European stock markets closed slightly lower on Thursday, with the Stoxx 600 index falling by 0.24%. Major bourses, such as Germany’s DAX, France’s CAC 40, and the U.K.’s FTSE 100, also closed in the red. The head of Latvia’s central bank, Martins Kazaks, stated that the European Central Bank is likely to cut interest rates in June but should proceed in a measured way from there. He emphasized the importance of making decisions based on outlook meetings and new projections, as the euro zone economy saw growth and inflation stabilize.

Shares of Danish pharmaceutical company Novo Nordisk dipped after a fire broke out at a construction site in Denmark. However, the company confirmed that no one was injured, and the fire had been extinguished. Novo Nordisk remains optimistic that the incident will not delay its expansion plans. Meanwhile, British telecom company BT saw its shares soar by 10.5% after announcing a cost-cutting program in its full-year results. CEO Allison Kirkby emphasized the company’s focus on improving customer service and exploring options to optimize its global business.

German technology giant Siemens reported a drop in profit at its industrial business in the fiscal second quarter, with its automation division showing a slowdown. The industrial profit fell by 2% compared to the same quarter last year, below analyst expectations. British low-cost airline EasyJet also posted a larger than expected pre-tax loss for the first half of the year, despite signs of easing inflationary pressures in the industry. CEO Johan Lundgren highlighted the positive momentum as the airline entered the summer travel season and expected to receive all new plane deliveries from Airbus.

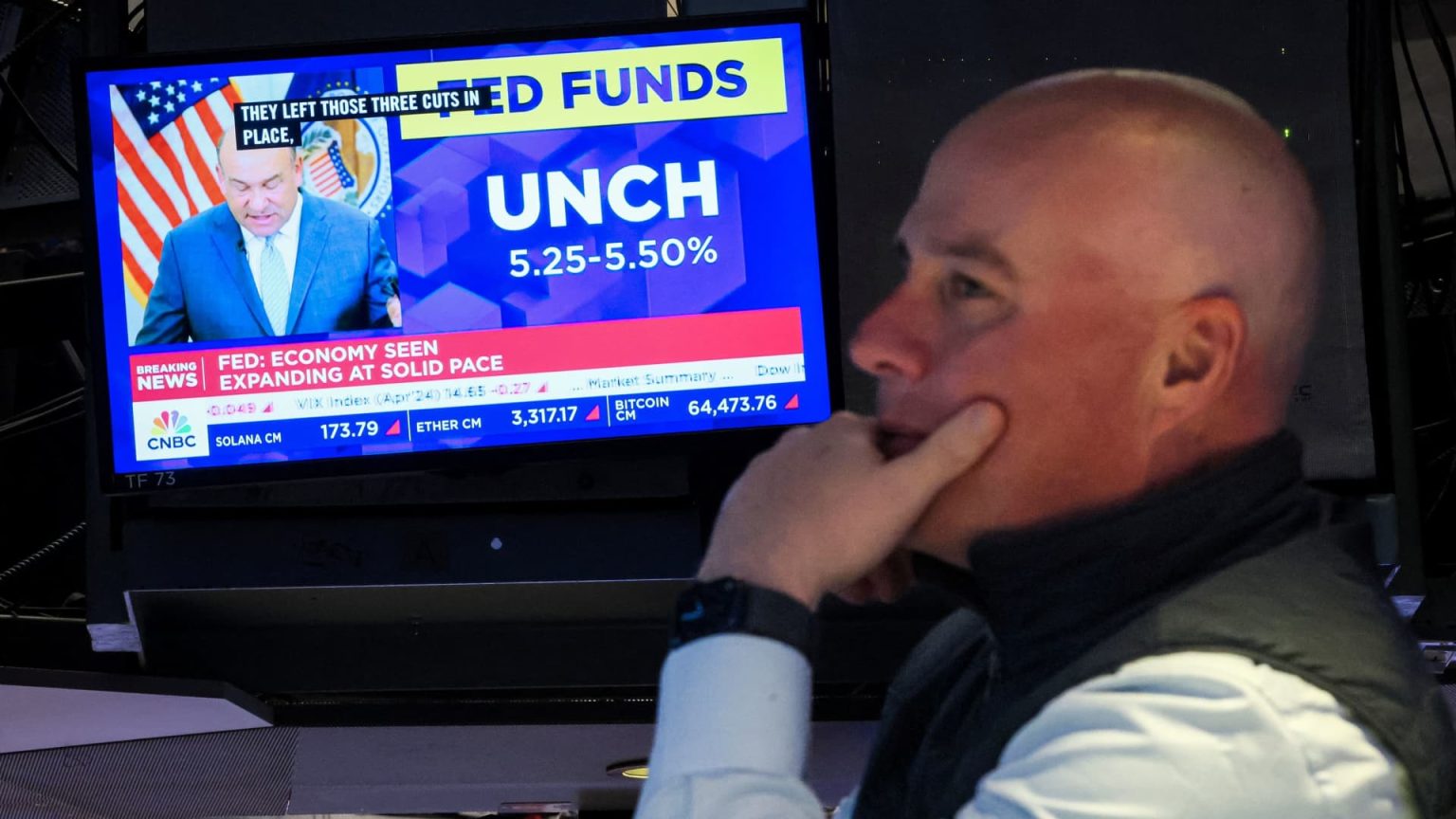

In other news, Citi named an under-the-radar stock to buy on a “data and AI opportunity,” pointing to a threefold increase in its total addressable market. Despite a slight easing of inflation in April, experts like Bankrate’s Mark Hamrick believe that interest rates will remain higher for longer due to the lingering impact of inflation. Additionally, an investor noted that India’s mid-cap stocks are in a “bubble,” while European markets were expected to open higher on Thursday, with notable earnings reports from companies such as Swiss Re, Zurich Insurance, and Deutsche Telekom scheduled for release.