The IRS has extended the Free File program through October 2029, allowing taxpayers to access free private-sector tax software. Initially launched in 2003, Free File is a public-private partnership between the IRS and Free File Inc., offering eligible taxpayers access to tax preparation and filing software. The program was developed to help the IRS meet e-file targets set by the Restructuring and Reform Act of 1998.

Despite the availability of free e-filing services, only a small percentage of eligible taxpayers actually used the Free File program. Allegations arose that tax software providers were directing taxpayers to paid services rather than the free options. These claims led to litigation and changes in the program, requiring companies to provide transparency about their free filing services and ensuring accessibility through search engines.

In the 2024 tax filing season, traditional Free File participants like Intuit and H&R Block opted out of the program, with eight private-sector partners offering guided tax software products. Taxpayers with AGI of $79,000 or less qualify for Free File, allowing them to select from various software options or use IRS Free File Fillable Forms if their income exceeds the threshold.

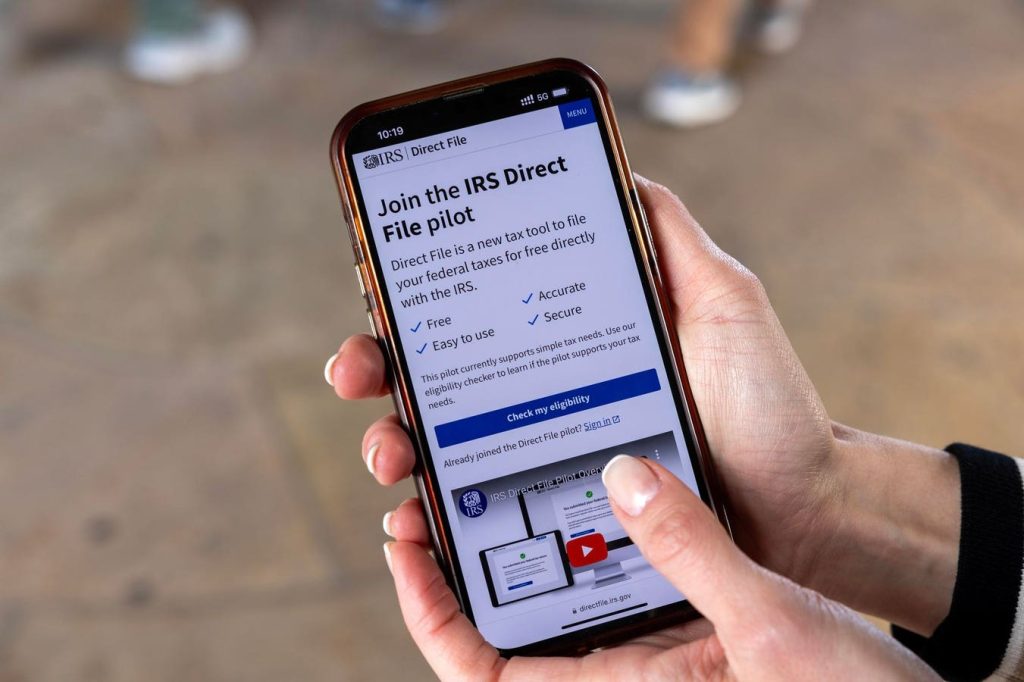

The Direct File program, introduced as part of a pilot in 2024, allowed eligible taxpayers to file their federal tax return directly with the IRS for free. While the pilot program has ended, the IRS deemed it a success with hundreds of thousands of taxpayers using the service. The IRS has expressed openness to making Direct File permanent nationwide following positive feedback from participants.

Taxpayer experiences with Direct File varied, with some users finding the program user-friendly and trustworthy. Others, however, faced challenges such as delayed refunds. Organizations advocating for an expansion of Direct File have urged the IRS to make the program permanent, emphasizing potential cost savings for taxpayers and simplification of the filing process.

Expanding Direct File could provide significant benefits to taxpayers, potentially saving billions of dollars in filing fees and streamlining the tax filing process. While the IRS has shown willingness to move forward with the program, the level of support in Congress remains uncertain. Regardless, the extension of the Free File program and the success of the Direct File pilot highlight ongoing efforts to improve access to free tax preparation services for eligible taxpayers.