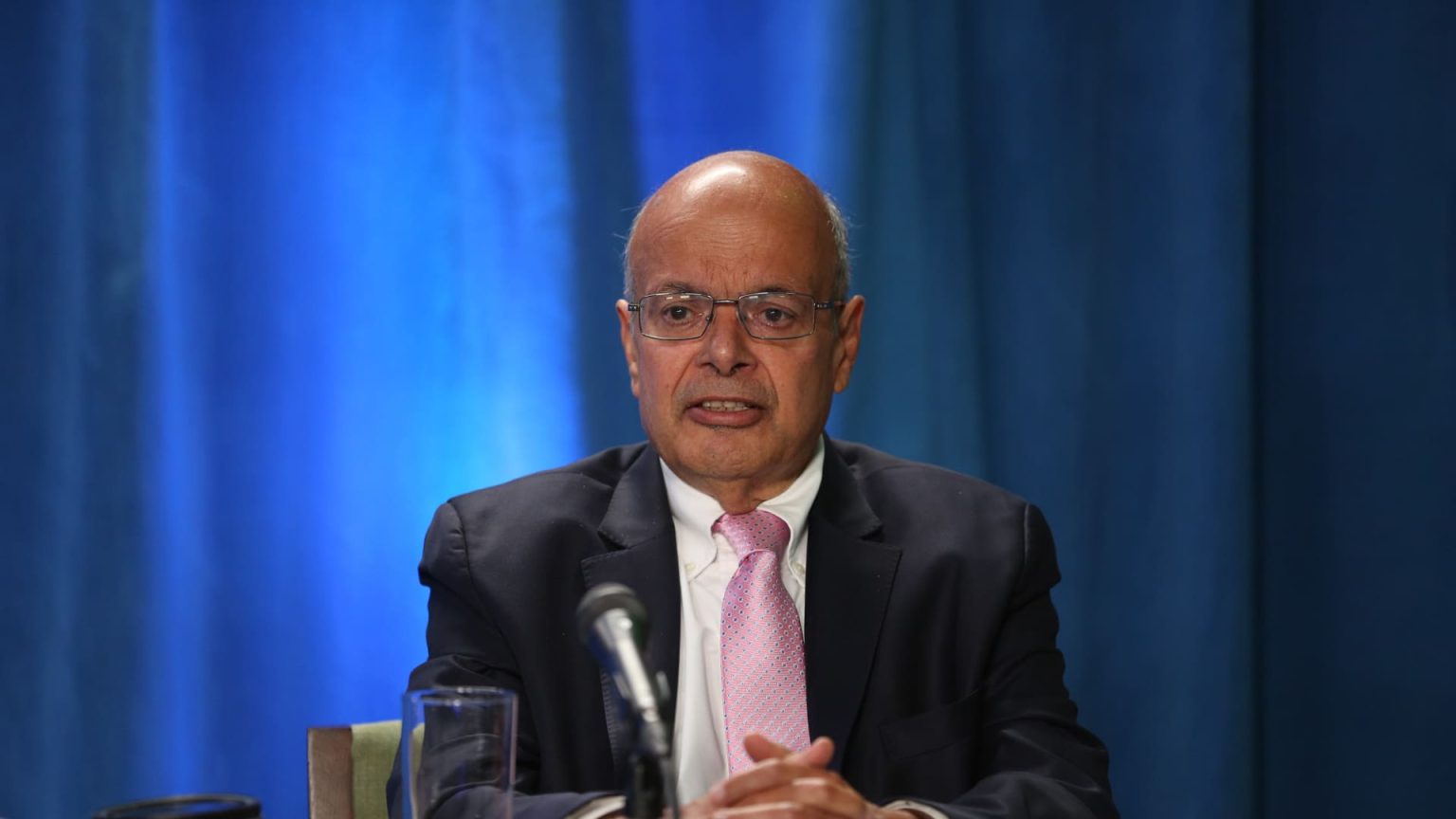

Ajit Jain, Warren Buffett’s insurance chief and top executive, sold more than half of his stake in Berkshire Hathaway, according to a new regulatory filing. The 73-year-old vice chairman of insurance operations sold 200 shares of Berkshire Class A shares at an average price of $695,418 per share, totaling roughly $139 million. This move left him with only 61 shares, while family trusts and his non-profit corporation held the rest. This sale represented a significant decrease in Jain’s holdings, marking the biggest decline since he joined Berkshire in 1986. The reasons for Jain’s sale are not clear, but he may have taken advantage of Berkshire’s recent high stock price, which reached a $1 trillion market capitalization at the end of August.

The sale by Jain indicates that he may view Berkshire as being fully valued, according to David Kass, a finance professor at the University of Maryland. Berkshire’s share buyback activity has also slowed down recently, with the company repurchasing only $345 million worth of its stock in the second quarter, compared to $2 billion in each of the prior two quarters. Bill Stone, CIO at Glenview Trust Company and a Berkshire shareholder, believes that the stock is not cheap at its current levels, and he does not expect many stock repurchases from Berkshire. Jain has been a key figure in Berkshire’s success, playing a crucial role in the company’s achievements in the reinsurance industry and in leading the turnaround of Geico, Berkshire’s auto insurance business.

In 2018, Jain was named vice chairman of insurance operations and appointed to Berkshire’s board of directors. Buffett has praised Jain’s contributions, stating in his annual letter in 2017 that Ajit has created tens of billions of value for Berkshire shareholders. Despite rumors that Jain might one day lead Berkshire, Buffett clarified that Jain never wanted to run the conglomerate and there was no competition between the two. It was later announced that Greg Abel, Berkshire’s vice chairman of non-insurance operations, would eventually succeed Buffett. Buffett even expressed willingness to trade himself for another Ajit, acknowledging the value Jain has brought to Berkshire.

Jain’s decision to sell a significant portion of his Berkshire stake may reflect his belief that the company is fully valued and may not offer further upside potential in the near term. The high stock price and the slowdown in Berkshire’s share buyback activity may have also influenced his decision. Despite his reduced stake, Jain’s contributions to Berkshire’s success over the years have been widely recognized, and he has played a crucial role in key sectors of the company’s business. As Berkshire continues to navigate leadership transitions and strategic decisions, Jain’s influence and legacy within the company remain significant, even as he divests a portion of his ownership.