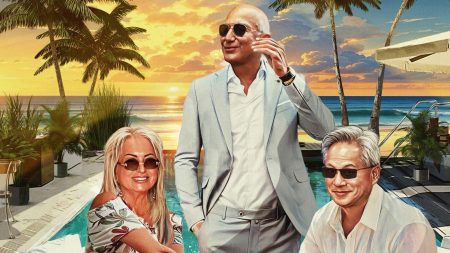

Billionaire venture capitalist Walter Kortschak, known for his successful investments in the tech sector, shared insights on his investing strategy and experiences in a recent interview with Forbes. Kortschak emphasized the importance of duration and persistence in investing, highlighting his own consistency and success over the years. With an estimated worth of $1.6 billion, Kortschak’s career began in the early 1980s in the computer graphics startup scene and later led to his involvement in growth equity firm Summit Partners, where he made key investments in companies like McAfee, E-Tek Dynamics, and Xylan.

Kortschak’s time at Summit Partners earned him a spot on Forbes’ Midas List of top venture capital investors from 2005 to 2009. After leaving Summit in 2010, Kortschak ventured into early-stage investing through his personal vehicles, Firestreak Ventures and Kortschak Investments, focusing on AI, machine learning infrastructure, and developer-facing companies. He has been an early investor in successful companies like The Trade Desk, Lyft, Palantir, Robinhood, and Twitter, as well as in AI companies like OpenAI and Anthropic. Kortschak has observed a shift back to early-stage investing, with a focus on different types of companies this time around.

In his Q&A with Forbes, Kortschak shared his views on current investment trends and risks, cautioning against the fear of missing out (FOMO) mentality that can lead investors to make hasty decisions. He emphasized the importance of patience, selective investing, and avoiding the mass hysteria surrounding certain sectors, particularly in the AI field. Reflecting on his greatest investment triumph with E-Tek Dynamics and The Trade Desk, Kortschak highlighted the importance of strategic vision, founder quality, and capital efficiency in driving successful outcomes.

Kortschak also shared a candid assessment of his biggest disappointment in a personal investment that ultimately failed due to over-capitalization and a lack of focus. Learning from this experience, Kortschak stressed the importance of maintaining a clear strategic direction and avoiding distractions. Drawing on insights from mentors and recommended reading, including books like “Bad Blood” by John Carreyrou and “The Innovator’s Dilemma” by Clayton Christensen, Kortschak underscored the critical importance of sound decision-making and continual learning in the fast-paced world of venture capital investing.

Overall, Walter Kortschak’s journey from early-stage to growth equity investing and back to early-stage investing reveals a seasoned approach to navigating the ever-changing landscape of technology investments. By sharing his successes, failures, and key insights with Forbes, Kortschak offers valuable perspectives for aspiring investors looking to make informed decisions in today’s dynamic market environment.