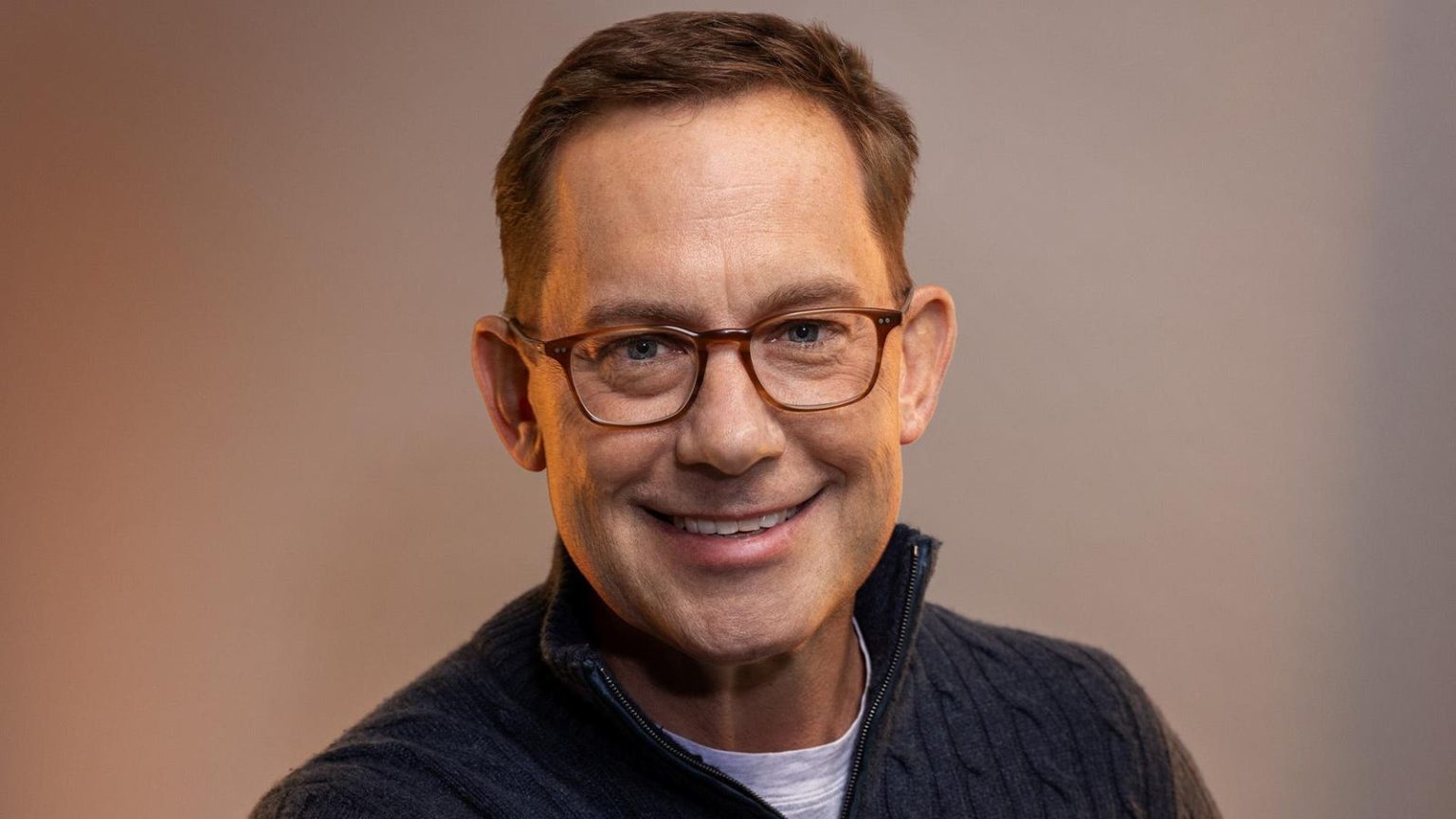

Chime, the nation’s largest digital-only bank with $1.5 billion in annualized revenue and seven million customers, is eyeing a possible IPO in 2025. CEO Chris Britt, with a background in banking and finance, has remained committed to serving low and middle-income consumers throughout Chime’s 12-year journey. With plans for growth and expansion, Chime is looking to broaden its product line and customer base to achieve profitability and attract public investors.

Located in San Francisco’s financial district, Chime has experienced significant growth and expansion, raising $750 million in 2021 at a $25 billion valuation. Despite facing some challenges, such as layoffs in 2022 and addressing fraud issues, Chime remains focused on its mission to provide affordable and accessible banking services to its target demographic. With a strong emphasis on technology and cost-effective operations, Chime aims to serve a broader customer base and offer new products like personal loans, retirement accounts, and ETFs.

Chime’s success in attracting young Americans earning between $35,000 and $65,000 annually can be attributed to its features such as free checking accounts, direct deposit requirements, and no traditional checkbook. By leveraging technology and eliminating physical branches, Chime has been able to offer affordable banking solutions with a focus on customer loyalty. However, as competition from traditional banks and other fintechs intensifies, Chime faces challenges in expanding its market share and diversifying its revenue streams.

Despite its growth and innovation, Chime faces potential risks from regulatory changes and increased competition. The threat of increased regulation and changes to interchange fees could impact Chime’s revenue model and profitability. Additionally, the possibility of traditional banks entering the digital banking space poses a challenge to Chime’s market position. CEO Chris Britt acknowledges these risks and is actively engaging with lawmakers to address regulatory concerns and protect Chime’s business interests.

As Chime continues to navigate the evolving fintech landscape, its leadership team remains focused on innovation, customer satisfaction, and sustainable growth. By introducing new products like personal loans and exploring opportunities in lending, Chime aims to reduce its reliance on interchange-based revenue and expand its customer base. With a strong commitment to serving low and middle-income consumers, Chime is poised to overcome challenges and achieve long-term success in the competitive banking industry.

With an eye towards a possible IPO in the near future, Chime’s leadership team, investors, and employees are aligned in their mission to provide accessible and affordable banking services to a wide range of customers. Through strategic initiatives, technological advancements, and a customer-centric approach, Chime is well-positioned to continue its growth trajectory and solidify its position as a leading digital-only bank in the market. As CEO Chris Britt plans for the company’s future, Chime remains steadfast in its commitment to serving the financial needs of underserved communities and driving positive change in the banking industry.