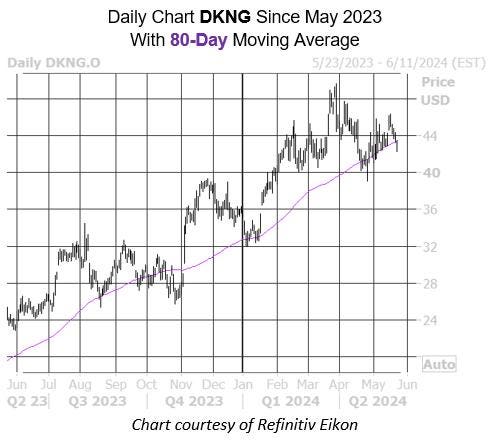

Despite the recent pullback, DraftKings is still up 12% year-to-date, and up a staggering 231% in the past 12 months. The stock has been on a tear since its April 2020 initial public offering (IPO) and has shown no signs of slowing down in the long term. With the recent dip in price, now could be a good opportunity for investors to get in on the action at a more affordable price.

Analysts remain bullish on DKNG, with 15 of the 19 in coverage sporting a “buy” or better rating. The average 12-month price target of $73.94 represents a healthy premium of 74.3% to current levels. Should DraftKings bounce from its current levels and resume its upward trend, investors could stand to make a significant profit in the coming months.

The company has been expanding aggressively, recently partnering with the NFL, MLB, and PGA Tour to offer sports betting options to fans. With the continued legalization of sports betting in several states across the U.S., DraftKings is primed to capitalize on this growing market and cement its position as a leader in the industry.

One potential concern for investors is the competitive landscape in the sports betting and daily fantasy sports space. DraftKings faces stiff competition from the likes of FanDuel and BetMGM, as well as traditional sportsbooks and casinos that are looking to enter the online market. However, DraftKings’ strong brand recognition, innovative products, and aggressive marketing strategies give it a competitive edge in the industry.

Overall, DraftKings remains a strong growth stock with the potential for significant upside in the long term. While short-term volatility may present buying opportunities for investors, the company’s continued expansion, partnerships, and strong performance make it a compelling investment in the sports betting and daily fantasy sports sector. With affordable options pricing and a historically bullish trendline, now could be a prime opportunity to buy into this high-growth stock.