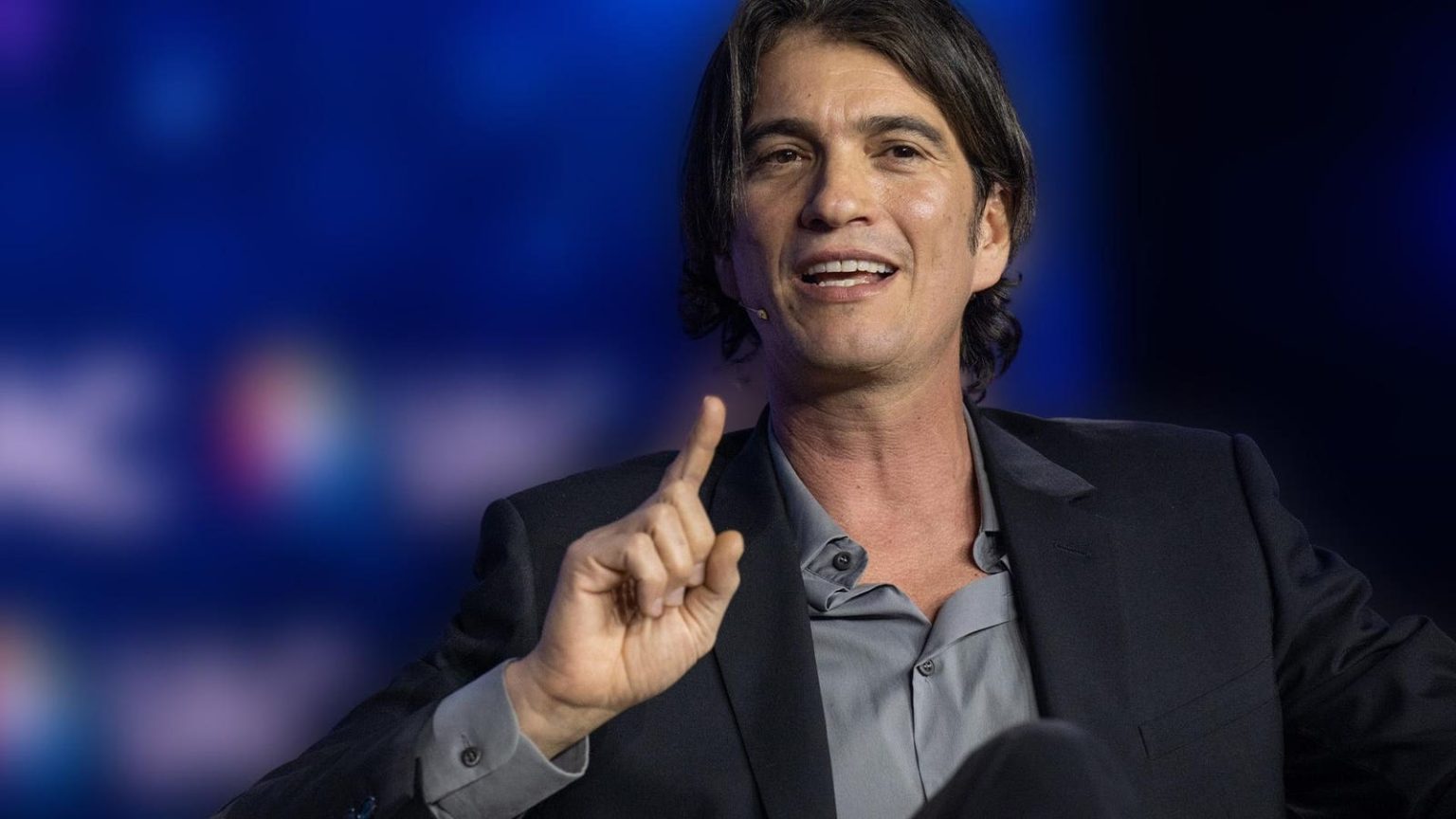

Climate tech startup Flowcarbon, co-founded by WeWork’s Adam Neumann, has been quietly refunding investors after failing to launch its “Goddess Nature Token,” which was intended to merge carbon credits with the blockchain. Despite raising $70 million in funding from investors like Andreessen Horowitz, the token never materialized due to market conditions and resistance from carbon registries. Flowcarbon has been issuing refunds to buyers and asking them to sign releases waiving claims against the company, citing industry delays as the reason for the refunds.

The company did not address specific questions about the refund process but stated that it has been offering refunds to retail GNT buyers since last year due to industry delays. Flowcarbon has been communicating with its audiences through email, phone, and Zoom after ceasing the use of Discord as a communications channel. Despite the recent refunds, the company has not disclosed this information on any public platform, and investors have raised concerns about the transparency of the process.

Flowcarbon’s high profile in the crypto-carbon space, backed by major investors like Andreessen Horowitz and General Catalyst, made it a prominent player in the industry. The company raised at least $38 million through the sale of its token, with Fifth Wall Ventures purchasing $4 million worth of tokens. However, it is unclear if retail buyers were included in this figure. The voluntary carbon market, aimed at offsetting emissions, saw significant growth in 2021, but concerns about the quality and integrity of carbon credits have led to market instability.

The launch of Flowcarbon’s token was delayed multiple times due to regulatory concerns and market conditions. Verra, a prominent carbon registry, banned the tokenization of retired credits, further complicating Flowcarbon’s plans. Frustrated buyers questioned when they would be able to access their funds, prompting the company to issue a policy of honoring all refund requests since 2023. Verra has maintained its decision to prohibit the creation of tokens based on retired credits, leaving the future of blockchain applications in carbon markets uncertain.

Despite the challenges faced by Flowcarbon, the company’s daily management falls to CEO Dana Gibber and COO Caroline Klatt, who are sisters. The company’s origins can be traced back to Neumann and his wife, Rebekah Neumann, who pledged $1 billion to charitable causes during WeWork’s IPO in 2019. Flowcarbon was incubated by Neumann’s family office, 166 2nd Financial Services, with investments from family members and close associates. While there have been rumors of a potential partnership with Neumann’s real estate startup Flow, Flowcarbon has stated that there are no plans for collaboration at this time.