In recent years, the idea of using gold and silver as money, known as “Sound Money,” has gained popularity among various States in the United States. With over 40 States passing some form of Sound Money legislation, Representative Alex Mooney of West Virginia has introduced the Monetary Metals Tax Neutrality Act, HR 8279, in the US House to replicate these efforts at the Federal level. The use of gold and silver as money is supported by both Republicans and Democrats, but faces challenges due to tax classifications and regulations.

Despite the Constitutional mandate that only gold and silver should be used as money, the Federal Reserve and US Treasury continue to print money, leading to concerns about inflation. The principle of allowing the use of alternatives to traditional currency, such as gold and silver, has gained widespread support across the States. Efforts to eliminate sales taxes, capital gains taxes, and other regulatory barriers related to gold and silver transactions are ongoing.

Some States have taken further steps towards accepting gold and silver for tax payments and holding cash reserves in gold and silver. Recent legislative successes include Alabama, Nebraska, Kentucky, Utah, and Wisconsin, which have all made progress in removing taxes on gold and silver transactions. Organizations like the Sound Money Defense League and Citizens for Sound Money have been actively supporting these efforts at both the State and Federal levels.

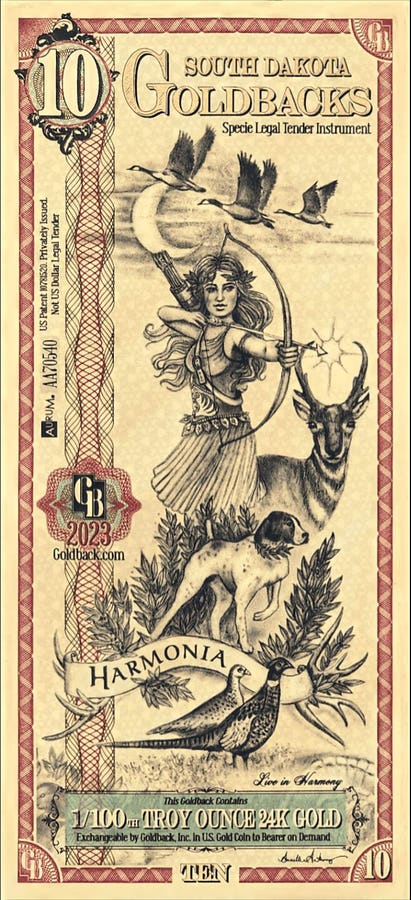

Private-market alternatives to traditional currency, such as the Goldbacks and various digital platforms, have emerged in response to the growing interest in gold-based transactional systems. These platforms, including cryptocurrency stablecoins and other crypto-based solutions, offer users the ability to conduct transactions with gold and earn interest on their balances. Commercial banks could potentially play a significant role in the adoption of gold-based transactional systems on a larger scale.

The implementation of large-scale gold-based transactional systems through commercial banks could revolutionize the way people conduct financial transactions. Technologies such as Hashgraph, recommended by technologist George Gilder, offer advantages such as increased transaction speeds and real-time settlements. Commercial banks have the infrastructure and security measures in place to facilitate the adoption of gold-based payment systems at both the retail and corporate levels.

The concept of a parallel currency solution, using gold as an international currency alongside domestic currencies, is gaining traction globally. Countries like Russia, part of the BRICS consortium, are introducing gold checking accounts and goldback notes to facilitate alternative forms of payment. As the value of traditional currencies like the dollar and euro diminishes, the appeal of a gold-based monetary system becomes more evident. The use of gold as a form of money offers a stable and reliable alternative to the current financial system and has the potential to reshape the future of global transactions.