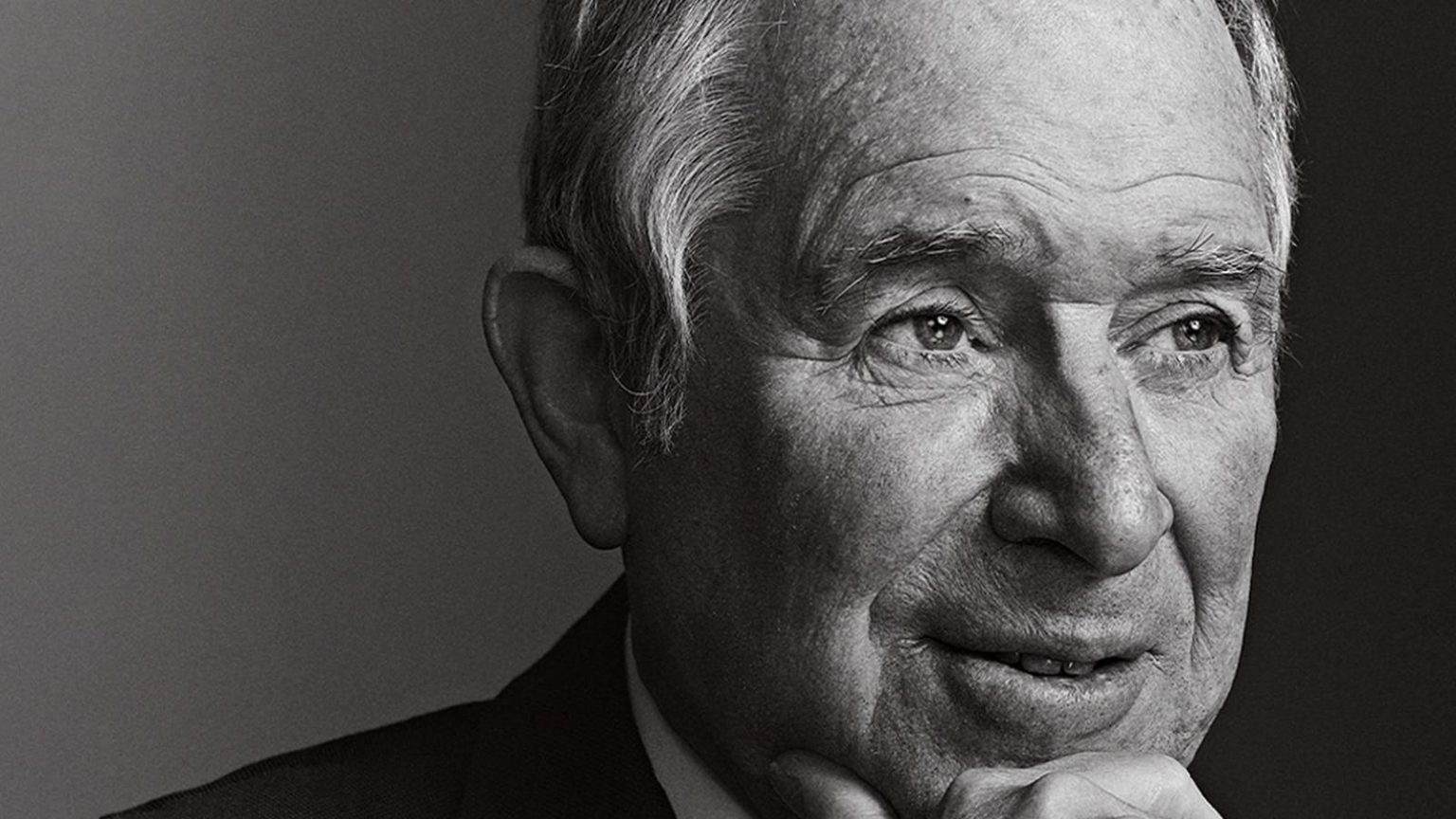

Steve Schwarzman, the founder and CEO of Blackstone, has always had a philosophy of going big. Despite Blackstone surpassing $1 trillion in assets, Schwarzman still feels expansive. Schwarzman grew up in Philadelphia, working in his father’s curtains and linens store from a young age. His drive to succeed started early, and he recalls trying to expand the successful fabric store nationally. Schwarzman attended Yale University and founded Blackstone in 1985 with Pete Petersen. The firm is now the world’s largest alternative asset manager with a net worth of $39 billion.

Blackstone, which started as a traditional leveraged buyout operation, has evolved into a buy and build firm with innovative financing techniques. Schwarzman has led the firm to embrace new investment strategies and diversify into different asset classes. The firm currently has 72 different investment strategies, with real estate being a massive business for Blackstone. Schwarzman cites the investment in Hilton as one of the firm’s greatest triumphs, resulting in a total return profit of $14 billion. However, he also acknowledges the disaster that was Edgcomb Steel, which led to a restructuring of the firm’s decision-making process.

When asked about important metrics for investors, Schwarzman emphasizes understanding the macro environment and looking for industries with built-in growth potential. He advises investors to be patient and only invest when there is confidence in the potential success of an opportunity. Schwarzman highlights credit, real estate, and private equity as areas of interest for investors today. He also points out geopolitical risks, regulatory concerns, and political uncertainty as major risks facing investors in the current environment.

Schwarzman recommends his book, “What It Takes,” for investors to read, as well as Phil Knight’s memoir, “Shoe Dog.” He emphasizes the importance of surrounding oneself with smart people and generating proprietary data for making investment decisions. Schwarzman’s advice for his 20-year-old self includes being patient and seeking out contemporary information to identify trends. Overall, Schwarzman’s success with Blackstone showcases his ability to adapt to changing markets and seize profitable opportunities.