Summarize this content to 2000 words in 6 paragraphs Having a car has become an expensive necessity for many Americans—as manufacturers push more expensive vehicles out, the cost of repairs and maintenance is climbing, gas prices are rising, and insurance premiums continue soaring.The average cost of full coverage car insurance has already jumped a whopping 12 percent this year compared to 2024 at the national level, according to Bankrate’s latest data, reaching $2,638. Considering the national median household income of $77,719, the typical U.S. household spends 3.39 percent of its income on car insurance.While drivers all across the country are shouldering the weight of rising car insurance costs, there are states where vehicle owners are not spending as much of their household income on premiums—and others where they are spending much more.Why It MattersAmerican households are still struggling with the high cost of living, which climbed in the years following the pandemic and has yet to subside. Gas prices have recently climbed, and are likely to continue doing so as the spring season approaches, with many refineries doing maintenance and expected outages.Meanwhile, car repairs have become more costly as experts say drivers are exhibiting more reckless behavior, contributing to pushing up insurance premiums. Experts expect the cost of coverage to continue climbing throughout 2025, adding more pressure on American households already burdened by the higher costs of living—including skyrocketing egg prices.What To KnowWhile drivers in Louisiana don’t have the highest car insurance premium in the country at $3,978, they spend the highest percentage of income on their coverage, according to a new study by Bankrate. The median household income in the Pelican State is currently $58,229 per year, which means that Louisiana drivers spend 6.83 percent of their income on car insurance—3.44 percent more than the national average.Florida has the second most expensive car insurance in terms of the share of household income required to pay for full coverage. The average annual premium in the Sunshine State is $4,171, higher than Louisiana. But the median annual income in the state is also higher, and drivers spend 5.69 percent of it on coverage—2.29 percent more than the national average and 1.14 less than Louisiana.

These two states, according to Bankrate, have a few things in common that are driving up the cost of car insurance: both have high vehicle theft rates, frequent extreme weather losses and high rates of insurance fraud.”These risk factors are inherently costly to insurance carriers and reinsurance companies, which could explain why both states tend to have high premiums,” said the Bankrate report.At the metropolitan level, two Florida cities have the highest average cost of full coverage car insurance in the nation. Drivers in the Miami-Fort Lauderdale-West Palm Beach metropolitan statistical area (MSA) pay $5,174 per year for full coverage, more than 6.78 percent of their income; those in Tampa-St. Petersburg-Clearwater spent an average of 6.29 percent of their annual income on coverage.The Sunshine State also saw the biggest jump in car insurance premiums in the country between 2024 and 2025; while at the national level rates went up by $289 per year, in Florida they’re now $782 higher.The state with the lowest car insurance costs, in terms of how much of their income drivers spent on coverage, was Hawaii, which has an average annual premium of $1,689. Drivers in the state pay 1.77 percent of their household annual income for full coverage.

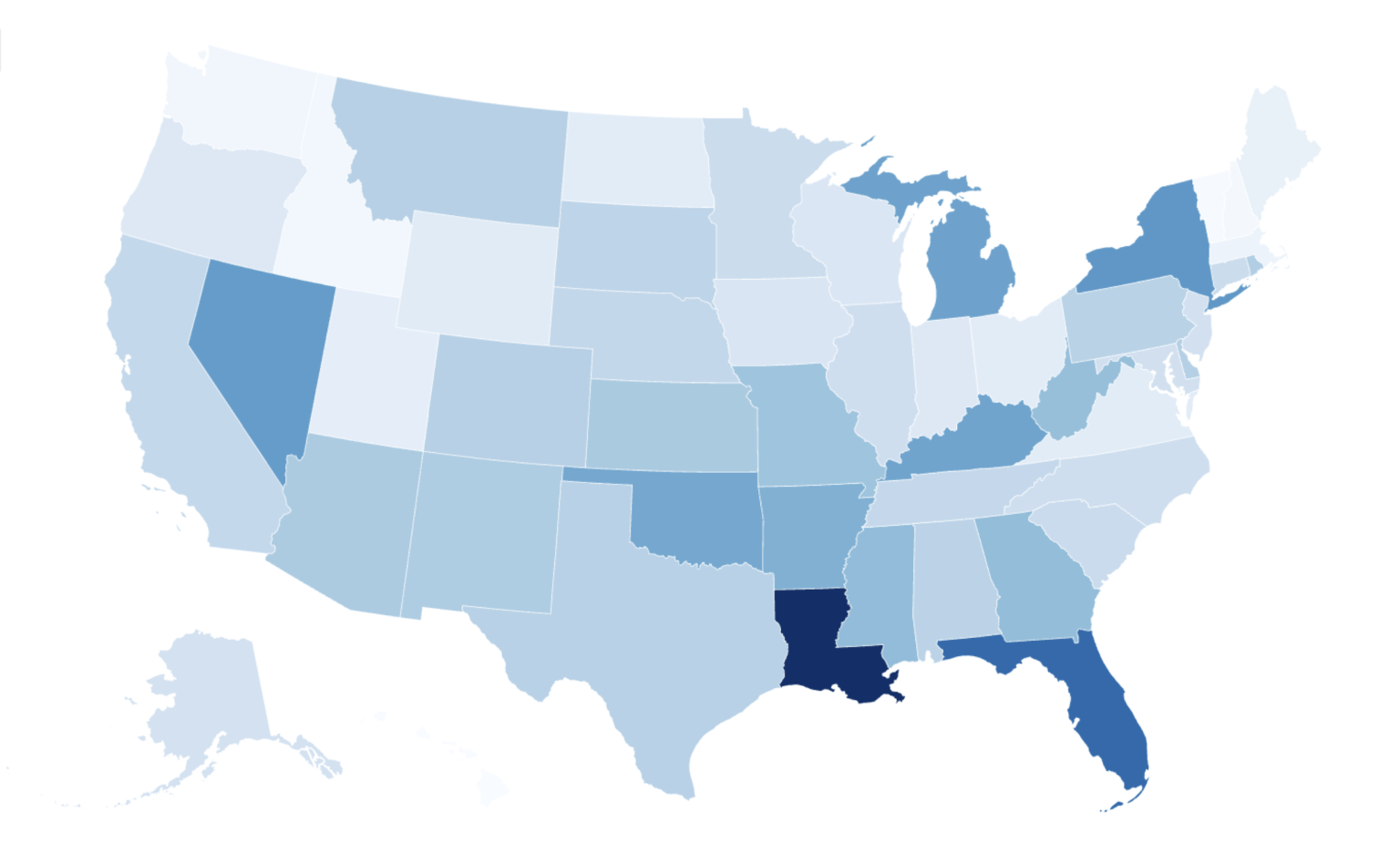

A map showing the states with the highest car insurance costs, according to data shared by Bankrate including average annual premiums and percent of income spent.

A map showing the states with the highest car insurance costs, according to data shared by Bankrate including average annual premiums and percent of income spent.

Bankrate

What People Are SayingLendingTree writer and licensed insurance expert Rob Bhatt previously told Newsweek: “For most of 2022 and 2023, insurance companies had to repair or replace more cars than normal and spend more than normal to repair or replace each one. After two years of steep rate increases to catch up with these expenses, there are signs that auto insurance rates are stabilizing.”He added: “Higher premiums appear to be giving insurance companies enough money to cover their claims expenses again. We may be past the worst of it, barring the unexpected.”ValuePenguin.com insurance expert Divya Sangameshwar said in a statement accompanying the company’s 2025 State of Auto Insurance study: “If Donald Trump goes forward with his plan to impose tariffs on imported goods, insurance rate hikes could speed up again.”What’s NextValuePenguin.com, a LendingTree company, expects car insurance premiums to continue climbing by an average of 7.5 percent throughout 2025, reaching a record high of $2,101 a year at the national level. Insurify’s experts expect car insurance rates to grow by a more modest 5 percent this year.