Kiki Barki, an Indonesian billionaire, is expanding his investments in nickel with his company Harum Energy’s acquisition of a majority stake in Blue Sparking Energy. The deal, worth $206 million, involves Harum Energy’s unit Tanito Harum Nickel acquiring one million shares in Blue Sparking, diluting Tanjung Development Investment’s stake in the company to 49%. Blue Sparking Energy is developing a nickel and cobalt refining facility in North Maluku province that will support the production of batteries used in electric vehicles. This move comes as demand for electric vehicles is on the rise globally.

Harum Energy’s investment in Blue Sparking Energy follows a recent investment of $215 million in nickel smelter Westrong Metal Energy. The company has been focusing on expanding its presence in the nickel industry since 2020, coinciding with the rise of electric vehicle manufacturing in Indonesia. With global car giants like Hyundai and Mitsubishi turning to Indonesia as a key supplier of nickel, Harum Energy’s strategic investments in the battery metals sector are well-timed.

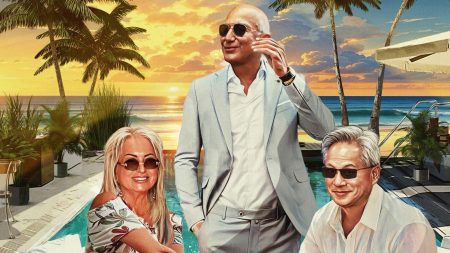

In addition to Kiki Barki’s Harum Energy, other Indonesian billionaires are also increasing their investments in battery metals. Lim Hariyanto Wijaya Sarwono’s Trimegah Bangun Persada and Garibaldi Thohir’s Merdeka Battery Materials are among those building nickel smelters in Indonesia to capitalize on the growing demand for electric vehicles. Indonesia, as the world’s top nickel supplier, is poised to benefit from the shift towards sustainable transportation technologies.

Kiki Barki, who founded Harum Energy in 1995 and took it public in 2010, has a net worth of $1.4 billion and was ranked no. 33 on Indonesia’s 50 Richest list. His son, Lawrence Barki, is currently serving as the company’s president commissioner. Barki also holds a stake in Australia’s Nickel Industries, which operates nickel mining and processing facilities in Indonesia. With his extensive experience in the industry, Barki is well-positioned to lead Harum Energy’s growth in the nickel and battery metals sector.

The acquisition of Blue Sparking Energy by Harum Energy signals a continued commitment to expanding its presence in the nickel market and supporting the production of batteries for electric vehicles. As the demand for electric vehicles continues to grow, strategic investments in battery metals processing facilities are crucial for meeting the increasing need for sustainable transportation solutions. With Indonesia playing a key role in the global supply chain for nickel, companies like Harum Energy are well-positioned to capitalize on the opportunities in the evolving electric vehicle industry.

Overall, Kiki Barki’s Harum Energy’s acquisition of Blue Sparking Energy underscores the growing importance of nickel and battery metals in the transition towards electric vehicles. With investments in key players in the nickel industry, Indonesian billionaires like Kiki Barki are not only expanding their business interests but also contributing to the development of sustainable transportation technologies. As the global demand for electric vehicles continues to rise, Indonesia’s position as a leading supplier of nickel puts companies like Harum Energy in a favorable position to capitalize on the opportunities in the evolving automotive market.