The field of economics was forever changed by the work of psychologists Amos Tversky and Daniel Kahneman. These two influential thinkers challenged the traditional belief that rational people always act in a way that maximizes their income, upending the way we think about finance and economics, including tax policy. Their groundbreaking research showed that human decision-making is often irrational and influenced by biases, leading to a reevaluation of economic models and predictions.

Before Tversky and Kahneman, economists believed that people would always act in their economic self-interest. However, the duo’s research, starting in 1979, revealed that human behavior is far more complex and unpredictable than previously thought. They demonstrated that traditional economic theories did not always hold true, such as the assumption that tax breaks would lead workers to save more for retirement. Instead, their findings showed that subtle nudges from employers could have a much greater impact on behavior.

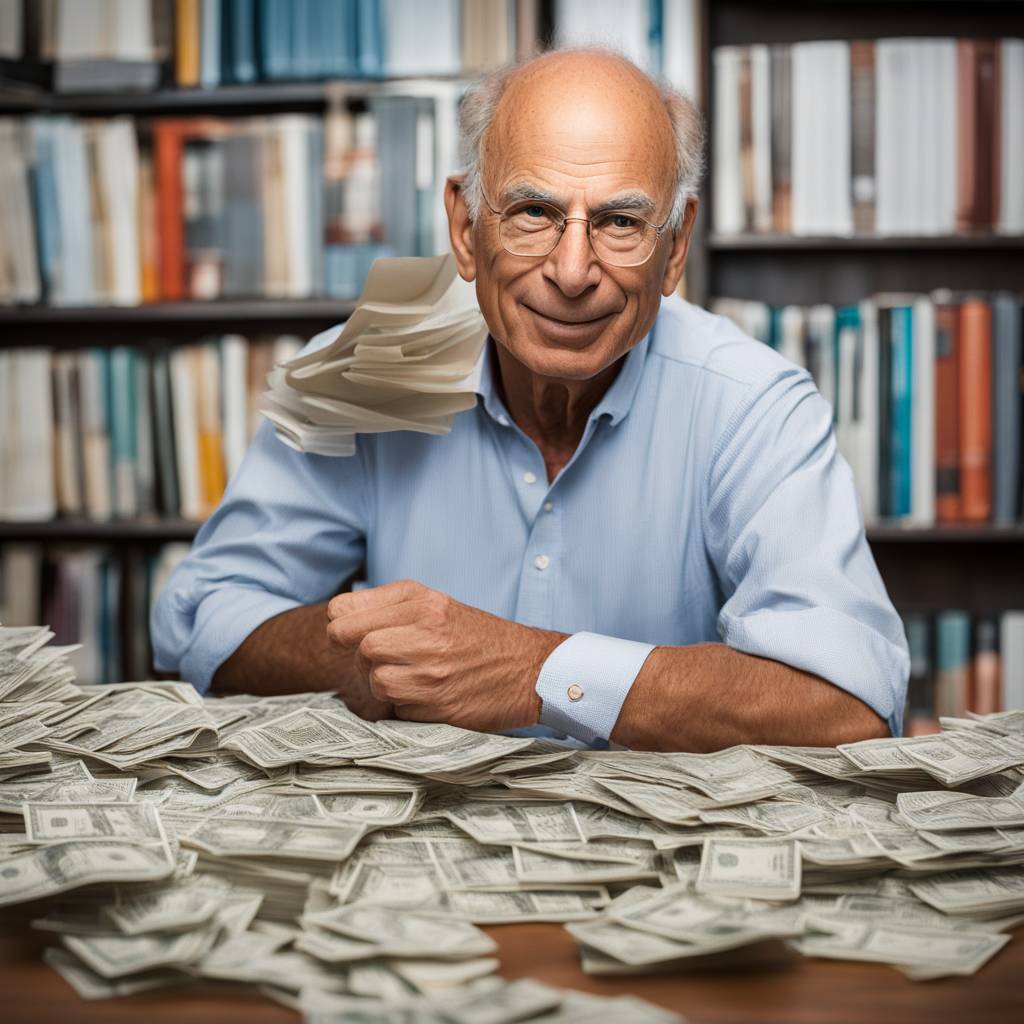

Through a series of experiments conducted over several decades, Tversky and Kahneman highlighted the constant battle between the intuitive mind and the analytical mind in human decision-making. Kahneman’s insights about this psychological struggle have been applied to various fields, from medicine to marketing to law. Despite initial resistance from academic economists, the influence of their work eventually led to the mainstream acceptance of behavioral economics, with Kahneman being dubbed the “grandfather of behavioral economics.”

Kahneman’s research has major implications for public policy, particularly in understanding how individuals and policymakers respond to incentives and losses. Loss aversion, the fear of loss outweighing the opportunity for gain, is a key concept that drives behavior in economics, such as investors selling in a falling market or lawmakers being reluctant to raise taxes after cutting them. As Congress faces the expiration of the individual provisions of the 2017 Tax Cuts and Jobs Act, Kahneman’s insights may prove relevant in understanding the political and economic challenges of making such decisions.

The impact of behavioral economics on the field of economics has been profound, leading to the Nobel Prize in Economics being awarded to Kahneman and Vernon Smith in 2002, with Tversky being ineligible due to his death. Another Nobel Prize for advancing behavioral economics was awarded to Richard Thaler, a student of Kahneman, in 2017. Kahneman’s legacy as a revolutionary thinker who brought economics closer to understanding real-world human behavior has left a lasting mark on the field, challenging economists to consider the complexities of human decision-making in their policy recommendations.