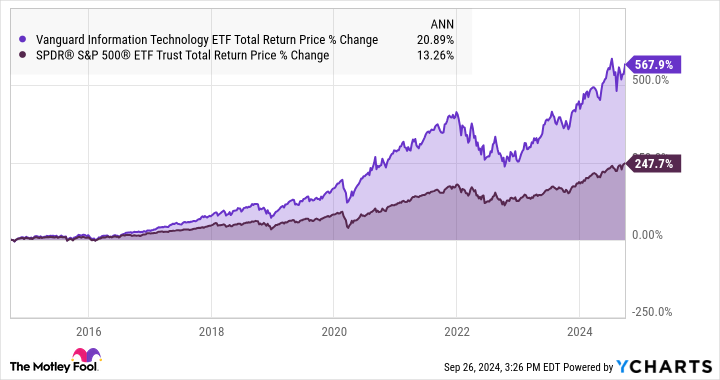

Investing in the S&P 500 market index through ETFs like the SPDR S&P 500 Trust provides diversification and strong long-term returns. Over the past decade, a $1,000 investment in the SPDR fund with dividend reinvestment would have grown to $3,500, with a compound annual growth rate of 13.2%. However, there are ETFs that offer even better returns, such as the Vanguard Information Technology ETF, which has outperformed the S&P 500 with a CAGR of 20.9%.

The Vanguard IT ETF has shown strong performance over the past decade, and a hypothetical $1,000 investment would have grown to $6,678. By setting up a dollar-cost averaging plan with monthly contributions, investors could have turned a $12,000 investment into $41,118. While the SPDR S&P 500 fund would have also yielded respectable results, the Vanguard IT ETF offers the potential for higher returns.

While the Vanguard IT ETF has outperformed the S&P 500 over the long term, there are additional risks to consider. During challenging market periods, the ETF’s focus on high-growth investments can result in negative returns. The fund underperformed the S&P 500 initially and faced challenges during market downturns in 2008-2009 and 2022. Investors should be prepared for price drops along the way, as growth stocks can be volatile.

The Vanguard Information Technology ETF’s portfolio consists of 317 American tech stocks, weighted by market cap. The fund’s top holdings include tech giants like Apple, Microsoft, and Nvidia, with the top three stocks making up around 48% of the portfolio. While these companies also dominate the S&P 500, their weight in the IT index is higher, allowing for potential higher returns but also increased market risks.

Deciding whether to invest in the Vanguard Information Technology ETF depends on individual preferences and risk tolerance. While the SPDR S&P 500 ETF may provide a more stable investment option, the Vanguard IT ETF offers exciting potential for long-term growth. Investors should weigh the potential returns against the risks of investing in a fund focused on high-growth tech stocks.

Ultimately, the Vanguard Information Technology ETF may not be suitable for every investor, but it presents an enticing opportunity for those looking for higher returns in the tech sector. By exploring different investment options and considering the potential risks and rewards of the Vanguard IT ETF, investors can make informed decisions about their portfolios.