CVS Health is currently ranked in the top 10% of dividend stocks by the DividendRank formula at Dividend Channel, indicating that it is a promising investment opportunity for investors looking for strong fundamentals and undervalued stocks. In addition to its high rank, CVS Health has entered oversold territory, with its stock price dropping to $56.71 per share on Thursday. The Relative Strength Index (RSI) reading for CVS Health is 29.4, below the average RSI of 49.8 for dividend stocks in the coverage universe. This presents a potential buying opportunity for investors looking to capture a higher yield from the recent annualized dividend of 2.66/share, yielding 4.63% at the current share price of $57.44.

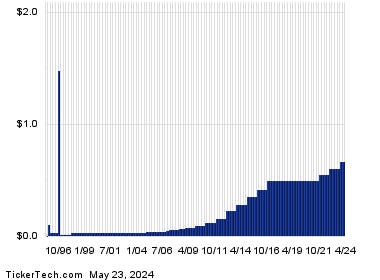

A bullish investor may view CVS Health’s RSI reading as a signal that the heavy selling pressure on the stock is starting to dissipate, making it a good time to consider buying opportunities on the buy side. Examining the company’s dividend history can provide valuable insights into its performance and sustainability of dividends. While dividends are not always a guarantee, analyzing the historical dividend payments can help investors make informed decisions about the future prospects of CVS Health as an investment.

Investors interested in income investing can gain valuable insights and engage in discussions on platforms like ValueForum.com. By joining the conversation on platforms like ValueForum.com, investors can access special offers and invitations to explore income investing opportunities. Engaging with other investors and experts in the field can provide valuable information and perspectives on dividend stocks like CVS Health.

In conclusion, CVS Health’s strong rank in the DividendRank formula, coupled with its entry into oversold territory, presents an attractive opportunity for investors looking to capitalize on undervalued dividend stocks. With a high annual yield and potential for a rebound in stock price, CVS Health is an interesting candidate for further research and consideration by income investors. Engaging with communities like ValueForum.com can provide additional support and insights for investors seeking income-generating opportunities in the market.