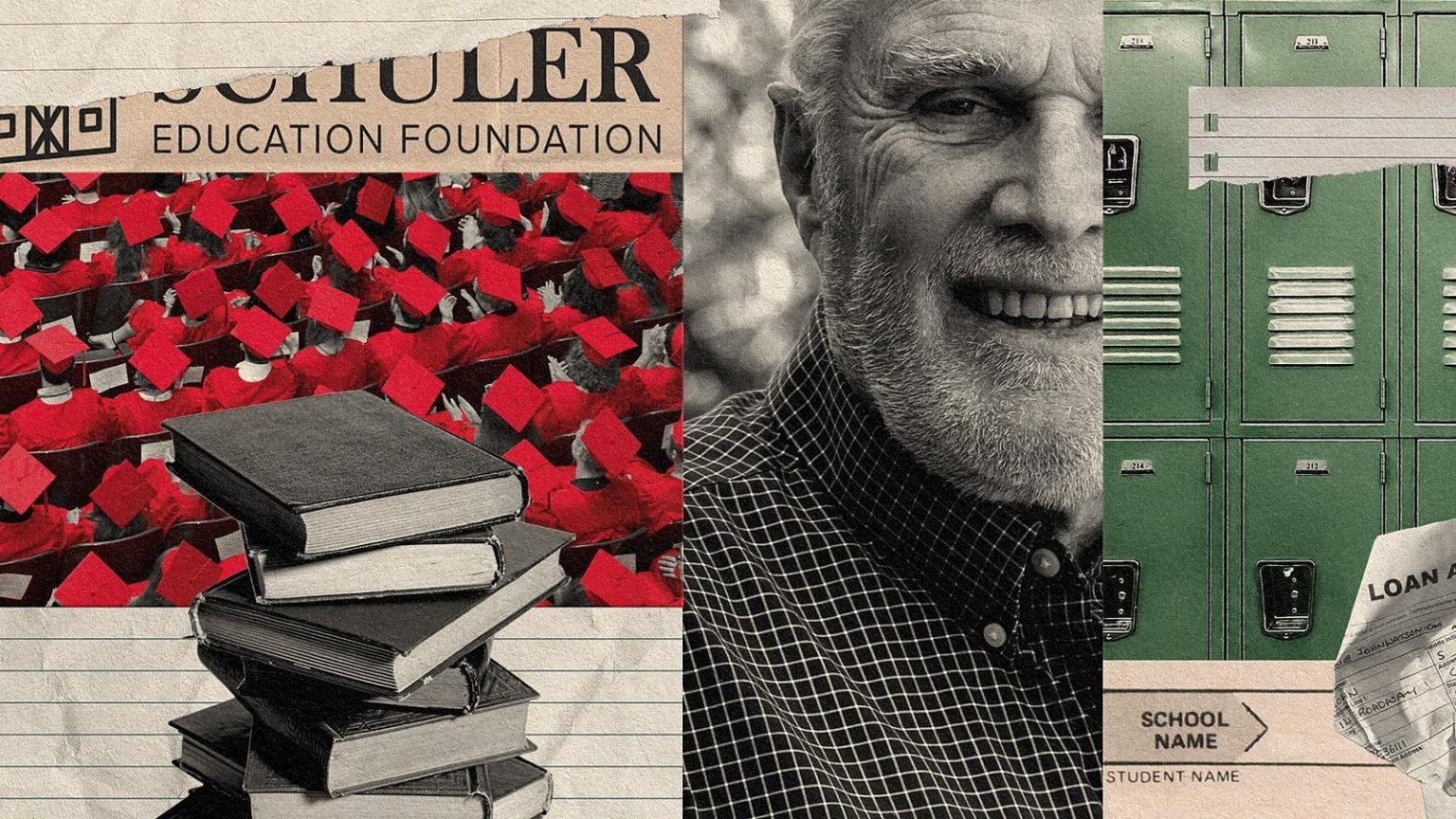

Jack Schuler, a former president of healthcare giant Abbott Laboratories, made a risky healthcare bet that ultimately cost him most of his fortune and left hundreds of underserved kids in a difficult situation. The Schuler Education Foundation, which he funded, announced its shutdown in March, leaving its employees and students in shock. The foundation had spent $150 million over two decades to help low-income students gain admission to elite colleges.

The foundation’s assets were tied to volatile stocks, with QuidelOrtho being its largest asset. Schuler’s personal net worth took a hit as well, with his portfolio dropping from $1.1 billion to around $200 million. Despite this, he refused to diversify his holdings to protect them in the long run. His bets on companies like Accelerate Diagnostics also backfired, leading to further financial troubles for the foundation.

The foundation’s financial woes led to the suspension of payments for its Schuler Access Initiative, a program aimed at enrolling more undocumented students in universities. Some colleges involved have had to rely on fundraising or reserves to make up for the lost funding from Schuler. The foundation’s decision to halt funding for deserving students has left a gap in support for these individuals.

Throughout the years, Schuler continued to invest in risky healthcare stocks, hoping to turn things around. However, these investments did not pay off, further complicating the foundation’s financial situation. The foundation’s leadership believed the market would turn in their favor, refusing to sell their assets even as the value continued to decline.

As the foundation faced mounting liabilities, it made cuts to its programs and laid off staff. Students were informed that the foundation would no longer fund college visits and that the program would wind down. While scholarships will be honored for current college students, high school students will see a reduction in funding and resources.

The foundation’s closure has left many students and staff members in a difficult situation, with questions about the future of the program and how the students will be supported moving forward. Despite efforts to find alternative resources, the impact of the foundation’s high-risk portfolio is evident in the fire sale approach taken to wind down the organization.