Abercrombie & Fitch, the iconic fashion brand that dominated the Y2K era, reported record-breaking first-quarter earnings Wednesday, signaling a successful turnaround as young millennials turned back to the nostalgic brand’s inclusive revamp—with shares growing over fivefold, outpacing Nvidia over the past year. Abercrombie & Fitch reported a 22% annual increase in first-quarter sales topping $1 billion, the “highest first-quarter net sales in company history,” following last year’s 16% revenue growth. Shares surged more than 20% Wednesday after the earnings announcement, extending to a 459% gain over the past year as of Friday afternoon—outperforming Nvidia’s stock growth in the same period. The company increased its full-year outlook on net sales growth to around 10%, up from the previous forecast of 4-6%. The company’s two brands both delivered solid sales growth: Abercrombie brands posted a 31% increase, while Hollister brands saw a 12% rise.

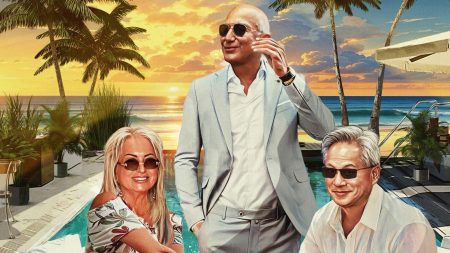

Once an iconic mall staple in the 1990s and early 2000s, the Ohio-based retailer faced severe criticism and declining popularity in the 2010s due to its controversial and exclusive marketing tactics, including sexualized advertising and refusing to make XL or XXL sizes. Under the leadership of CEO Fran Horowitz since 2017, the company has reinvented itself by focusing on inclusivity, broadening its product range and revamping the brand image targeting young professionals who grew up wearing the nostalgic brand. The company’s inclusive strategy includes offering denim in a range of styles and sizes, such as 90s low-rise baggy jeans, ultra high-rise straight jeans, and the Curve Love line which went viral on TikTok—shifting away from its previous image of fitting only slim customers. In March, Abercrombie launched the A&F Wedding Shop Collection—tailored to brides and wedding guests—to diversify its product lines beyond casual wear, which exceeded expectations from the beginning, during the earnings call on Wednesday.

Abercrombie & Fitch has undergone a significant transformation over the past decade, ending its “sexualized marketing” practices and adopting a more inclusive culture. CEO Fran Horowitz spearheaded a comprehensive rebranding, featuring models of various body shapes and skin tones, and expanding product lines. The company introduced Curve Love, tailored to curvier customers with sizes up to XXXL, which now accounts for nearly half of the women’s denim segment. The company also launched Your Personal Best (YPB), an activewear line in 2022, and unveiled a bridal shop in March, catering to the diverse lifestyles of young millennials. On the back of these strategic shifts, the retailer’s stock soared 285% in 2023, with an additional 91% surge so far this year. The key factor behind Abercrombie’s success is a relentless focus on the customer, according to Neil Saunders, managing director and retail analyst at GlobalData, indicating that the brand has successfully transformed into a modern label appealing to younger and middle-aged shoppers.

The 131-year-old apparel company had a controversial history under its former CEO Mike Jeffries, who faced criticism over discriminatory hiring practices and controversial marketing tactics targeting only “good-looking” customers. After Jeffries left in 2014, the brand hit a 17-year low stock price but has since made a remarkable recovery under the leadership of CEO Fran Horowitz. While Abercrombie & Fitch is making headlines with its stunning revival, Gap is another nostalgic 90s brand signaling a comeback under new leadership. Following the appointment of Richard Dickson as CEO, Gap has undergone a turnaround, with shares rising by 256% over the past year and all four brands—Gap, Old Navy, Athleta, and Banana Republic—seeing quarterly sales growth for the first time in history. The company raised its full-year guidance and appointed fashion designer Zac Posen as creative director to enhance the brand’s reinvigoration. Gap’s market share is gaining for the fifth consecutive quarter, signaling a promising future for the iconic brand.

The success of Abercrombie & Fitch and Gap’s comebacks reflect a shift in consumer preferences towards more inclusive and diverse brands. Abercrombie’s focus on inclusivity and expanding product lines has resonated with customers, leading to record-breaking sales and stock growth. Gap’s reinvigoration under new leadership and strategic shifts has also paid off with increased sales and market share. Both brands are adapting to the changing retail landscape by embracing diversity and catering to the diverse lifestyles of young millennials and Gen Zs. The revival of these iconic 90s brands demonstrates the power of rebranding and the importance of listening to customer preferences. As the retail industry continues to evolve, Abercrombie & Fitch and Gap are setting a new standard for inclusivity and innovation in the fashion world, paving the way for a more diverse and customer-centric future.