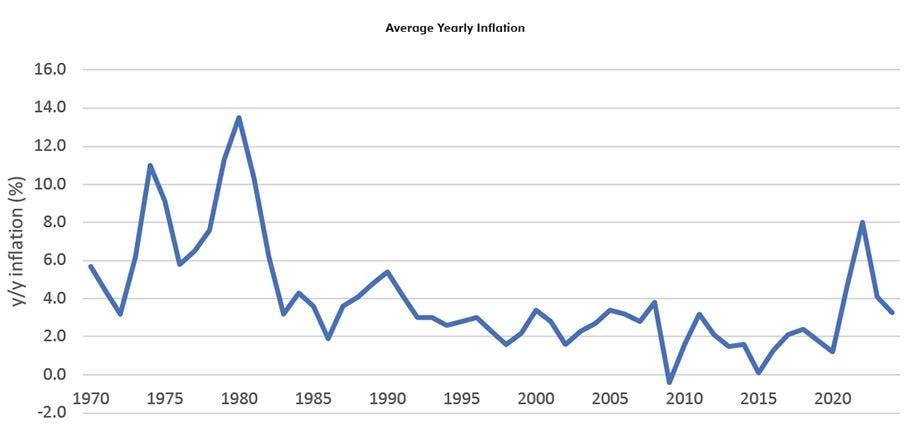

Inflation, which had been relatively contained between zero to 4% over the last 50+ years, began to rise steadily during the COVID pandemic year of 2020, reaching a high of 8% in 2022. Despite some decline, inflation has remained stubbornly high, currently sitting at 3.3%, after re-accelerating over the last several months. This increase in inflation has been accompanied by rising commodity prices, which tend to correlate with higher US yields. The ongoing military conflicts in the Ukraine and the Middle East raise the risk of further price increases.

Historical data shows that commodity sectors tend to outperform when inflation is high, while the stock market does better when inflation is decreasing. The S&P 500 has averaged a 5% gain during years with inflation greater than 3%, while Energy stocks have recorded a 10% gain. Conversely, when inflation is below 3%, the S&P 500 has averaged a 13% gain and Energy stocks a 7% gain. The relationship for Material stocks is not as clear-cut due to the sector’s diversity.

During decades where inflation has trended higher, like the 1970s, the S&P 500 has produced lackluster returns while commodity-driven sectors have performed better. However, in the current period of 2020-2024, with higher inflation than the previous 39 years, the overall market has performed better than commodity sectors. This anomaly suggests that commodity sectors may be due for a “catch up” period if the US economy remains resilient.

Two specific scenarios where historical averages were deviated from are highlighted: periods with high inflation and high interest rates but a strong stock market, and periods with higher commodity prices and Energy/Material sector outperformance but not overly high inflation. These examples suggest that the current period may see a similar trend, with inflation around 3.5% and Energy and Materials picking up relative performance, while the S&P 500 looks healthy overall, up 10% year-to-date.

O’Neil Global Advisors remains positive on commodity sectors, given the technical and fundamental setups and historical trends. The breakout in the Reuters/Jefferies CRB Index, which includes various commodities like Energy, Agriculture, Base Metals, and Precious Metals, further supports their view. While commodity-related stocks should not be the entirety of a portfolio, O’Neil Global Advisors recommends overweighting them relative to the overall market in the current economic climate.

Kenley Scott, Director of Global Sector Strategist at William O’Neil + Co., contributed significantly to the data compilation, analysis, and writing for this article. The article also includes disclosures regarding compensation related to specific recommendations or views expressed. O’Neil Global Advisors, Inc. is an SEC Registered Investment Adviser, and the information presented is not an offer to sell or solicit any offer to purchase securities or other investments. Past performance should not be viewed as a guarantee of future performance, and no information contained herein constitutes financial, legal, tax, or investment advice.