Despite softening in U.S. macroeconomic data, equity markets rebounded in the week ending May 10th, with Nasdaq gaining 1.1%, S&P 500 rising 1.85%, and DJIA climbing 2.16%. Rental components of the CPI, which have a significant weight in the index, have been disinflating for the past five quarters, leading to a downward trend in CPI inflation. Additionally, the European equivalent of the CPI, the HICP, shows consumer inflation in the U.S. at 1.9%, below the Fed’s 2% target.

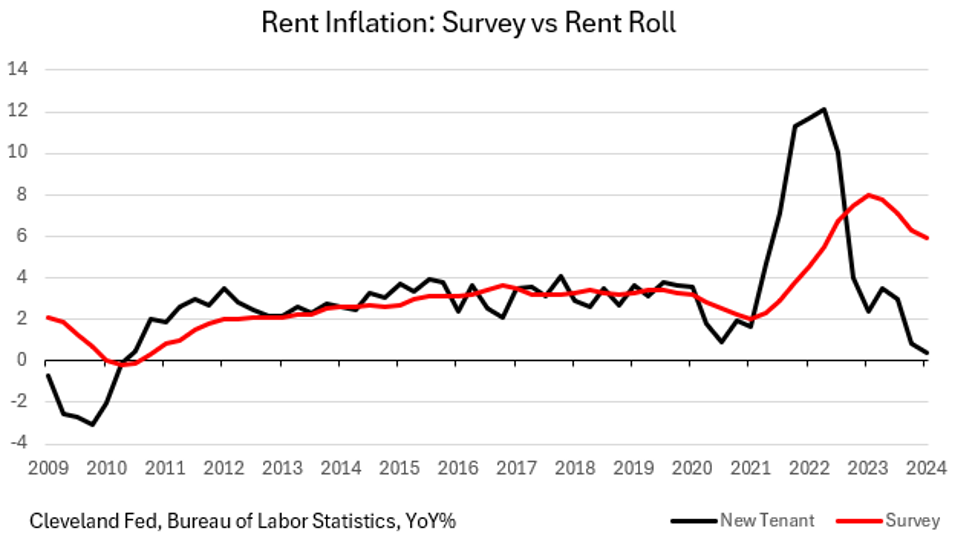

The PCE Deflator, the Fed’s main inflation indicator, indicates that goods are deflating, while services inflation is still elevated at 3.7%. However, given that the largest component of services inflation, shelter costs, are moving towards disinflation, it is likely that overall inflation will trend lower in the coming months. Despite this trend, the Fed is waiting for lagged data to reach their 2% inflation target before considering a less restrictive monetary policy.

Manufacturing has been in recession for over a year, with the ISM Manufacturing Index showing contraction for 16 of the last 17 months. The ISM Services Index dipped into contraction in April, leading to an overall contraction in the combined Manufacturing and Services Index. Employment data also reflects a negative trend, with rising unemployment rates, lower job openings, and increased layoff announcements.

Consumer confidence is at its lowest level since July 2022, as consumers have exhausted their excess savings from government stimulus. Retail sales have stagnated since 2021, with nominal growth primarily driven by inflation rather than real growth. Commercial real estate defaults continue, with major foreclosures occurring weekly. Despite declining sales and poor forward guidance from major companies such as Starbucks, YUM Brands, and Nestle, equity markets continue to rise.

Looking ahead, inflation is expected to continue retreating for the remainder of the year, with the impact of monetary policy on the economy still unfolding. Consumption, which makes up nearly 70% of GDP, is already showing signs of slowdown, with a recent drop in GDP growth. While equity markets have rebounded from a previous dip in April, their sustainability in the face of a weakening economy remains uncertain.