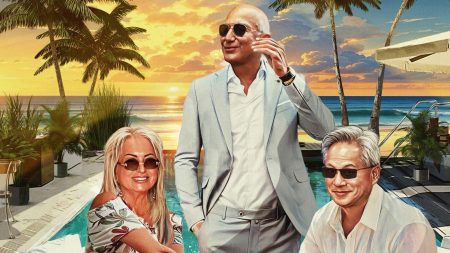

District of Columbia Attorney General Brian L. Schwalb has announced a settlement with billionaire Michael Saylor and MicroStrategy, Inc., in which they will pay $40 million to resolve allegations of violating the District’s False Claims Act and tax laws. This settlement, described as the largest income tax recovery in District history, was the result of a lawsuit filed under the amended D.C. False Claims Act which alleged that Saylor had falsely claimed to reside in lower-tax states to avoid paying income taxes to the District of Columbia.

Forbes estimates that Saylor, with a net worth of $4.8 billion, has personal holdings in bitcoin and MicroStrategy stock. The lawsuit against Saylor alleged that he had avoided paying over $25 million in District income taxes by falsely claiming residency in Virginia and Florida. The D.C. False Claims Act allows individuals to file claims alleging wrongdoing and receive a percentage of any recovered funds. The District sought to recover taxes, interest, and penalties from Saylor and MicroStrategy for previous tax years.

The lawsuit alleged that Saylor had established residency in the District in the early 2000s, spending millions on luxury properties and referring to the area as his home on social media. Despite residing in the District for most of the year, Saylor filed taxes as a resident of Virginia and later Florida, where income tax rates were lower or non-existent. The District maintained that Saylor’s physical location logs corroborated his residency in the District and MicroStrategy’s knowledge of this fact.

Saylor and MicroStrategy have denied any wrongdoing, with Saylor asserting that he has been a resident of Florida since 2012. The settlement, however, requires Saylor to comply with the District’s tax laws and file income tax returns if he owns or rents a residence in the District and is physically present for at least 183 days. MicroStrategy clarified that it was not responsible for Saylor’s individual tax affairs and is not required to contribute financially to the settlement.

Following the announcement of the settlement, MicroStrategy’s stock price increased by 3.33%, trading at $1,681.61 on the NASDAQ. The settlement signifies a significant victory for the District in cracking down on tax evasion and ensuring that all residents, regardless of wealth or status, abide by the law. Attorney General Schwalb emphasized the importance of holding tax cheats accountable to ensure resources are available for critical programs in public safety, infrastructure, and education.