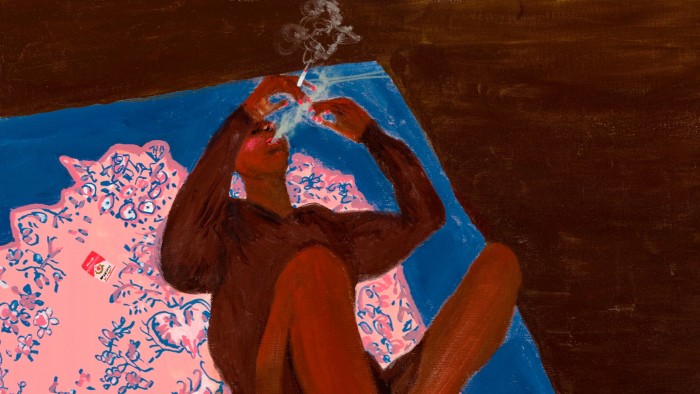

Summarize this content to 2000 words in 6 paragraphs in Arabic London’s auctions of upscale 20th- and 21st-century art this week painted a picture of a market adjusted to the realities of wider political and economic volatility. As news of President Donald Trump’s turbulent tariffs on the US’s trading partners spread through the salerooms at Sotheby’s, Christie’s and Phillips, the repeated mantra of attendees was that “good things will still sell”. The art market’s current challenge is to prise “good things” from sellers who would rather wait for better times. As a result, volumes were down more than a quarter on last year’s equivalent sales, while values fell even deeper, by a third, to total £208mn (including the auction house fees). The bulk of this came courtesy of Christie’s, with by far the bigger and better sale this season, boosted by its surrealism specialism, though its £130mn haul was still considerably down on last year’s £197mn. One advantage of the smaller-sized auctions is that there is less that can go wrong. While last year 20 works were withdrawn at the last minute (10 per cent of the lots), usually because sellers got cold feet, this year only nine suffered the same fate (6 per cent). Similarly, 12 per cent of art went unsold last year, while this fell to 8 per cent last week. It might seem slim pickings, but there are signs that the auction houses are reading the market better — and managing to persuade their clients to settle for more realistic reserves and estimates — which injected a sense of necessary stability into the salerooms.In a less risky environment, the previous cult of testing dozens of nearly new works is very much a thing of the past — with exceptions that prove the rule including a bird’s-eye view of a woman lying on her back with a Marlboro Red cigarette by the New Jersey-based painter Danielle Mckinney at Christie’s. This 2021 work, “Other Worldly”, was estimated between £40,000 and £60,000 and sold to a keen telephone bidder for an artist’s record of £210,0000 (£264,600 with fees). Still, this and most of the prices for art made after 2020 remained within the realms of art market reality. “There was so much aggressiveness and speculation in contemporary art before, it was unhealthy, particularly for young artists. A bit of a market shock helps,” says Rome gallerist and 20th-century art specialist Mattia De Luca, in town for the sales.In general, works that peaked this season were, like Mckinney’s, immediately impactful and, frankly, Instagram-friendly. Lisa Brice’s “After Embah” (2018), a glorious, red-backed painting of confident female muses, models and musicians — including one in the pose of rapper Nicki Minaj — sold comfortably above estimate for £4.4mn (£5.4mn with fees) at Sotheby’s, another artist record. At the other end of the timescale, though equally visually arresting and in-demand, were surrealist works. Christie’s separate section of 25 such pieces helped boost its evening total by nearly £50mn and provided the deepest bidding of the week. René Magritte’s trompe l’oeil painting of a suited man standing on a moonlike sphere, “La reconnaissance infinie” (1933), proved the top lot of the season, selling for £8.7mn (£10.3mn with fees). This work was bought in 2004 for £677,250.Disappointments were less about the works that didn’t sell and more about some of the pre-hyped star lots that failed to fizzle — there were no easy wins this season. These included Francis Bacon’s “Portrait of Man with Glasses III” (1963), a disquieting painting of a contorted face, which sold at Christie’s on just one bid for a below estimate £5.5mn (£6.6mn with fees). At Sotheby’s, Banksy’s remix painting “Crude Oil (Vettriano)” (2005), sold by the co-founder of the punk-pop band Blink-182, landed within estimate, for £3.5mn (£4.3mn with fees) to an online bidder who didn’t meet with much competition.The top-end auction market is increasingly concentrated in New York, where the estates of the US’s many historic collectors and the tax pressures on their heirs bring troves of art in one go. In London “it’s about individual works and comes down to personal relationships,” says Katharine Arnold, Christie’s head of postwar and contemporary art, Europe. Gathering art “was hard work this season,” she says, but they went about it by persuading consignors to offer pieces that chimed with the UK, notably its museum exhibitions, which put artists more in the limelight.So, at Christie’s, were works by Jenny Saville (who has a forthcoming solo show at the National Portrait Gallery, sponsored by the auction house) and Monet (a pastel of London’s Waterloo Bridge that chimed with the artist’s recent showing at the Courtauld) while the Bacon was hanging in the National Portrait Gallery’s acclaimed Human Presence exhibition until the start of this year. Among the handful of sought-after lots at Sotheby’s was one by Yoshitomo Nara (a trademark sulky girl painting from 2005), who gets his first solo exhibition in the UK at the Hayward Gallery in June.Buying seemed mostly to come via the auction houses’ US specialists, some manning two or three phones, while a collection of three works by the eerie surrealist Paul Delvaux all sold particularly strongly through a Christie’s specialist based in Hong Kong. Sotheby’s reported a high number of UK bidders, despite what chief executive Charles Stewart described as “a bit of an exodus of the wealthy” under the latest tax regime.Nonetheless, the spectre of New York’s relative power in this market was never far away, not least as the auction houses took the opportunity to show off some of their forthcoming highlights during the London previews. At Sotheby’s were works from a $80mn-$120mn group of Old Masters from the late, longtime partner and managing director of Morgan Stanley, Thomas Saunders, and his wife, Jordan. These include a pair of freely painted Frans Hals portraits of children (possibly the artist’s) and a zinging “Still Life with Cauliflower” by 18th-century Spanish painter Luis Meléndez. Christie’s showed off seven prime 20th-century works — including a 1922, red-dominated composition by Mondrian — from the $250mn collection of Leonard and Louise Riggio (the former was the founder of Barnes & Noble). All come for sale in New York in May.Still, it’s a sign that things could be picking up more widely, despite the unpropitious backdrop, and London has often set the tone in the past. “We always go first [in the calendar year and after the summer break], it’s our responsibility each time, and we’ve shown that this market is stable,” says Christie’s Arnold. But, at the moment, the art scene needs such reassurance: “We are in a world that needs confidence.”

rewrite this title in Arabic The recipe for art auction success? Surrealism — and Instagram-friendly painting

مقالات ذات صلة

مال واعمال

مواضيع رائجة

النشرة البريدية

اشترك للحصول على اخر الأخبار لحظة بلحظة الى بريدك الإلكتروني.

© 2025 جلوب تايم لاين. جميع الحقوق محفوظة.