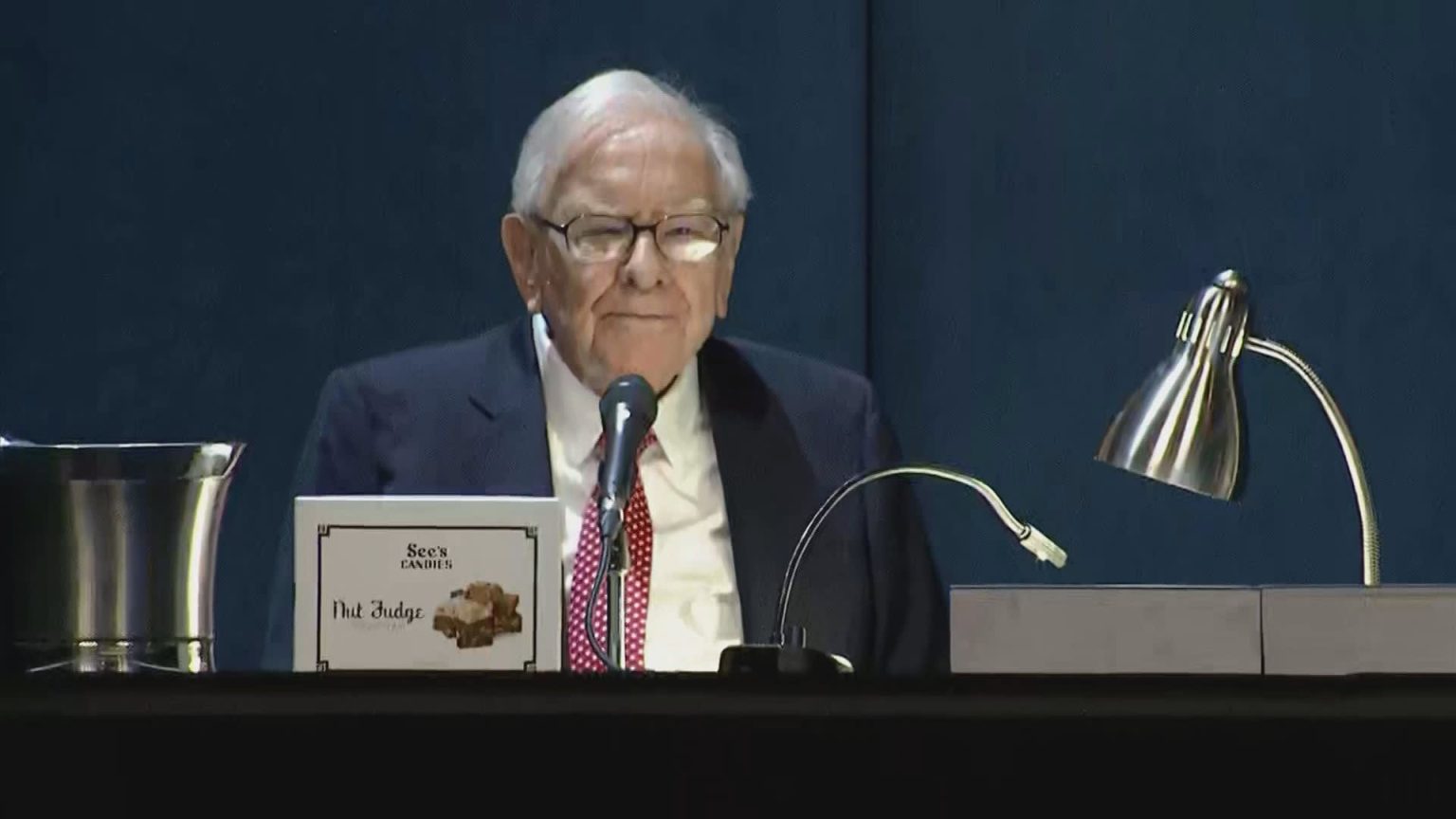

Warren Buffett recently revealed his secret stock pick in a new regulatory filing, disclosing that his conglomerate Berkshire Hathaway has purchased nearly 26 million shares of insurer Chubb for a stake worth $6.7 billion. Chubb became Berkshire’s ninth largest holding at the end of March, causing shares of Chubb to jump nearly 7% in extended trading. The stock has gained about 12% year to date. Chubb was originally acquired by Ace Limited in 2016 for $29.5 billion, and the combined company adopted the Chubb name. Chubb’s CEO, Evan Greenberg, is the son of Maurice Greenberg, former chairman and CEO of insurance giant American International Group.

Berkshire Hathaway has a significant presence in the insurance industry, with investments ranging from auto insurer Geico to reinsurance firm General Re, as well as various home and life insurance services. Berkshire also acquired insurance company Alleghany for $11.6 billion in 2022. Recently, Berkshire exited positions in Markel and Globe Life in the same industry. The mysterious purchase of Chubb had been kept secret for two quarters, with Berkshire being granted confidential treatment to withhold details of its stock holdings. The topic didn’t come up at Berkshire’s annual meeting in Omaha earlier this month, leading to speculation that the secret purchase could be a bank stock, as the conglomerate’s cost basis for “banks, insurance, and finance” equity holdings had significantly increased.

It is unusual for Berkshire to seek confidential treatment for its stock holdings, with the last instance being when it purchased Chevron and Verizon in 2020. The secrecy surrounding the Chubb purchase had intrigued many investors and analysts, as Berkshire’s actions in the market are closely watched. The revelation of Chubb as Buffett’s latest investment decision has caused a stir in the financial world, with Chubb’s stock seeing a significant surge in value following the news. Berkshire Hathaway’s strategic investment in Chubb reflects Buffett’s continued confidence in the insurance industry and his ability to identify valuable investment opportunities.

The acquisition of Chubb by Berkshire marks a significant addition to its diverse portfolio of companies, further solidifying its position in the insurance sector. Berkshire’s long-term investment strategy and focus on quality companies with strong leadership have contributed to its success over the years. The decision to invest in Chubb demonstrates Buffett’s belief in the company’s growth potential and the value it can bring to Berkshire’s overall portfolio. With Berkshire’s extensive resources and expertise, the partnership with Chubb is expected to yield positive results for both companies in the years to come.

Overall, Warren Buffett’s decision to invest in insurer Chubb highlights his continued ability to identify lucrative investment opportunities and strategically position Berkshire Hathaway for long-term success. The secrecy surrounding the acquisition had heightened anticipation among investors and analysts, making the revelation of Chubb as Buffett’s latest stock pick a significant event in the financial world. The positive market reaction to Berkshire’s investment in Chubb underscores the confidence that investors have in Buffett’s investment acumen and the potential for growth in the insurance industry. As Berkshire continues to expand its holdings and seek out new opportunities, the partnership with Chubb is expected to be a key driver of future growth and success for both companies.