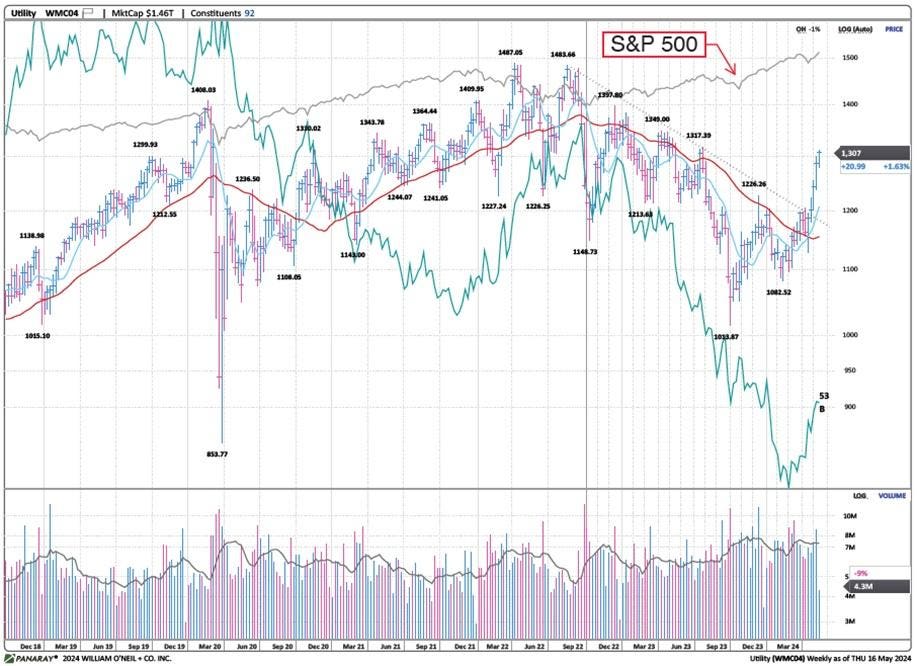

Investors in the Utility sector may have something to look forward to as the sector’s performance has historically lagged behind the overall stock market. Factors such as higher interest rates and slower earnings growth have contributed to this underperformance. However, recent data suggests that this trend may be changing, with the Utility sector showing signs of improvement compared to the S&P 500 over the past year.

Electric Power Utilities are currently the strongest segment within the Utility industry, with a strong potential to provide alpha to portfolios in the next 12-18 months. With the electrification of the economy driving increased electricity demand, there is an opportunity for Utilities to close the gap with the broader market. Non-profit Regional Transmission Organizations covering two-thirds of US electricity demand are overseeing price-competitive markets, which may benefit Utilities in supply/demand imbalances.

The adoption of trends such as the electrification of the economy and the increasing power consumption needed for Artificial Intelligence is expected to drive a rise in US electricity demand over the next decade. This growth in demand, coupled with limited new investment in high-voltage transmission lines in the past decade, highlights the potential for Utilities to benefit from rising market rates for power. Companies like Constellation Energy, Vistra Energy, and NRG Energy have already seen significant increases in their stock prices this year.

Data centers and oil and gas production are expected to be key drivers of increasing electricity demand in the coming years, particularly in regions like Texas. As demand for electricity rises, stakeholders in the Electric Utility industry, including nuclear power producers and service providers, are poised to benefit. Additionally, the exploration of small-scale nuclear reactors may offer a solution to future strains on power grids, providing opportunities for companies like Cameco and BWX Technologies.

As electricity rates are expected to rise in competitive markets, Electric Utilities and related companies are attracting investor attention. Companies with significant exposure to renewable energy or nuclear energy, as well as access to faster-growing markets, are likely to perform well in the coming years. Those involved in supporting the Electric Utility industry, such as construction companies and energy consultants, may also see increased demand. Overall, investors are advised to consider allocating funds to this sector for potential growth opportunities.