As you complete your 2023 taxes, the issue of how long one needs to keep old tax records and paperwork associated with filing taxes is likely to come up. The question of whether you can scan printed copies of tax returns also arises. Some people have boxes full of old receipts, documents, and tax returns, leading to concerns about hoarding and clutter.

The IRS advises that the length of time you should keep tax documents depends on the type of files and taxable transactions involved. You should keep records supporting your income, deductions, credits, and exemptions at least until the period of limitations for each tax return ends. This period is when you can amend tax returns to claim refunds or credits and when the IRS can assess additional tax liabilities.

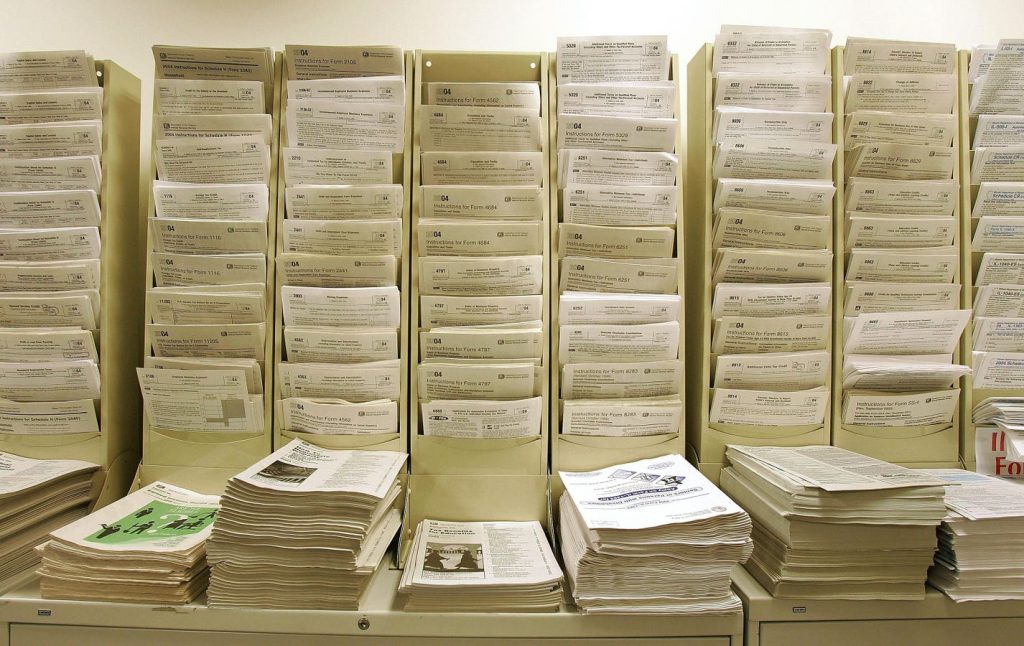

The period of limitations varies depending on specific situations, such as not reporting income, filing false returns, or claiming losses or deductions. Generally, the IRS recommends keeping tax records for three to seven years. Individuals with more complex tax situations or higher incomes should lean towards keeping records longer than the minimum period to be safe. Keeping tax records longer than seven years might be necessary when dealing with real property or using 1031 exchanges on rental properties.

When it comes to state tax documents, it’s convenient to keep them alongside federal tax records. State tax agencies may have longer timeframes for auditing returns than the IRS. In California, for example, the Franchise Tax Board has up to four years to audit state income tax returns, requiring residents to retain state tax records for at least four years.

To securely dispose of old tax documents, it’s important to avoid simply throwing them away. Such documents contain personal information like Social Security numbers that could be misused if they fall into the wrong hands. The best practice is to scan the documents before securely disposing of them, either by shredding them or using other appropriate methods.

Beyond tax returns, individuals should also retain supporting documents like contracts for loans, mortgages, insurance papers, medical bills, and warranty information. The list of financial records to keep extends beyond what the IRS requires. Digital storage is a convenient option for maintaining records over the long term, allowing easy access to past tax returns when needed for future tax filings or financial planning.