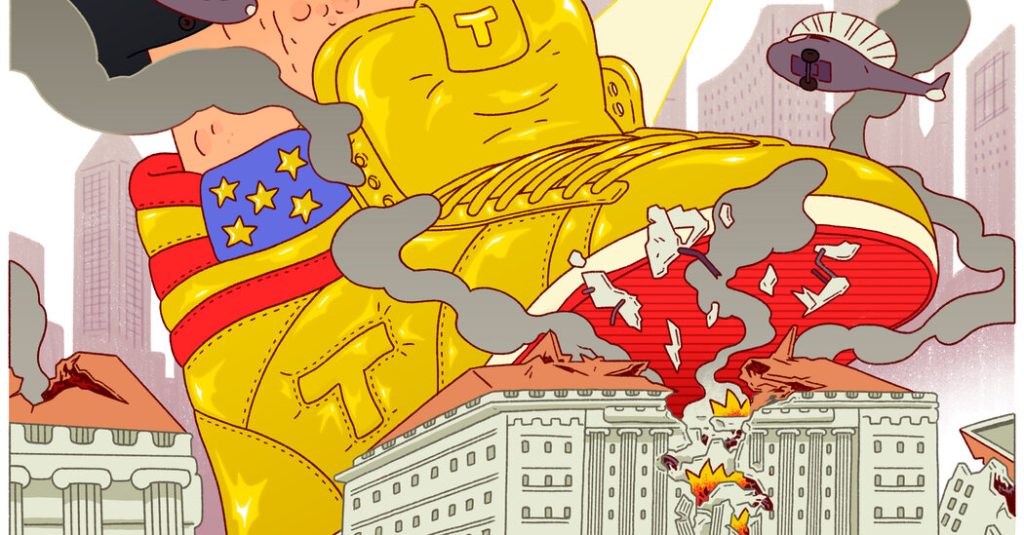

Summarize this content to 2000 words in 6 paragraphs If you were to ask the top chief executives in the world to name the best strategy to attack waste in their organizations and balance the books, there is one answer you would be very, very unlikely to hear: Take an ax to accounts receivable, the part of an organization responsible for collecting revenue.Yet the private sector leaders advising President Trump on ways to increase government efficiency are deploying this exact approach by targeting the Internal Revenue Service, which collects virtually all the receipts of the U.S. government — our nation’s accounts receivable division. Last week, the Trump administration started laying off about 6,700 I.R.S. employees, many if not most of whom are directly involved in collecting unpaid taxes.Every year, the government receives much less in taxes than it is owed. Closing that gap, which stands at roughly $700 billion annually, would almost certainly require maintaining the I.R.S.’s collection capacity. Depleting it is tantamount to a chief executive saying something like: “We sold a lot of goods and services this year, but let’s limit our ability to collect what we’re owed.”Perhaps only the company’s competitors would approve of such an approach. Yet here we are. Aggressive cuts to our nation’s accounts receivable function will reduce the amount of tax revenue coming in, which will in turn increase our nation’s deficit and add to our $36 trillion in debt.So why go down this path? Let’s be clear: Shrinking the I.R.S. will not lower your tax obligation. That’s up to Congress.Aggressive reductions in the I.R.S.’s resources will only render our government less effective and less efficient in collecting the taxes Congress has imposed. It will shift the burden of funding the government from people who shirk their taxes to the honest people who pay them, and it will impede efforts by the I.R.S. to modernize customer service and simplify the tax filing process for everyone.I.R.S. employees are mothers, fathers, people of faith, Little League coaches, community volunteers and neighbors. Thousands are also veterans or members of military families. More than 98 percent live outside the Washington, D.C., area, in cities, suburbs and small towns across the country.And despite what many Americans have heard, more than 97 percent of I.R.S. employees don’t carry a gun. The few who do are law enforcement officers working to disrupt drug dealers, human traffickers and terrorists. For a vast majority who do not, the most dangerous thing on their person is probably a calculator.Like any bureaucratic institution, the I.R.S. could certainly improve its efficiency and effectiveness. As commissioners, each of us, across various presidential administrations, worked toward this goal. We all sought to deliver the service taxpayers deserve and to reduce the gap between taxes owed and taxes paid. And we all sought to do so while adhering closely to the Taxpayer Bill of Rights, including the right to privacy and the right to prompt, courteous, professional assistance. None of us claimed to have had all the right answers, so a fresh perspective should always be welcome. And having served under both Republican and Democratic administrations and Congresses, we recognize and respect that elections have consequences.But whatever the future size and priorities of the I.R.S., our country needs a fully functioning tax system.Nearly 200 million Americans are in the process of completing their tax returns. We urge caution in initiating major changes to I.R.S. operations during the filing season. But even after filing season ends, we believe — and we believe that successful chief executives across the country would concur — that making drastic cuts to accounts receivable as a way to improve cost efficiency just doesn’t add up.Lawrence Gibbs was an I.R.S. commissioner appointed by Ronald Reagan; Fred Goldberg, by George H.W. Bush; Charles Rossotti, by Bill Clinton; Mark Everson, by George W. Bush; John Koskinen, by Barack Obama; Charles Rettig, by Donald Trump; and Daniel Werfel, by Joe Biden.The Times is committed to publishing a diversity of letters to the editor. We’d like to hear what you think about this or any of our articles. Here are some tips. And here’s our email: [email protected] the New York Times Opinion section on Facebook, Instagram, TikTok, Bluesky, WhatsApp and Threads.

Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.

© 2026 Globe Timeline. All Rights Reserved.