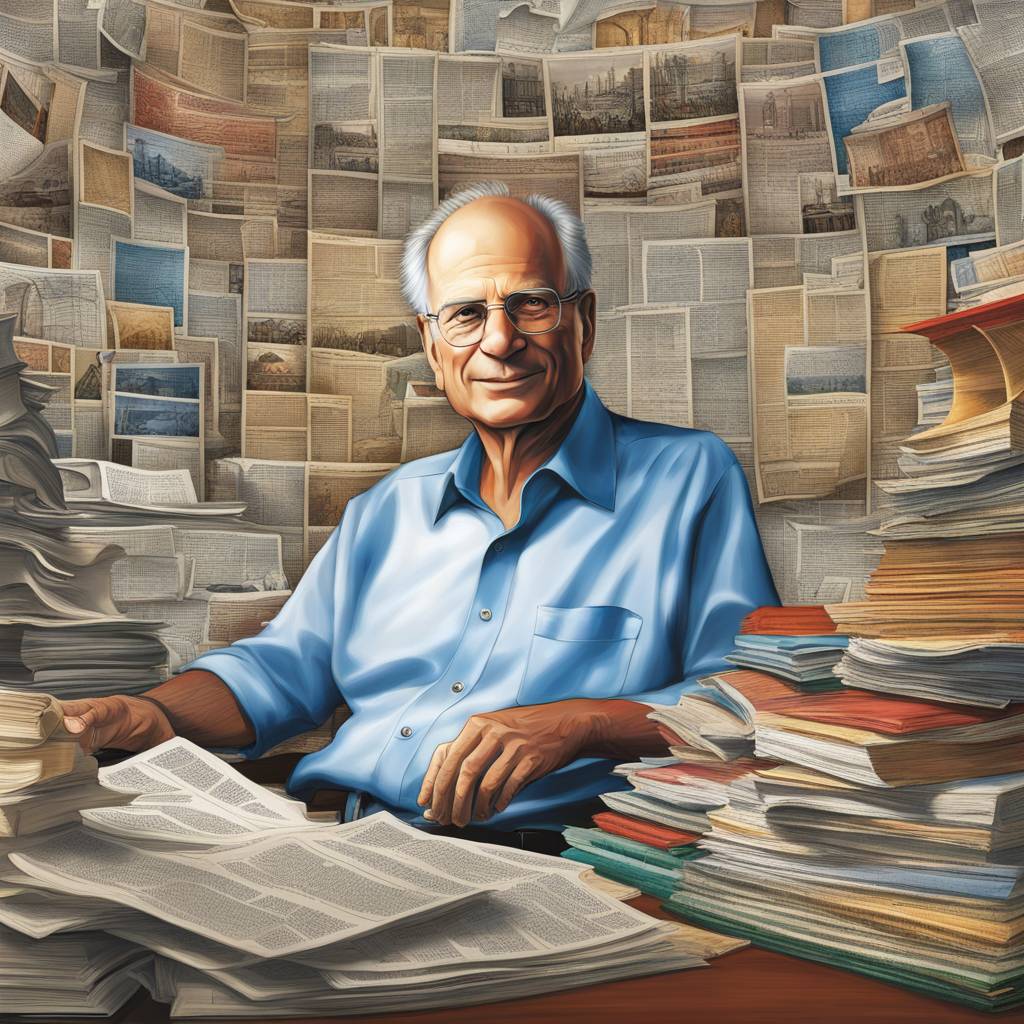

Dr. Daniel Kahneman, a renowned psychologist who revolutionized the way we think about decisions, passed away at the age of 90. His groundbreaking research continues to influence us in various aspects of our lives. Kahneman, who won the Nobel Prize in economics, authored the influential book “Thinking Fast and Slow,” which delves into the complexities of human decision-making. His work laid the foundation for behavioral economics, exposing the flaws in our decision-making processes and challenging conventional wisdom.

Through interviews with Dr. Kahneman, it became apparent that he was not only a brilliant thinker but also a generous individual who shared his insights willingly. Along with his research partner, Amos Tversky, Kahneman debunked the notion that individuals always act in their best interests, especially when it comes to financial decisions. Their studies revealed the impact of biases and emotions on decision-making processes, leading to flawed conclusions that hindered individuals from making optimal choices.

One of Kahneman’s key contributions was highlighting the role of the reptilian brain in triggering fight-or-flight responses and creating biases that impede sound decision-making. His research emphasized the importance of recognizing and overcoming these biases in various aspects of life, from financial investments to everyday choices. By shedding light on the limitations of human cognition, Kahneman paved the way for a more nuanced understanding of decision-making processes.

Kahneman’s research inspired practical applications that aimed to improve decision-making outcomes, such as the “Save More Tomorrow” program designed by Prof. Shlomo Benartzi and Prof. Richard Thaler. This program encourages automatic savings increases in retirement accounts, helping individuals secure their financial future without requiring constant attention. Additionally, Kahneman’s work underscored the dangers of overconfidence and the prevalence of “useful fictions” that cloud judgment, urging individuals to approach decisions with humility and careful consideration.

By emphasizing the importance of choice architecture and decision analysis, Kahneman advocated for a more systematic and logical approach to decision-making. His distinction between System 1, which relies on intuition and emotions, and System 2, which is more deliberate and rational, highlighted the need to balance these cognitive processes for better outcomes. By encouraging individuals to slow down, weigh the facts, and think long-term, Kahneman promoted a more thoughtful and informed approach to decision-making.

In honoring Kahneman’s legacy, individuals are urged to embrace humility and take the necessary time to make important decisions. By allowing the rational parts of the mind to guide decision-making processes, individuals can mitigate biases, avoid overconfidence, and ultimately make more informed choices. Kahneman’s enduring impact on behavioral economics and decision theory serves as a reminder of the importance of critical thinking, self-awareness, and deliberate decision-making in navigating the complexities of life.